- United States

- /

- Biotech

- /

- NasdaqGS:MDGL

Madrigal Pharmaceuticals (MDGL): Forecasts Point to 34.8% Annual Revenue Growth Ahead of Earnings

Reviewed by Simply Wall St

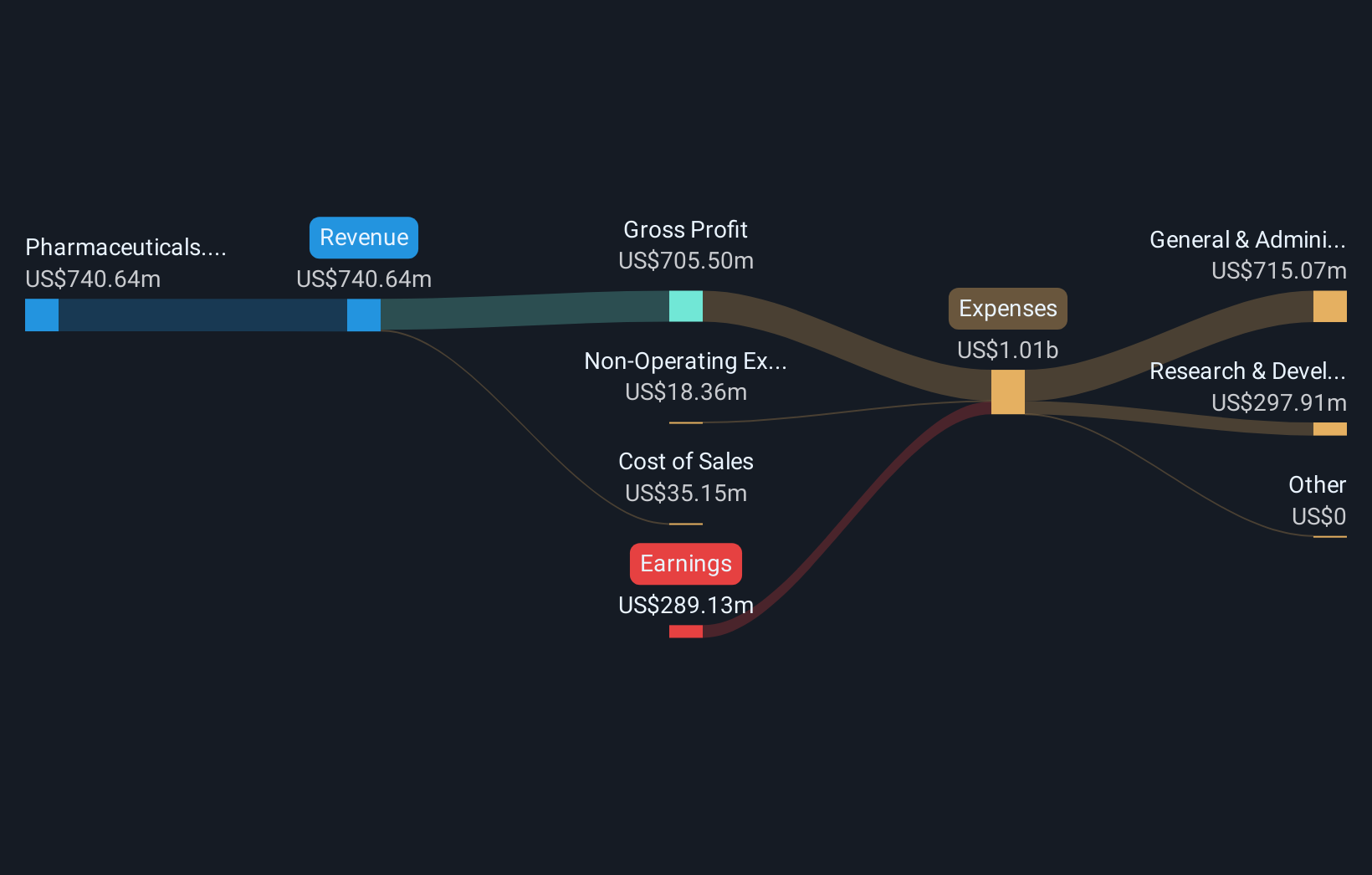

Madrigal Pharmaceuticals (MDGL) remains in the red, with losses widening at a 15.3% annual rate over the last five years and net profit margins not improving in that period. Looking ahead, analysts forecast annual revenue growth of 34.8% and earnings growth of 67.2% per year, setting the company on a path to profitability within three years. This represents a much faster trajectory than the US market’s projected 10.5% revenue growth. With shares trading below an estimated fair value and the Price-To-Sales Ratio of 13.4x undercutting peers’ 21x average, Madrigal offers compelling growth potential against a backdrop of continued unprofitability.

See our full analysis for Madrigal Pharmaceuticals.Let’s see how these headline figures compare with the key narratives shaping market expectations, and where the latest update might surprise investors.

See what the community is saying about Madrigal Pharmaceuticals

Patent Lifespan Extends Growth Horizon

- With Rezdiffra’s new U.S. patent pushing exclusivity to 2045, management can count on decades of protected revenue stream—an edge that is not typical for most biotech launches.

- Analysts' consensus view sees patent protection working together with rising global demand, adding:

- Early-stage penetration in the U.S. MASH market remains low (only about 7% of diagnosed patients), suggesting that there is significant headroom for recurring revenue as awareness and diagnoses increase.

- International launches, starting with Germany and backed by strong cash reserves, are expected to diversify revenues and reduce single-market risk. This underpins the outlook for sustained top-line expansion.

- Curious what market-watchers see as the next phase? Get the full narrative and see how analysts weigh these expansion bets. 📊 Read the full Madrigal Pharmaceuticals Consensus Narrative.

Margins Expected to Swing: -54.7% to 33.3%

- Analysts believe Madrigal can achieve one of the most dramatic margin swings in the sector, projecting net profit margins rising from the current -54.7% to a positive 33.3% within three years. This is well above the industry’s average pace.

- Consensus narrative highlights both the tailwinds and possible challenges:

- Pricing power and an expanding patient base are expected to fuel margin expansion, but aggressive R&D and SG&A investments could weigh on the bottom line if cost inflation is not kept in check.

- The pipeline’s combination therapies and market entry hurdles in the EU might delay margin upside, especially if reimbursement challenges or heavier competition occur sooner than expected.

Valuation Stands Out: Peer Discount, Industry Premium

- Madrigal’s Price-To-Sales Ratio is 13.4x, which is attractively discounted relative to direct peers at 21x, yet still above the broader U.S. biotech average of 10.8x. At $444.64 per share, the current market price is approximately 5.7% below the top analyst price target of $525.93.

- Consensus narrative points out that this valuation mix creates both opportunity and caution:

- The stock’s discount to peers supports the growth case if bullish forecasts materialize, but its premium to the wider sector may limit near-term upside unless execution continues to exceed expectations.

- Analysts view the narrow gap between price and target as a signal that Madrigal is fairly valued at present, making future growth delivery crucial for any rerating.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Madrigal Pharmaceuticals on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the numbers from another angle? Share your point of view and craft a personal narrative in just a few minutes. Do it your way

A great starting point for your Madrigal Pharmaceuticals research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Madrigal’s rapid growth prospects are offset by continued unprofitability, volatile margins, and a premium valuation compared to the broader biotech sector.

If you prefer companies delivering steady gains with consistent earnings and revenue expansion, check out stable growth stocks screener (2079 results) that put predictability and financial stability at the forefront.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MDGL

Madrigal Pharmaceuticals

A biopharmaceutical company, focuses on delivering novel therapeutics for metabolic dysfunction-associated steatohepatitis (MASH) in the United States.

Exceptional growth potential and good value.

Market Insights

Community Narratives