- United States

- /

- Life Sciences

- /

- NasdaqGS:MLAB

A Piece Of The Puzzle Missing From Mesa Laboratories, Inc.'s (NASDAQ:MLAB) 27% Share Price Climb

Mesa Laboratories, Inc. (NASDAQ:MLAB) shareholders would be excited to see that the share price has had a great month, posting a 27% gain and recovering from prior weakness. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 14% over that time.

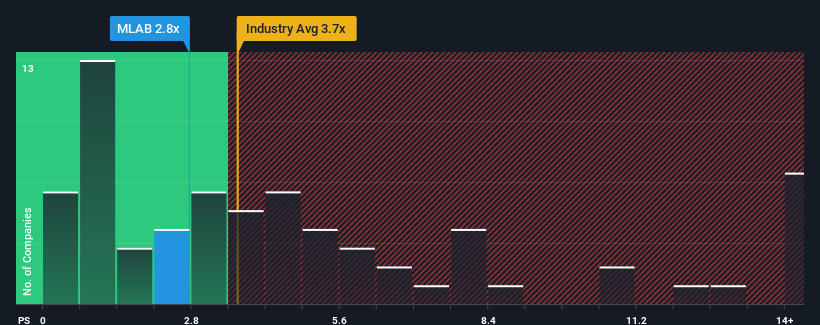

In spite of the firm bounce in price, Mesa Laboratories may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 2.8x, since almost half of all companies in the Life Sciences industry in the United States have P/S ratios greater than 3.7x and even P/S higher than 6x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Mesa Laboratories

What Does Mesa Laboratories' P/S Mean For Shareholders?

The recently shrinking revenue for Mesa Laboratories has been in line with the industry. Perhaps the market is expecting future revenue performance to deteriorate further, which has kept the P/S suppressed. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. In saying that, existing shareholders may feel hopeful about the share price if the company's revenue continues tracking the industry.

Want the full picture on analyst estimates for the company? Then our free report on Mesa Laboratories will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as low as Mesa Laboratories' is when the company's growth is on track to lag the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 1.3%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 61% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 7.7% per year over the next three years. With the industry predicted to deliver 7.0% growth each year, the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that Mesa Laboratories' P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

What Does Mesa Laboratories' P/S Mean For Investors?

Mesa Laboratories' stock price has surged recently, but its but its P/S still remains modest. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It looks to us like the P/S figures for Mesa Laboratories remain low despite growth that is expected to be in line with other companies in the industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Mesa Laboratories with six simple checks.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MLAB

Mesa Laboratories

Develops, designs, manufactures, sells, and services life sciences tools and quality control products and services in North America, Europe, the Asia Pacific, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives