- United States

- /

- Biotech

- /

- NasdaqGS:MLYS

A Fresh Look at Mineralys Therapeutics (MLYS) Valuation After Narrower Q3 Loss and $300M Shelf Registration

Reviewed by Simply Wall St

Mineralys Therapeutics (MLYS) delivered third-quarter results that showed a smaller net loss than a year ago, signaling some operational progress. Alongside earnings, the company also filed a $300 million shelf registration.

See our latest analysis for Mineralys Therapeutics.

Mineralys Therapeutics has seen its 90-day share price return skyrocket an impressive 196.99 percent, helping drive a year-to-date share price return of 254.20 percent. Momentum has been building, with positive investor sentiment likely fueled by operational progress and the newly announced shelf registration.

If you're looking to uncover other healthcare stocks making noise and showing real promise, take the next step and explore See the full list for free.

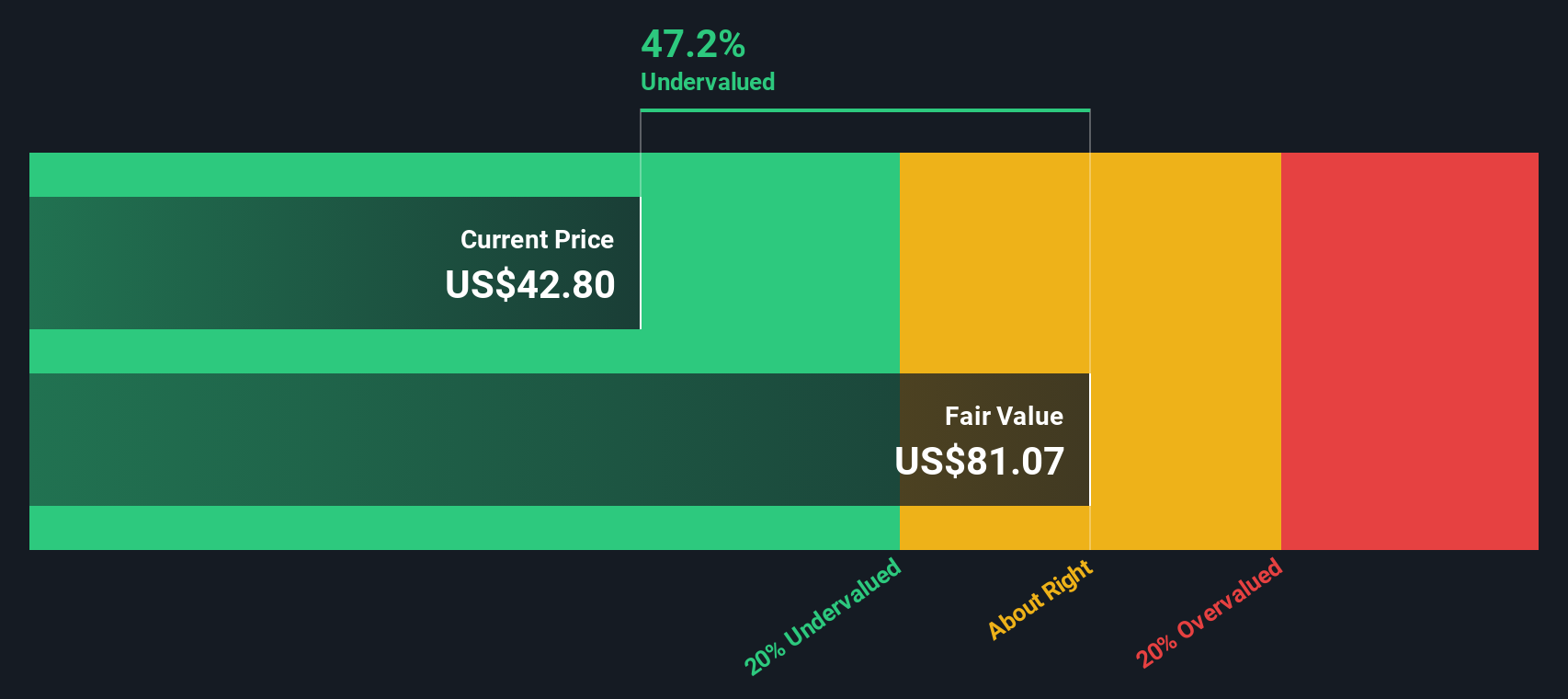

But with shares at nearly $43 and a substantial rally already in the rearview mirror, investors have to wonder if MLYS is truly undervalued, or if the market has already priced in much of its future growth potential.

Price-to-Book Ratio of 6x: Is it justified?

Mineralys Therapeutics trades at a price-to-book ratio of 6, below its peer average of 10.9 despite a strong share price run-up. At its last close of $43.39, the stock appears cheaper than peers when measured by this multiple.

The price-to-book ratio compares a company’s market value to its net assets and is often used to evaluate early-stage biotech firms like MLYS that are not yet profitable. For companies with little to no revenue and negative earnings, this ratio can signal how much the market is willing to pay for future potential.

While MLYS looks attractive versus its peer average based on price-to-book, the picture is less favorable against the broader US Biotech industry, which carries a lower average of just 2.5x. This suggests the market expects higher growth or value in Mineralys compared to the average biotech stock, even factoring in its lack of current revenue and ongoing losses. There is insufficient data to determine what would represent a fair ratio for MLYS specifically, but the current premium leaves room for debate about just how much potential is already baked into the price.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 6x (ABOUT RIGHT)

However, ongoing losses and the lack of current revenue still pose real risks that could impact the bullish narrative if progress stalls.

Find out about the key risks to this Mineralys Therapeutics narrative.

Another View: Discounted Cash Flow Perspective

While the price-to-book ratio offers one perspective on value, our DCF model provides a different view. According to this method, MLYS is trading nearly 50% below our estimate of fair value, suggesting there could be significant upside that the current market price does not reflect. Could the real opportunity be much larger than what the usual multiples indicate?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Mineralys Therapeutics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 909 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Mineralys Therapeutics Narrative

If you see the situation differently or want to dig into the numbers for yourself, you can quickly build your own view in just a few minutes: Do it your way

A great starting point for your Mineralys Therapeutics research is our analysis highlighting 2 key rewards and 5 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let smart opportunities slip past you. Tap into the momentum of winning stocks by using these tailored screeners, each loaded with unique investment angles worth your attention.

- Tap into the technology wave by jumping into these 27 AI penny stocks to find companies propelling the AI revolution.

- Unlock real value by seeking out these 909 undervalued stocks based on cash flows, which generates strong cash flows and may appeal to value-focused investors seeking upside.

- Catch the next disruptive trend by exploring these 81 cryptocurrency and blockchain stocks as they lead advancements in digital transactions and blockchain innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MLYS

Mineralys Therapeutics

A clinical-stage biopharmaceutical company, develops medicines to target diseases driven by dysregulated aldosterone in the United States.

Excellent balance sheet with moderate risk.

Market Insights

Community Narratives