- United States

- /

- Biotech

- /

- NasdaqGS:MDGL

A Fresh Look at Madrigal Pharmaceuticals (MDGL) Valuation After Rezdiffra Launch and Pipeline Progress

Reviewed by Simply Wall St

Madrigal Pharmaceuticals (MDGL) is riding a wave of momentum following the strong debut of Rezdiffra, its novel therapy for metabolic dysfunction-associated steatohepatitis, or MASH. Early numbers suggest significant potential as U.S. adoption picks up.

See our latest analysis for Madrigal Pharmaceuticals.

On the heels of Rezdiffra’s strong launch and a steady drumbeat of positive developments, including the recent in-licensing of a GLP-1 drug, Madrigal Pharmaceuticals’ share price has climbed 84.7% year-to-date and delivered an 80.3% total return over the past year. Momentum is building as investor confidence grows in the company’s growth trajectory and expanding pipeline.

If fast-moving biopharma stories like this have you curious, now is a perfect time to discover more innovative healthcare stocks using our See the full list for free.

With such rapid share price gains and blockbuster potential in the pipeline, investors have to wonder: is Madrigal still undervalued given its future prospects, or is all that excitement already fully priced in?

Most Popular Narrative: 3% Overvalued

Madrigal Pharmaceuticals' last close at $579.45 stands just above the most widely followed narrative fair value of $563.80, suggesting the rally in the stock has outpaced analyst consensus. The difference underscores a tension: Are optimism and recent results already fully priced in?

"Recent clinical trial and real-world data reinforce Rezdiffra’s efficacy, particularly in patients with compensated cirrhosis and the MASH F4 subtype. This has bolstered peak sales estimates and longer-term growth projections."

Want to see what’s powering that premium price? This narrative is built on blockbuster revenue projections, soaring margins, and a multiple typically reserved for sector leaders. Curious which game-changing forecasts the analysts are counting on? Unlock the specifics driving this fair value. One number in particular may surprise you.

Result: Fair Value of $563.80 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still possible headwinds, such as tougher competition from new therapies and the challenge of driving broader adoption outside of core treatment centers.

Find out about the key risks to this Madrigal Pharmaceuticals narrative.

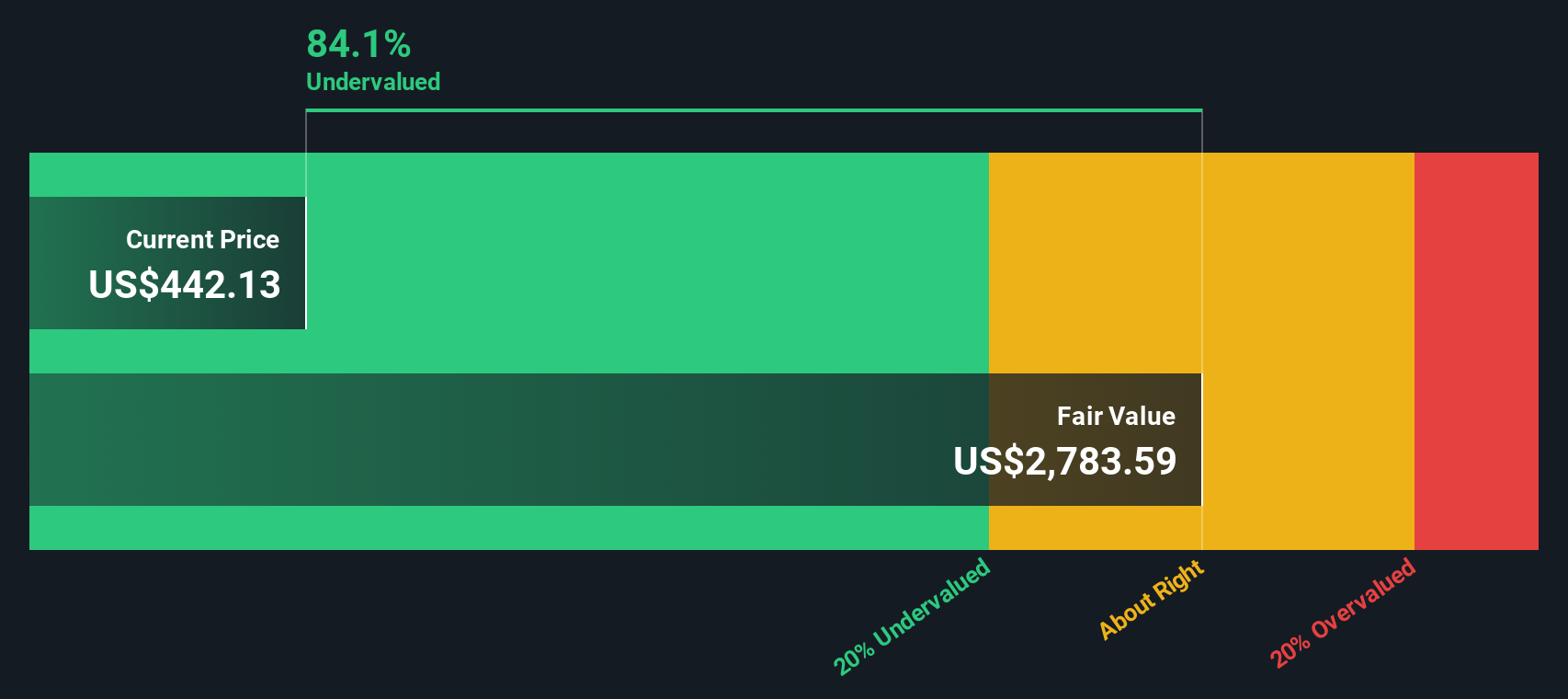

Another View: DCF Model Tells a Different Story

Taking a step back from the recent narrative fair value and analyst target, the SWS DCF model calculates Madrigal Pharmaceuticals' fair value at $2,916.74, a price far above current levels. This method suggests the stock could be dramatically undervalued if its long-term growth projections materialize. But is this outsized optimism realistic or a sign the market is missing something big?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Madrigal Pharmaceuticals Narrative

If you see things differently or want to test your own insights with the numbers, it only takes a few minutes to build your own perspective in your own way. Do it your way

A great starting point for your Madrigal Pharmaceuticals research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Smart investors never settle for just one big story. Stay ahead of the curve and explore what’s next by discovering more innovative, high-potential ideas with these powerful tools:

- Tap the potential of tomorrow's leaders and uncover value among these 3563 penny stocks with strong financials with strong financial fundamentals.

- Enhance your strategy with these 25 AI penny stocks driving advances in automation, analytics, and next-generation technology that are changing entire industries.

- Consider options for reliable income streams by reviewing these 14 dividend stocks with yields > 3%, which features attractive yields above 3% from quality, shareholder-focused companies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MDGL

Madrigal Pharmaceuticals

A biopharmaceutical company, focuses on delivering novel therapeutics for metabolic dysfunction-associated steatohepatitis (MASH) in the United States.

Exceptional growth potential and good value.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026