- United States

- /

- Life Sciences

- /

- NasdaqGS:MEDP

Medpace Holdings (MEDP): Evaluating Valuation After Robust Q3 Results and Strong 2025 Growth Guidance

Reviewed by Simply Wall St

Medpace Holdings (MEDP) just released its third quarter earnings, showing solid year-over-year growth in sales and net income. The company’s new 2025 guidance points to sustained momentum ahead, fueling conversation among investors.

See our latest analysis for Medpace Holdings.

Medpace’s upbeat quarterly results, confidence-boosting FY2025 outlook, and ongoing share repurchase program have fueled strong momentum. The stock’s 77.5% year-to-date share price return and 86.8% one-year total shareholder return stand out among peers. Investors are clearly rewarding the company’s accelerating earnings growth and positive signals on capital management.

If you’re curious about other fast-moving healthcare opportunities with similar potential, take the next step and discover See the full list for free.

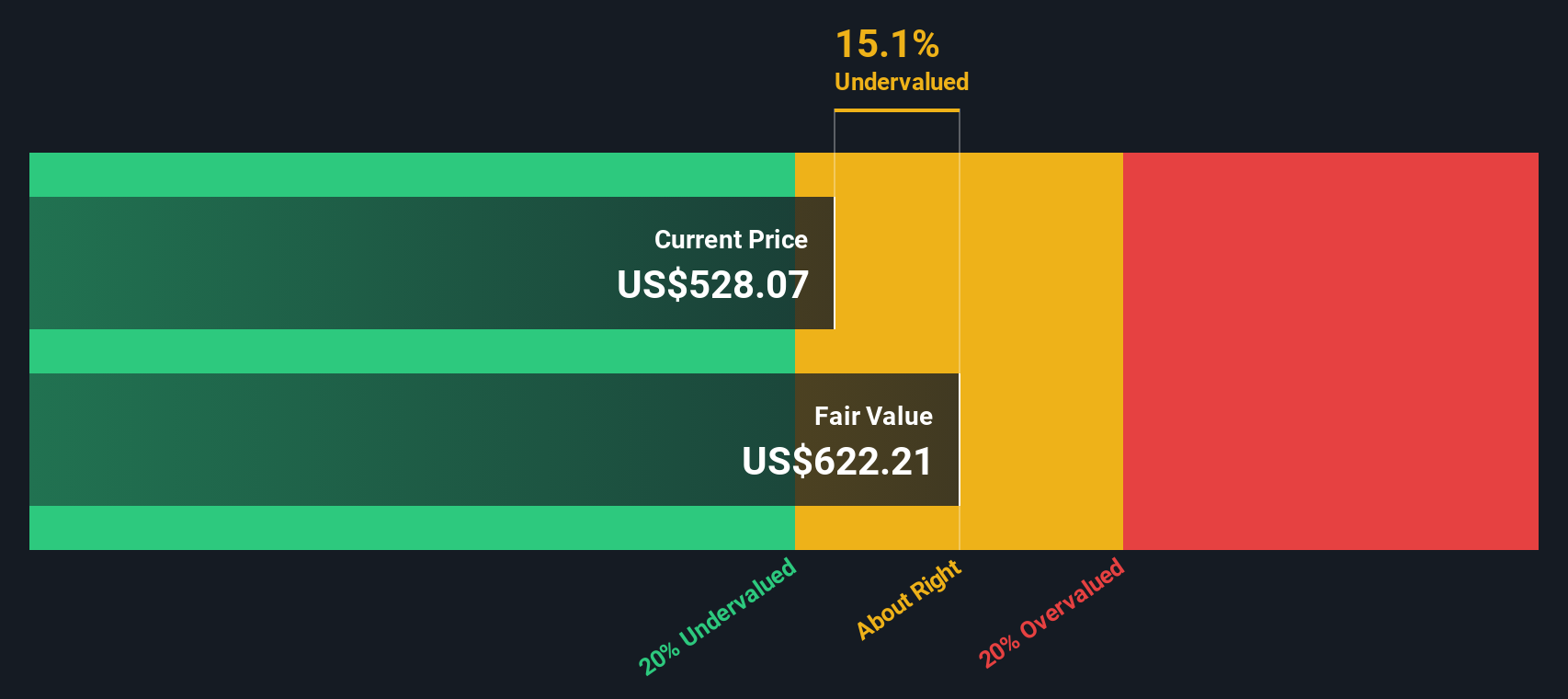

With shares already up nearly 80% this year and future growth forecasts looking bright, the key question is whether Medpace remains undervalued, or if the market has already priced in these strong prospects. Could this still be a timely buying opportunity?

Most Popular Narrative: 30% Overvalued

Medpace’s last close of $594.02 sits well above the most widely followed narrative’s fair value estimate of $456. Analysts are pricing in only a slight increase in the required return, but that still leaves a wide gap to the upside. What’s causing this cautious perspective?

Despite strong topline growth, win rates for new business were down and backlog is declining (down 1.8% year-over-year), suggesting competitive pressures and a lack of large contract wins may negatively impact future bookings and limit revenue and earnings visibility beyond 2025.

Want to know the story behind this valuation gap? The underlying forecast blends higher earnings with a shrinking profit margin, all while assuming Medpace can outpace industry risks. Wonder which controversial numbers drive the gap between the current price and narrative fair value? Uncover what analysts are really projecting and where expectations might run hottest.

Result: Fair Value of $456 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent strong demand for clinical trials or an unexpected surge in biotech funding could quickly challenge concerns about Medpace’s growth sustainability.

Find out about the key risks to this Medpace Holdings narrative.

Another View: Discounted Cash Flow Perspective

Looking at Medpace through our DCF model gives a very different picture. The SWS DCF model puts fair value at $692.62, so the current share price appears 14% undervalued. Could the market be underestimating Medpace’s long-term cash flow potential, or are there risks this model misses?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Medpace Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 839 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Medpace Holdings Narrative

If you have a different perspective or prefer hands-on analysis, you can dive into the numbers and craft your own take on Medpace’s outlook in just a few minutes. Do it your way

A great starting point for your Medpace Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for Your Next Big Opportunity?

Serious about taking control of your portfolio? Don’t miss the powerful market moves happening right now. There are standout investments waiting for smart investors like you.

- Unleash your curiosity for breakthrough innovation and check out these 28 quantum computing stocks to see how quantum advancements could supercharge your returns.

- Boost your income stream instantly by tapping into these 18 dividend stocks with yields > 3% that offer solid yields and reliable payouts above 3%.

- Catch the early momentum behind tomorrow’s AI leaders by exploring these 27 AI penny stocks before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MEDP

Medpace Holdings

Provides clinical research-based drug and medical device development services in North America, Europe, and Asia.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives