- United States

- /

- Biotech

- /

- NasdaqGS:KURA

Kura Oncology (KURA) Margin Miss Reinforces Debate Over Persistent Losses Versus Revenue Growth Promise

Reviewed by Simply Wall St

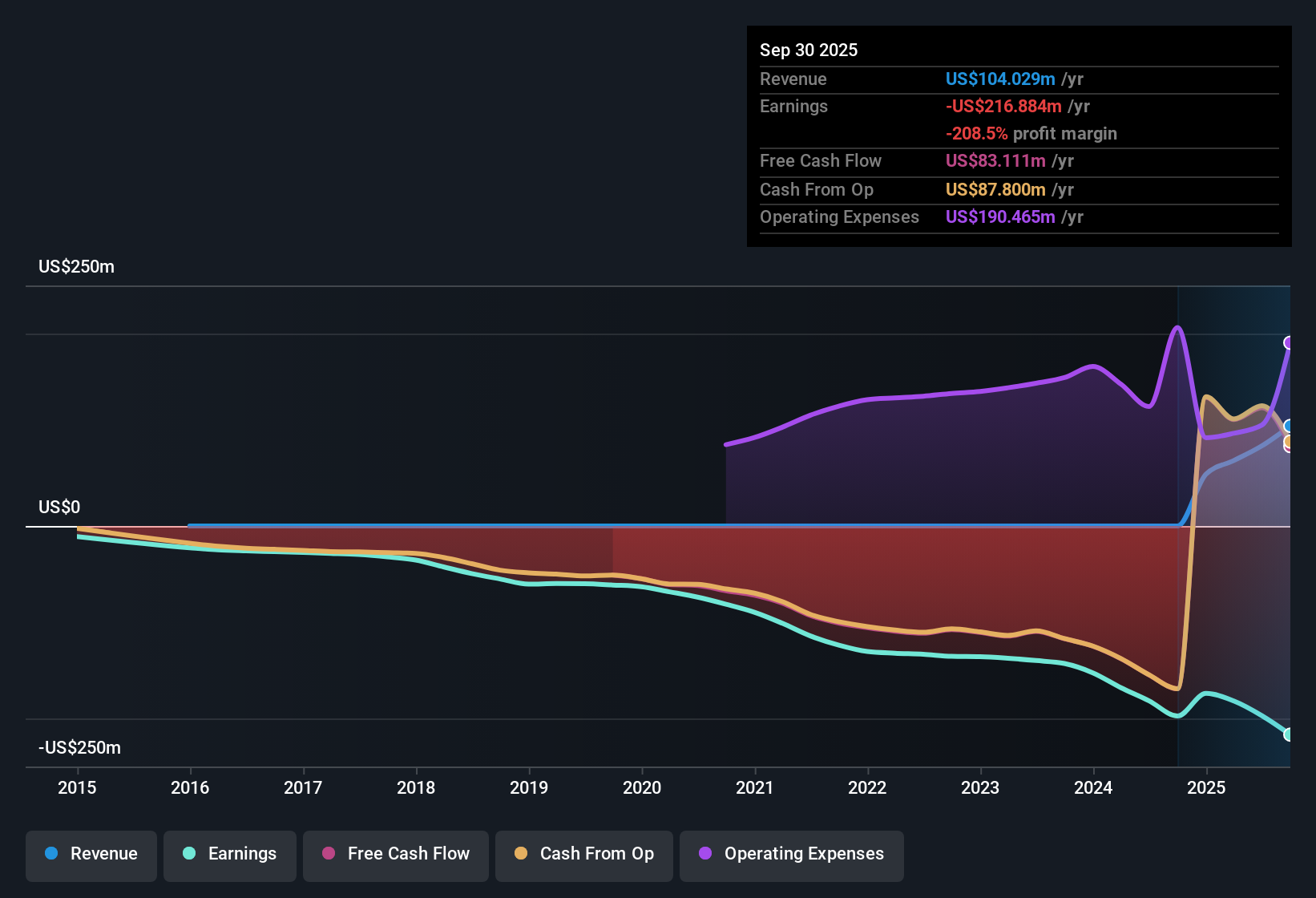

Kura Oncology (KURA) remains unprofitable and is projected to stay in the red for at least the next three years, with losses having widened at a pace of 15.3% per year over the last five. Despite negative profit margins and no signs of bottom-line improvement, the company is forecast to deliver revenue growth of 42.7% annually, significantly outpacing the broader US market’s 10.5% revenue growth expectation. Investors now face a trade-off between robust top-line growth potential and the concern of ongoing unprofitability as the market weighs future promise against current losses.

See our full analysis for Kura Oncology.The next section examines how these headline results compare with the major narratives around Kura, highlighting areas where the earnings story finds support and where the numbers raise new questions.

See what the community is saying about Kura Oncology

Profit Margins Deep in Negative Territory

- Kura Oncology's net profit margin stands sharply negative, with figures well below industry averages and no signal of near-term improvement flagged in the EDGAR summary.

- Analysts' consensus view highlights how the persistently negative net profit margin challenges hopes for sustainable bottom-line growth,

- Even with revenue growth forecasts, consensus notes that losses have widened at 15.3% annually over the past five years, keeping the company's earnings quality under pressure.

- Consensus narrative points out that the company's ability to move from a net loss today (currently at $-197.2 million) to a future earnings level requires a dramatic turnaround in profitability that few analysts see materializing in the next three years.

- Consensus narrative suggests there is significant disagreement among analysts about the path to profitability and its timeline, with the most optimistic expecting $259.1 million in future earnings by 2028, while the most bearish forecast a deepening loss to $-459.4 million.

- Consensus narrative notes that Kura's negative margin and widening losses are flagging risks for long-term shareholder value unless there is a successful turnaround in drug development and commercialization.

Pipeline Growth Meets Price-to-Sales Discount

- Kura's Price-To-Sales Ratio is 8.3x, lower than the US Biotech industry average of 10.8x but higher than direct peer median of 5.1x, placing its valuation in the middle of its sector context.

- Analysts' consensus view sees the robust expected annual revenue growth of 42.7% as the main near-term catalyst,

- Consensus notes anticipated FDA decisions and expanding commercial indications, specifically noting ziftomenib's potential, as key drivers that could boost revenues well above $400 million by 2028 and justify a premium Price-To-Sales valuation.

- At the same time, consensus flags that trading on a higher Price-To-Sales ratio than peers, while still deeply unprofitable, reflects the market's weighing of future pipeline promise against the present risk of ongoing negative margin trends.

Share Price Lags Analyst Targets

- Kura's current share price of $9.96 trades at a sizeable discount to the analyst consensus target of $27.00, a 171% upside if analysts' projections play out.

- Analysts' consensus view interprets this gap as a reflection of both the upside potential from multiple late-stage pipeline assets and the market's skepticism surrounding the company's ability to achieve industry-average profit margins,

- If profit margins reach the industry mean of 16.1% as projected, earnings could shift dramatically from $-197.2 million to $69.8 million, which would validate much of the analyst upside baked into the $27.00 target.

- However, consensus narrative acknowledges this outcome depends on major milestones like FDA approval and timely commercialization, and warns that persistent losses, funding needs, and competitive pressures could prevent the share price from tracking analyst optimism.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Kura Oncology on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got a unique take on the figures? It only takes a few minutes to craft your own perspective and share your narrative. Do it your way

A great starting point for your Kura Oncology research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Kura Oncology’s persistent unprofitability, widening losses, and weak margins highlight the risks of companies that cannot convert rapid revenue growth into sustainable earnings.

If steady progress matters more to you, use stable growth stocks screener (2077 results) to focus on companies with reliable earnings and revenue growth, not just future potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kura Oncology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KURA

Kura Oncology

A clinical-stage biopharmaceutical company, develops medicines for the treatment of cancer.

Excellent balance sheet with limited growth.

Market Insights

Community Narratives