- United States

- /

- Pharma

- /

- NasdaqGS:MNMD

Assessing MindMed (MNMD) Valuation Following $225 Million Capital Raise and New Growth Plans

Reviewed by Simply Wall St

Mind Medicine (MindMed) (NasdaqGS:MNMD) just completed an underwritten public offering, bringing in around $225 million. The company says it plans to use this new funding for product development, corporate needs, and potentially future acquisitions.

See our latest analysis for Mind Medicine (MindMed).

This latest funding round follows a sharp upswing in MindMed’s momentum, with the share price returning 8.6% over the past month and a remarkable 58.7% over the last 90 days. Investors may be taking note of both the strengthened balance sheet and fresh talk of potential acquisitions, as MindMed’s 1-year total shareholder return now stands at 118%. This signals substantial interest not just in the latest deal, but in the company’s broader long-term growth story.

If you’re curious to discover other healthcare innovators making waves, now’s a great time to explore See the full list for free.

With MindMed’s share price surging after its capital raise, the big question now is whether the current valuation still leaves room for upside or if future growth is already fully anticipated by the market.

Price-to-Book of 5.5x: Is it justified?

MindMed’s shares trade at a price-to-book ratio of 5.5x, substantially higher than both industry and peer averages. With a last close price of $13.39, this valuation places MindMed firmly in premium territory within pharmaceuticals.

The price-to-book ratio compares a company’s market value to its net assets. It is often used for firms with limited or no current profits, such as those still developing their products. Within biotech, this measure helps investors assess how much they are paying for future potential versus hard assets.

At 5.5x, MindMed’s price-to-book far exceeds the US pharmaceuticals industry average of 2.3x and the peer average of 3x. This significant premium suggests the market is pricing in ambitious future prospects or pipeline outcomes that are not yet realized. If market sentiment cools, this multiple could compress toward sector norms and impact the share price.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 5.5x (OVERVALUED)

However, continued net losses and MindMed’s lack of meaningful revenue could trigger a swift market reassessment if future growth falls short of expectations.

Find out about the key risks to this Mind Medicine (MindMed) narrative.

Another View: Discounted Cash Flow Model Tells a Different Story

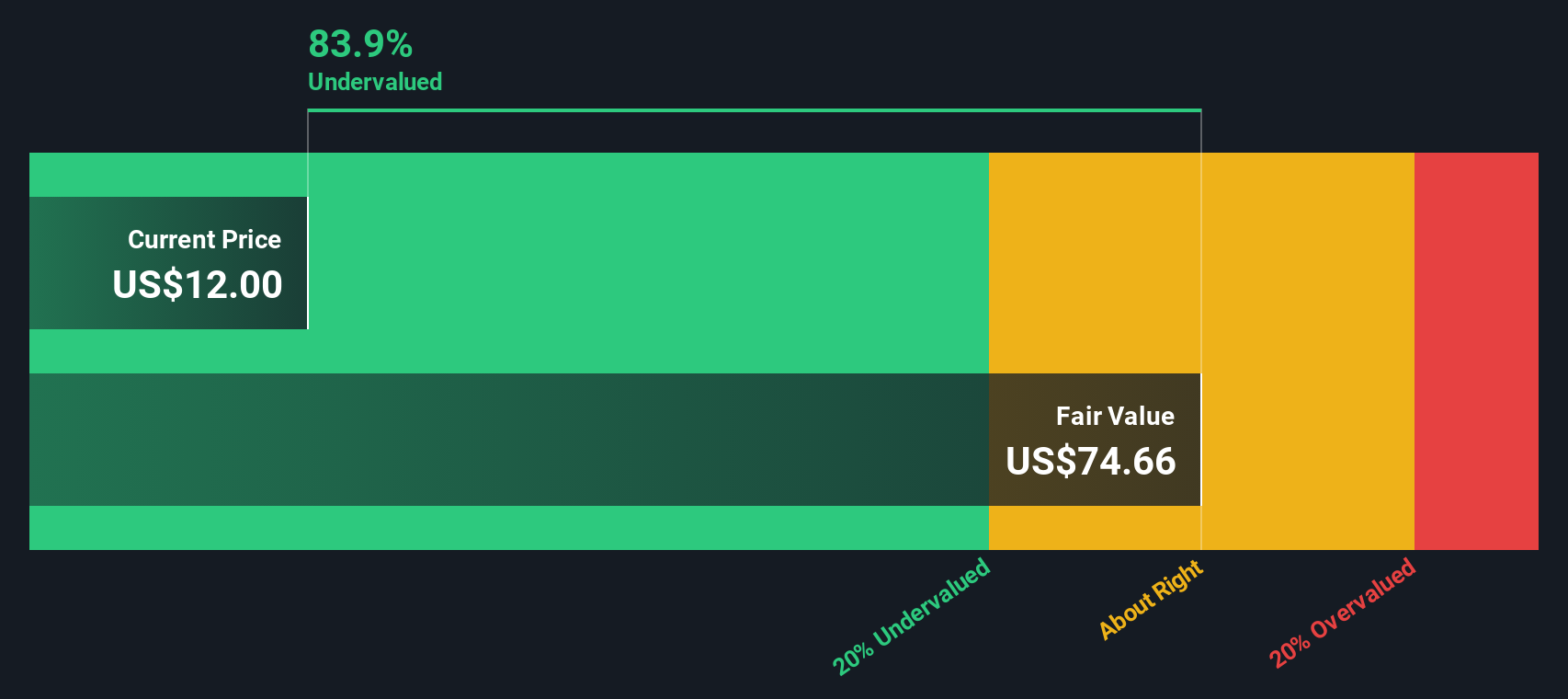

While MindMed looks expensive based on its price-to-book, our DCF model presents a starkly different angle. It values the company at around $75 per share, which is far above the recent trading price. Such a wide gap raises questions: is the market missing something, or is the DCF model too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mind Medicine (MindMed) for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 831 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mind Medicine (MindMed) Narrative

If you’d like to dig deeper or see the story through your own lens, shaping a personal MindMed outlook takes less than three minutes. Do it your way

A great starting point for your Mind Medicine (MindMed) research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let opportunity pass you by. Use the Simply Wall Street Screener to spot standout stocks perfectly aligned to your strategy, whether you want growth, value, or future trends.

- Unlock fresh potential by evaluating these 831 undervalued stocks based on cash flows trading well below intrinsic value. This could offer excellent entry points at compelling prices.

- Tap into the future of healthcare by checking out these 34 healthcare AI stocks, which is full of innovators transforming patient care with smart algorithms and advanced AI.

- Position yourself for passive income by reviewing these 24 dividend stocks with yields > 3% that consistently deliver strong yields above 3%. This approach is ideal for long-term stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MNMD

Mind Medicine (MindMed)

A clinical stage biopharmaceutical company, develops novel products to treat brain health disorders.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives