- United States

- /

- Biotech

- /

- NasdaqGS:KRYS

Krystal Biotech (KRYS): Assessing Valuation Following Strong Earnings Surge and Investor Optimism

Reviewed by Simply Wall St

Krystal Biotech (KRYS) just posted third quarter earnings that far outpaced last year. The company reported a sharp jump in net income and earnings per share for both the quarter and year-to-date. This strong performance quickly caught investors’ attention.

See our latest analysis for Krystal Biotech.

After this earnings jump, Krystal Biotech's share price quickly reflected renewed optimism, notching a 29.71% share price return year-to-date and a strong 35.93% gain over the last 90 days. Momentum has clearly been building, and the robust one-year total shareholder return of 8.43% is further outpaced by an impressive 384% total shareholder return over five years, highlighting the company’s long-term growth potential.

If you’re inspired by Krystal’s surge, now is a great time to explore other healthcare stocks on the rise. See the full list with our See the full list for free..

But with shares surging and earnings growth fresh in mind, is there still value left for new investors? Or has the market already priced in all of Krystal Biotech’s future potential?

Most Popular Narrative: 4.5% Undervalued

Krystal Biotech’s fair value is pegged at $212.50 per share, slightly higher than its last close of $203, indicating room for upside. This view ties recent earnings and pipeline progress to the company’s share price optimism.

“Significant international expansion is imminent, with VYJUVEK launches in Europe and Japan expected to substantially increase addressable market and top-line revenues over the next 12 to 18 months. Broad regulatory labels and established reimbursement pathways in these markets are likely to support pricing power and faster adoption.”

Curious what else is fueling this premium? The narrative hinges on ambitious growth projections and a profit trajectory that could redefine expectations for biotech valuations. Want to see which bold numbers and strategic bets underpin this target? Dive into the full narrative and discover why this valuation sparks heated debate.

Result: Fair Value of $212.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent revenue volatility resulting from unpredictable patient treatment patterns and reliance on a single therapy could quickly challenge Krystal Biotech’s bullish growth story.

Find out about the key risks to this Krystal Biotech narrative.

Another View: Are Multiples Painting a Different Picture?

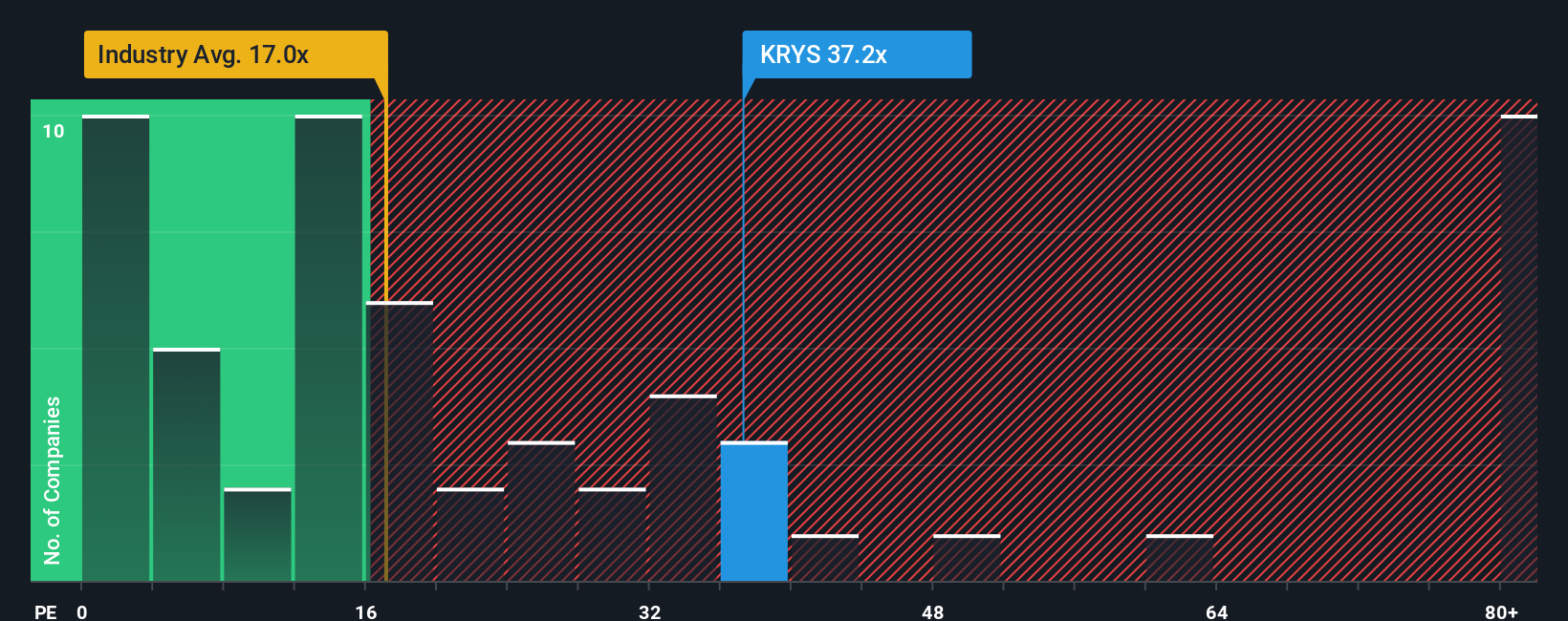

While the narrative points to Krystal Biotech being undervalued based on its growth outlook, a quick look at its current price-to-earnings ratio tells a more cautious story. KRYS trades at 29.6 times earnings, higher than both its fair ratio of 26.5x and the US Biotechs industry average of 17.1x. That gap means investors are already paying a premium for its strong results, which could make the stock vulnerable if execution slips or sentiment turns. Is this premium justified, or are risks building in plain sight?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Krystal Biotech Narrative

If these perspectives don't fully convince you, why not take a closer look at the numbers yourself and craft your own outlook in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Krystal Biotech.

Looking for More Investment Ideas?

You’re only scratching the surface if you limit yourself to one stock. Get ahead by searching for tomorrow’s winners with these targeted opportunities now.

- Catch the surge in next-generation artificial intelligence by using these 25 AI penny stocks to spot companies revolutionizing their industries with advanced automation and learning models.

- Boost your hunt for strong yields by checking out these 15 dividend stocks with yields > 3%, which offers attractive returns and robust fundamentals beyond the usual suspects.

- Seize promising prospects in digital assets by exploring these 82 cryptocurrency and blockchain stocks, a way to follow developments at the intersection of finance and blockchain innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Krystal Biotech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KRYS

Krystal Biotech

A commercial-stage biotechnology company, discovers, develops, manufactures, and commercializes genetic medicines to treat diseases with high unmet medical needs in the United States.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives