- United States

- /

- Biotech

- /

- NasdaqGM:MNKD

MannKind (MNKD) Margin Surge Reinforces Bullish Sentiment Despite Valuation and Financial Strength Concerns

Reviewed by Simply Wall St

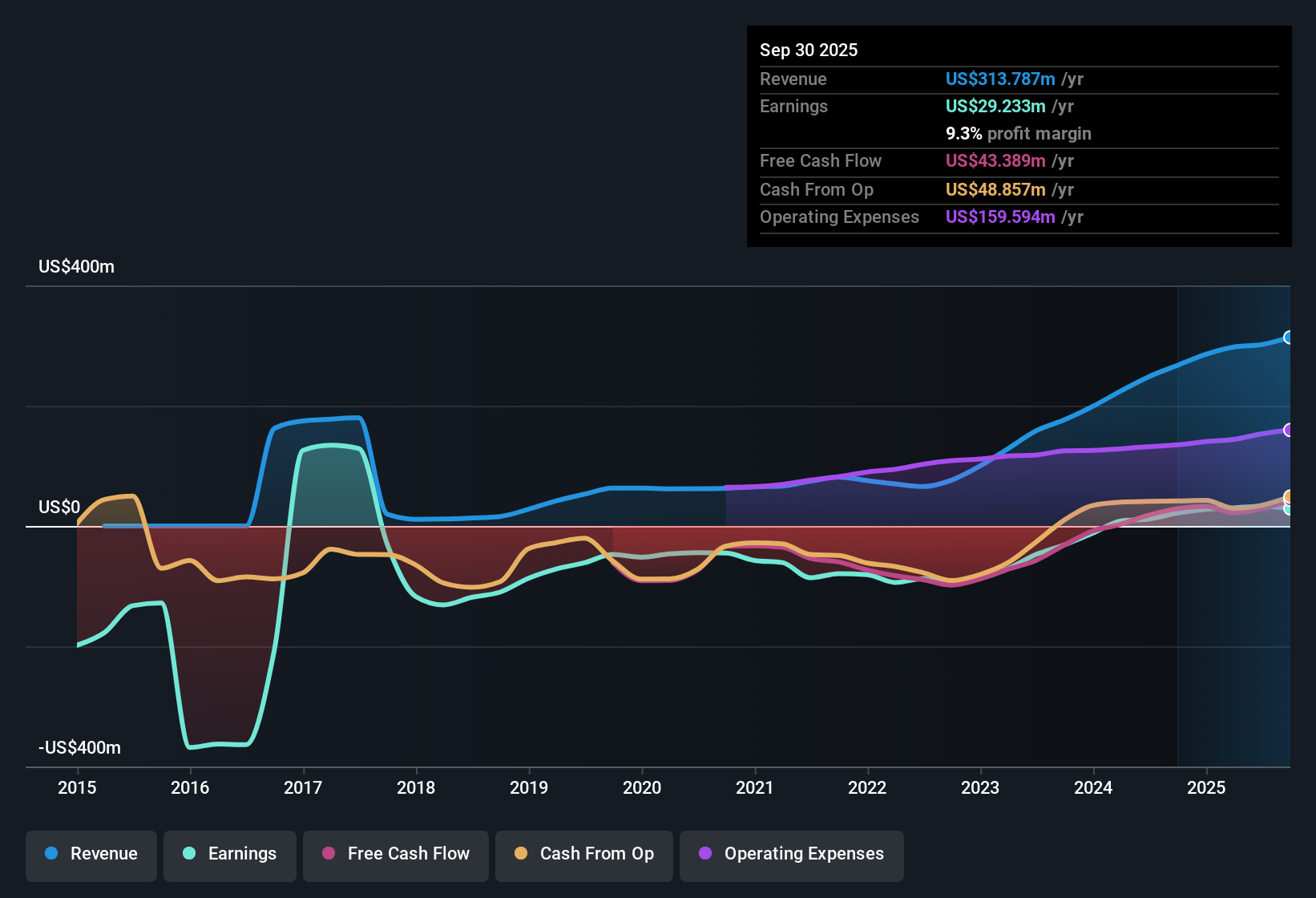

MannKind (MNKD) posted standout earnings results, with profits surging at an average annual rate of 47.9% over the last five years and rocketing 179.4% higher in the most recent year. Net profit margins rose to 10.9% from 4.7% previously. Revenue growth is projected at 10.2% per year, just shy of the US market’s 10.5% average. Investors now face a mix of high expectations and a stretched valuation as earnings growth far outpaces broader market trends. MannKind’s price-to-earnings ratio of 56.7x and ongoing questions about financial strength remain front and center.

See our full analysis for MannKind.Now let’s see how these results compare with the most widely discussed narratives—what lines up, and where surprises might shift the story.

See what the community is saying about MannKind

Margin Expansion as Cash Flow Driver

- Net profit margins have more than doubled to 10.9%, delivering higher quality earnings and solidifying the base for future self-funded growth.

- According to the analysts' consensus view, improved margins are supported by Afrezza's expanded reach, with increased scale across new indications and marketing investments expected to accelerate earnings gains.

- The consensus narrative highlights that scaling up Afrezza and pipeline innovation is poised to boost both revenue concentration and overall profitability.

- Strong royalty flows from Tyvaso DPI reinforce stable, high-margin cash flows in the near term and make MannKind less dependent on new equity to fund its ambitions.

- Results validate the analysts' expectation that robust profitability can help power ongoing clinical advances and broaden the product portfolio.

- Consensus points to further margin gains as management shifts towards higher-margin franchises while leveraging recent strategic financing for expansion efforts.

Pipeline Funding and Share Count Trends

- Strategic financing of $500 million via a non-dilutive revolver provides capital flexibility, yet analysts expect a 7.0% annual increase in shares outstanding over the next three years.

- The analysts' consensus view suggests that access to non-dilutive funding like Blackstone’s facility allows MannKind to accelerate its late-stage pipeline, while projected share dilution remains a material watchpoint for long-term shareholders.

- On the positive side, cash for pipeline launches now comes with less risk of heavy shareholder dilution and strengthens per-share earnings potential over time.

- While the funding supports business development, rising shares outstanding can offset EPS and constrain returns, especially if anticipated sales or margin uplifts under-deliver.

Premium Valuation: Room to Grow or Overextended?

- MannKind’s price-to-earnings ratio stands at 56.7x, far above the industry average of 16.9x and peer average of 34.3x, with a current share price of $6.06 compared to the analyst price target of $10.38 and a DCF fair value of just $1.28.

- Analysts' consensus view contends that maintaining such a valuation premium assumes sustained rapid earnings growth and margin expansion, but market adoption hurdles and dependency on a narrow portfolio heighten downside risk if targets are missed.

- Bulls argue high multiples reflect confidence in innovation and pipeline breakthroughs, supported by projected 46.2% annual earnings growth. However, any setback in adoption or regulatory wins could spark a valuation reset.

- With the share price currently at $6.06, significant upside to the consensus price target exists but the DCF fair value signals that investors must closely track execution, not just headline growth rates.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for MannKind on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do you interpret the data from a unique angle? Craft your personal take and shape the narrative in just a few minutes with Do it your way.

A great starting point for your MannKind research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Explore Alternatives

MannKind’s high valuation and dependence on rapid growth set a high bar. Ongoing questions about financial strength and dilution remain unresolved.

Prefer companies with stronger fundamentals and less financial uncertainty? Search for healthier opportunities now with our solid balance sheet and fundamentals stocks screener (1979 results) that highlight balance sheet strength and stable footing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:MNKD

MannKind

A biopharmaceutical company, focuses on the development and commercialization of therapeutic products and services for endocrine and orphan lung diseases in the United States.

Solid track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives