- United States

- /

- Pharma

- /

- NasdaqGS:MNMD

Will Mind Medicine (MindMed) (MNMD)'s Fresh Capital Shape a New Phase of Strategic Ambitions?

Reviewed by Sasha Jovanovic

- In October 2025, Mind Medicine (MindMed) Inc. announced and priced a follow-on equity offering, raising approximately US$225 million through the sale of 18,375,000 common shares at US$12.25 per share.

- The company indicated that proceeds will fund research, development, and may be used for future acquisitions, though no active acquisition plans are currently in place.

- To explore how this new capital could influence MindMed’s investment narrative, we’ll focus on its intention to pursue future business opportunities.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Mind Medicine (MindMed)'s Investment Narrative?

For anyone considering Mind Medicine (MindMed) as an investment, the biggest conviction often centers on the potential for its MM120 compound and other product candidates to break ground in the treatment of mental health disorders, particularly generalized anxiety disorder (GAD). The company’s recent US$225 million public offering introduces a new dynamic by significantly extending its cash runway, potentially supporting ongoing clinical trials, regulatory activities, and maybe even opportunistic acquisitions. This influx of capital could help address one of the core risks, liquidity as ongoing net losses and no current revenue have previously raised questions about funding future growth. However, with the stated intention of possibly pursuing acquisitions but no current commitments, the actual near-term impact on major catalysts like regulatory decisions or Phase 3 trial progress may not change materially. Still, the landscape for risks shifts a bit: while financial flexibility improves, dilution from share issuance and ongoing uncertainty around the path to profitability remain front and center.

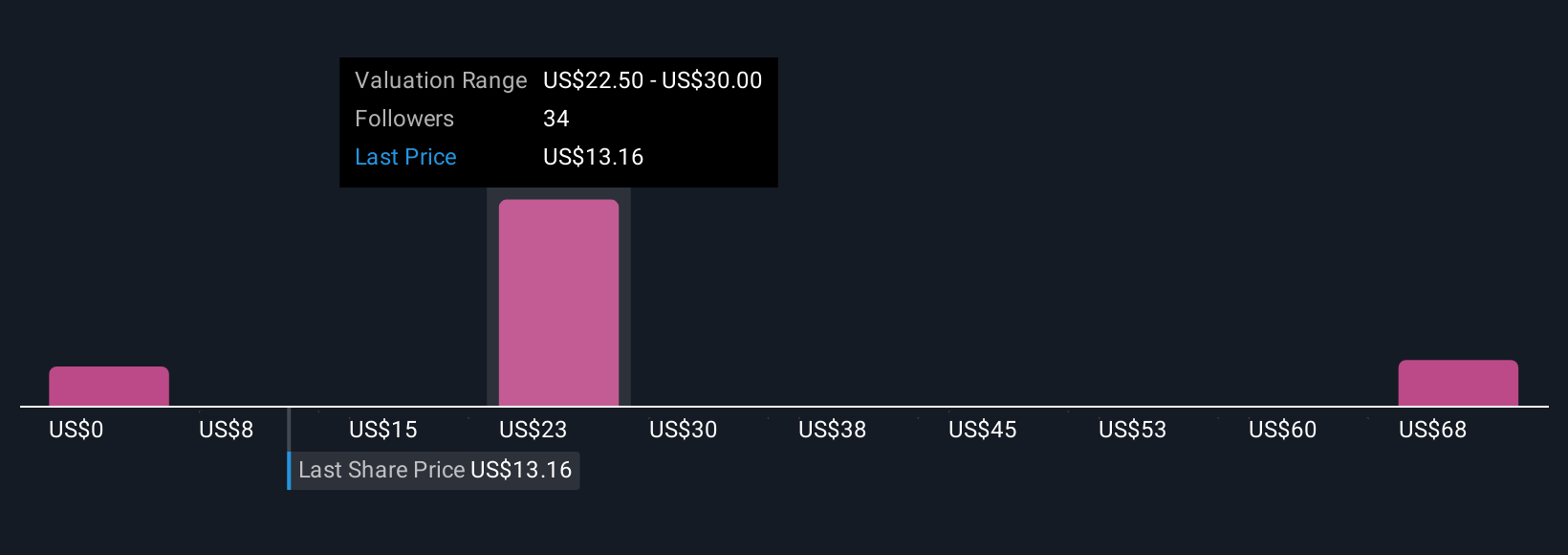

On the flip side, many will want to watch how rising losses and share dilution intersect with upcoming clinical updates. Mind Medicine (MindMed)'s shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 13 other fair value estimates on Mind Medicine (MindMed) - why the stock might be worth over 5x more than the current price!

Build Your Own Mind Medicine (MindMed) Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mind Medicine (MindMed) research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Mind Medicine (MindMed) research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mind Medicine (MindMed)'s overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 22 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MNMD

Mind Medicine (MindMed)

A clinical stage biopharmaceutical company, develops novel products to treat brain health disorders.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives