- United States

- /

- Biotech

- /

- NasdaqGM:KYMR

Kymera Therapeutics (KYMR) Losses Worsen, Challenging Bullish Narratives on Profit Timeline

Reviewed by Simply Wall St

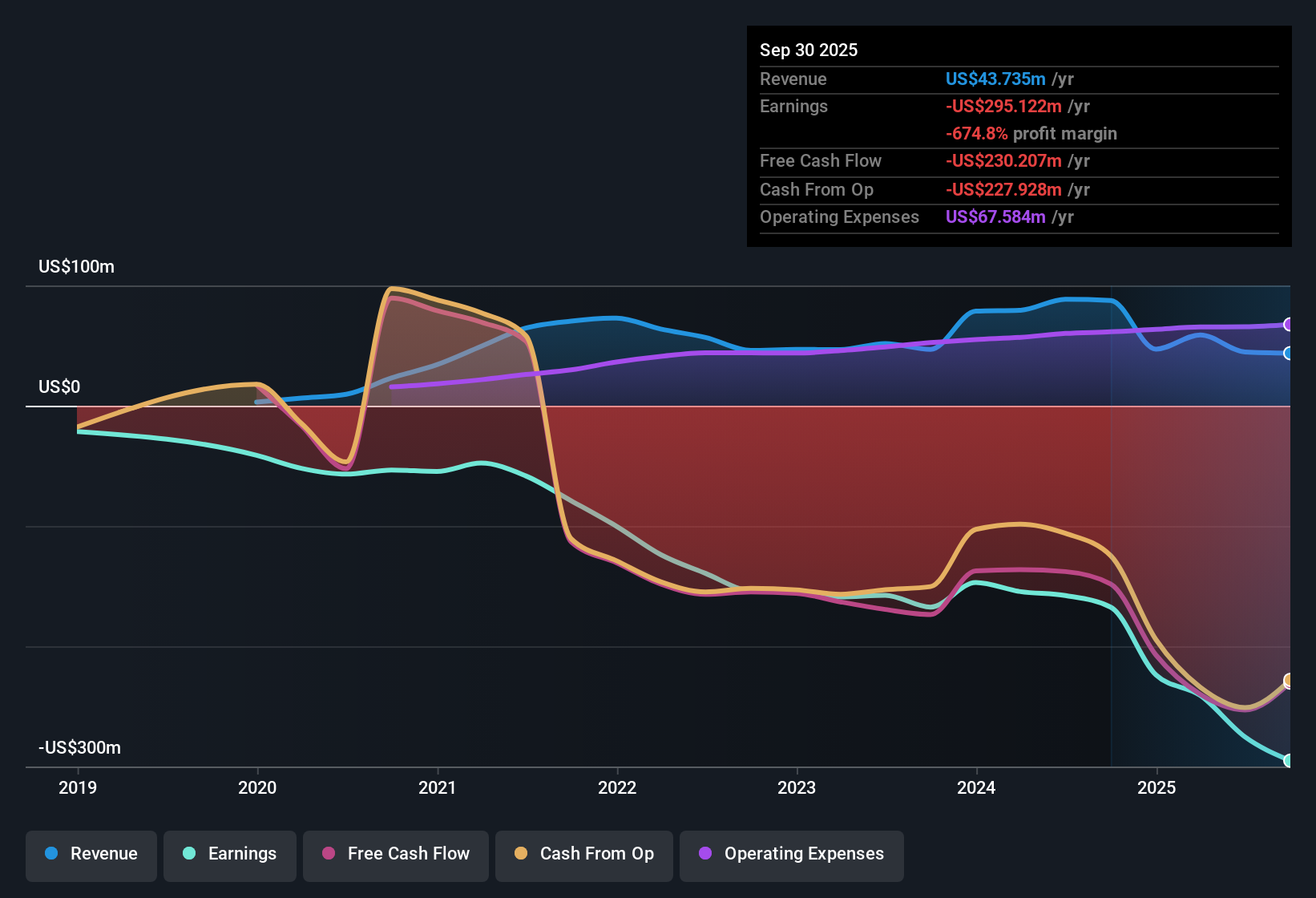

Kymera Therapeutics (KYMR) posted another unprofitable year, with annual losses growing at a rate of 28.4% per year over the past five years. The company’s margins remain under pressure, and analysts expect revenue to contract by roughly 2.5% annually over the next three years. Shares are currently trading at $59.91. With profitability still out of reach and revenue momentum fading, the numbers highlight the continued financial headwinds for Kymera.

See our full analysis for Kymera Therapeutics.Up next, we’ll see how the data compare with the prevailing narratives around Kymera. Some common stories may get reinforced, while others could be challenged by these new results.

See what the community is saying about Kymera Therapeutics

Price-to-Book Multiple Stands Out

- Kymera trades at a Price-to-Book Ratio of 4.5x, which is a 1.8x premium compared to the US Biotech industry average of 2.5x. This is slightly below the direct peer average of 4.9x.

- Analysts' consensus view notes that while Kymera's premium to the broader industry could concern value-focused investors, the valuation levels align more closely with peers. This reduces fears of a severe overvaluation.

- The share price of $59.91 leaves the stock trading above the analyst-consensus target of 72.36, suggesting potential for further downside or a demand for stronger growth to justify the price.

- Valuation decisions should be weighed carefully against high R&D expenses and lack of profitability progress, which remain central to the consensus narrative.

- See what the community is saying about Kymera Therapeutics 📊 Read the full Kymera Therapeutics Consensus Narrative.

Analysts Predict Revenue Contraction

- Despite recent advances, analyst forecasts call for Kymera's revenue to decrease by about 2.5% annually over the next three years.

- Analysts' consensus view raises caution about future top-line growth. Execution risks from increased competition and heavy reliance on partnerships may weigh on revenue momentum.

- While new clinical programs promise long-term potential, actual near-term revenue delivery could fall short if milestones are missed or partners slow development.

- Steadily rising costs, including $71.8 million in Q4 R&D spending, add to pressure on margins and underscore the challenge of turning progress in the pipeline into tangible sales.

Cash Runway Extends to 2027

- Kymera is backed by a substantial cash runway that is projected to last until mid-2027. This supports ongoing R&D and clinical programs without needing immediate new financing.

- Analysts' consensus view emphasizes that this financial buffer allows for sustained investment in pipeline growth. However, persistent unprofitability could still become a concern if new therapies do not reach commercialization as planned.

- High operating costs remain a structural risk. Success depends on clear clinical milestones and capitalization of expanding clinical programs.

- The ability to advance programs like STAT6, TYK2, and IRAK4 depends on both scientific progress and the maintenance of partnership momentum.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Kymera Therapeutics on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the figures from a different angle? Share your unique take and shape your own narrative in just a few minutes by clicking Do it your way.

A great starting point for your Kymera Therapeutics research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Kymera Therapeutics faces growing losses, fading revenue momentum, and ongoing unprofitability, which cast doubt on its near-term financial health.

If you want stocks with stronger balance sheets and greater financial resilience, check out solid balance sheet and fundamentals stocks screener (1981 results) designed for just that purpose.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kymera Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:KYMR

Kymera Therapeutics

A clinical-stage biopharmaceutical company, focuses on discovering and developing small molecule therapeutics that selectively degrade disease-causing proteins by harnessing the body’s own natural protein degradation system.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives