- United States

- /

- Biotech

- /

- NasdaqGM:NAMS

Assessing NewAmsterdam Pharma (NasdaqGM:NAMS) Valuation Ahead of Major Phase 3 Data Presentations

Reviewed by Simply Wall St

NewAmsterdam Pharma (NasdaqGM:NAMS) is preparing to share new safety and efficacy data from its pivotal Phase 3 BROOKLYN, BROADWAY, and TANDEM trials at the 2025 American Heart Association Scientific Sessions. These presentations, with a particular focus on CETP inhibition with obicetrapib and pooled LDL reduction data, have put the company back in the spotlight for investors evaluating next steps.

See our latest analysis for NewAmsterdam Pharma.

NewAmsterdam Pharma’s upcoming trial presentations come on the heels of a remarkable run for the stock, with momentum clearly building among investors. The company’s 30-day share price return stands at 23.7%, and looking further back, the 1-year total shareholder return has soared to 110.5%. This marks a notable reversal from last year’s quieter periods and suggests that anticipation around the latest LDL data and recent investor events is fueling optimism about future growth and value creation.

If novel biotech breakthroughs like NewAmsterdam’s pique your interest, consider broadening your watchlist to discover other innovators in the space with our See the full list for free.

With shares trading just below analyst price targets, but still at a significant discount to intrinsic value, is the recent rally the start of a broader re-rating, or is all the upside already factored in?

Price-to-Book of 5.5x: Is it justified?

At a price-to-book ratio of 5.5x, NewAmsterdam Pharma stands well above the US Biotech industry's 2.5x average. This signals a sizable premium at the current share price of $37.95.

The price-to-book ratio measures how much investors are willing to pay for each dollar of a company's net assets. This measure is especially relevant for biotech firms that may not yet be profitable. In this case, the premium reflects optimism about the company's future pipeline but also suggests investors may be expecting significant growth or a major breakthrough.

Compared to the industry, this multiple is elevated and is even higher than the peer average of 5.2x. The market is clearly valuing NewAmsterdam Pharma at a level reserved for companies with significant prospects, and a rerating could occur if growth estimates are not met.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 5.5x (OVERVALUED)

However, slowing revenue growth or missed milestones in the clinical programs could quickly temper investor enthusiasm and could trigger a sharp reassessment of prospects.

Find out about the key risks to this NewAmsterdam Pharma narrative.

Another View: Discounted Cash Flow Upside

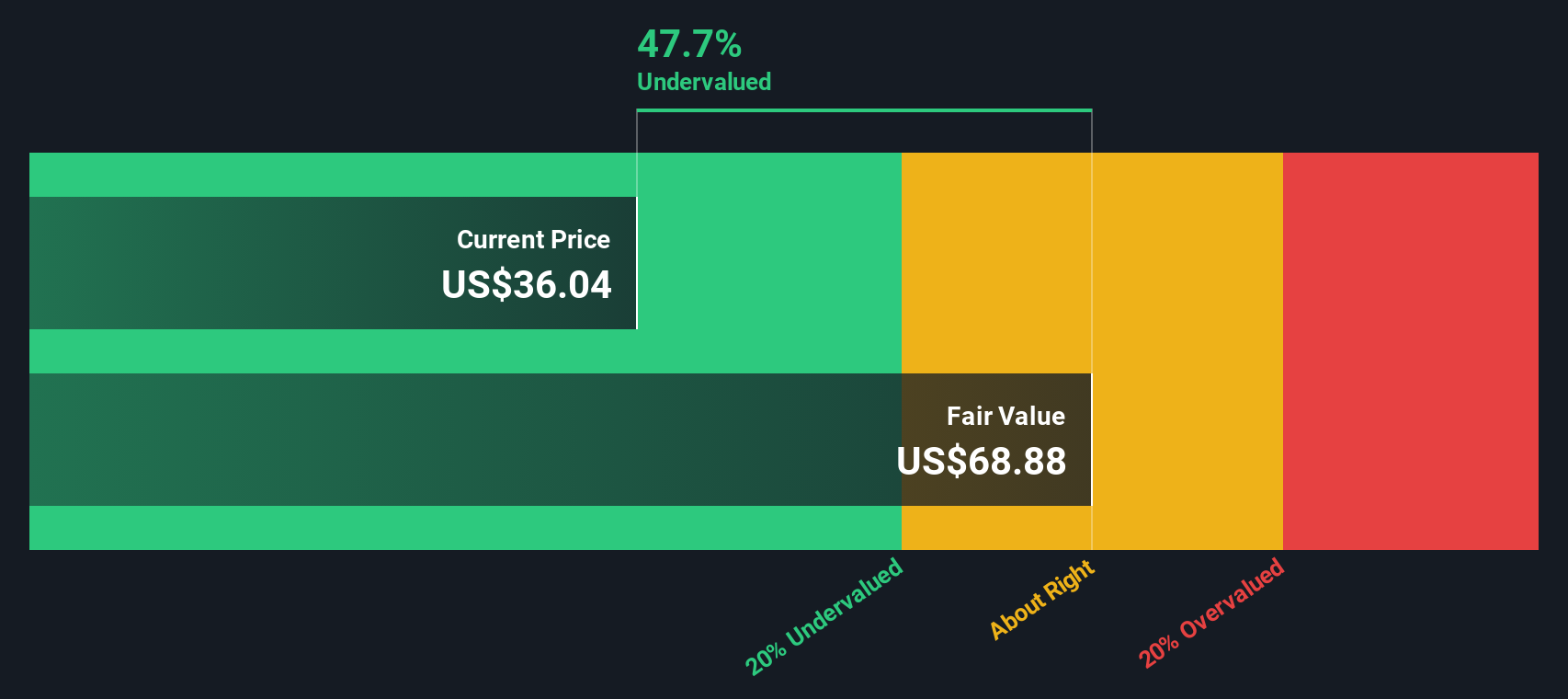

Looking beyond current market multiples, our DCF model paints a different picture. It suggests NewAmsterdam Pharma is trading at about 44% below its calculated intrinsic value. This indicates the stock may be significantly undervalued if long-term assumptions hold true. Is the market underestimating its future cash generation?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out NewAmsterdam Pharma for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 843 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own NewAmsterdam Pharma Narrative

If you have a different point of view or want to explore the data in your own way, you can easily build a personal narrative in just a few minutes, starting with Do it your way

A great starting point for your NewAmsterdam Pharma research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Stay a step ahead by finding unique opportunities that may boost your portfolio’s performance. The next big winner could be a click away, but only if you look!

- Supercharge your returns with attractive yields by targeting these 20 dividend stocks with yields > 3% offering consistent income potential in today’s market.

- Gain an edge with early-stage growth prospects by reviewing these 3587 penny stocks with strong financials in emerging sectors before they catch wider attention.

- Ride the next tech wave by spotting cutting-edge breakthroughs through these 27 AI penny stocks focused on artificial intelligence innovation and real-world impact.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NewAmsterdam Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:NAMS

NewAmsterdam Pharma

A late-stage biopharmaceutical company, develops therapies to enhance patient care in populations with metabolic disease.

Excellent balance sheet with low risk.

Market Insights

Community Narratives