- United States

- /

- Biotech

- /

- NasdaqGM:MRUS

Merus (MRUS) Forecasts 58.4% Revenue Growth, Ongoing Losses Challenge Bullish Narratives

Reviewed by Simply Wall St

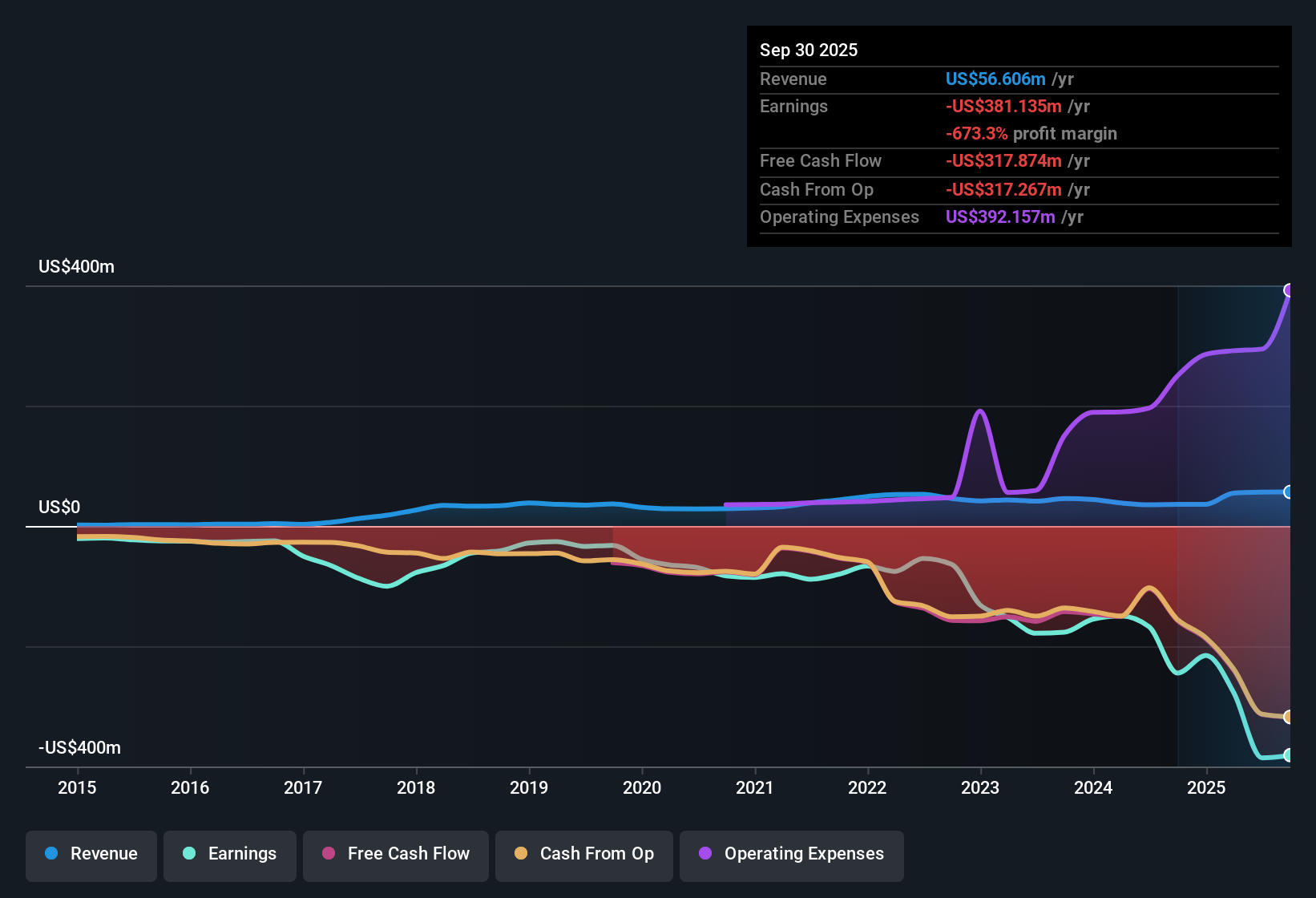

Merus (MRUS) is projected to deliver standout revenue growth of 58.4% per year, far outpacing the US market average of 10.4% per year. However, the company remains unprofitable, with losses increasing at a 34.9% annual rate over the past five years and no improvement in net profit margins. Investors are watching closely, as persistent losses now set a high bar for optimism. At the same time, rapid top-line growth keeps the story in focus.

See our full analysis for Merus.Next up, we will stack these figures against the key narratives that shape Merus’s market perception. This will highlight where current results match consensus expectations and where they might challenge the status quo.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Expand by 34.9% Annually

- Merus’s annual losses have grown at a steep 34.9% pace over the last five years, intensifying concerns about the company’s path to sustainability.

- Surprisingly, even as revenue growth accelerates, rising losses highlight the core challenge described by the prevailing market view:

- Persistent expansion of net losses outpaces any gains on the bottom line, which raises the stakes for translating topline momentum into real profitability.

- Investors looking for biotech success stories are reminded that brisk revenue growth does not necessarily mean the business model is turning the corner on sustainable earnings.

No Path to Profit in Three Years

- According to EDGAR, Merus is expected to remain unprofitable for at least the next three years, despite sector excitement and clinical advances.

- The consensus narrative notes that the market is hopeful on the innovation front, yet this ongoing lack of profits challenges even bullish optimism:

- The contrast between a promising pipeline and a long runway to break-even heightens the focus on execution risk in a sector known for binary outcomes.

- Investors lured by industry trends or recent buzz should factor in the possibility that even headline-making progress may not deliver near-term financial turnarounds.

Valuation Above Industry Average

- Merus trades at a price-to-book ratio higher than its peers in the biotechnology industry, creating a visible premium compared to sector norms.

- According to the prevailing market view, this premium valuation sets a high bar, as share price optimism now depends on whether revenue momentum eventually leads to improved margins and the prospect of real profitability:

- Investors may be paying up for growth potential, but ongoing losses and no clear fair value from discounted cash flow analysis make it harder to justify these levels purely on fundamentals.

- Those watching biotech multiples know that sentiment and sector momentum can support high valuations for a while, but the long-term story rests on financial performance catching up.

See our latest analysis for Merus.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Merus's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Merus faces widening losses, lacks a clear timeline to profitability, and trades at a valuation premium that appears difficult to justify without further financial progress.

If you’re seeking fairer value and stronger fundamentals, use these 838 undervalued stocks based on cash flows to quickly identify companies that offer better prospects at more attractive prices right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:MRUS

Merus

A clinical-stage immuno-oncology company, engages in the development of antibody therapeutics in the Netherlands.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives