- United States

- /

- Biotech

- /

- NasdaqGM:KOD

Why Kodiak Sciences (KOD) Is Gaining Attention After Promising KSI-101 Results and Conference Spotlight

Reviewed by Sasha Jovanovic

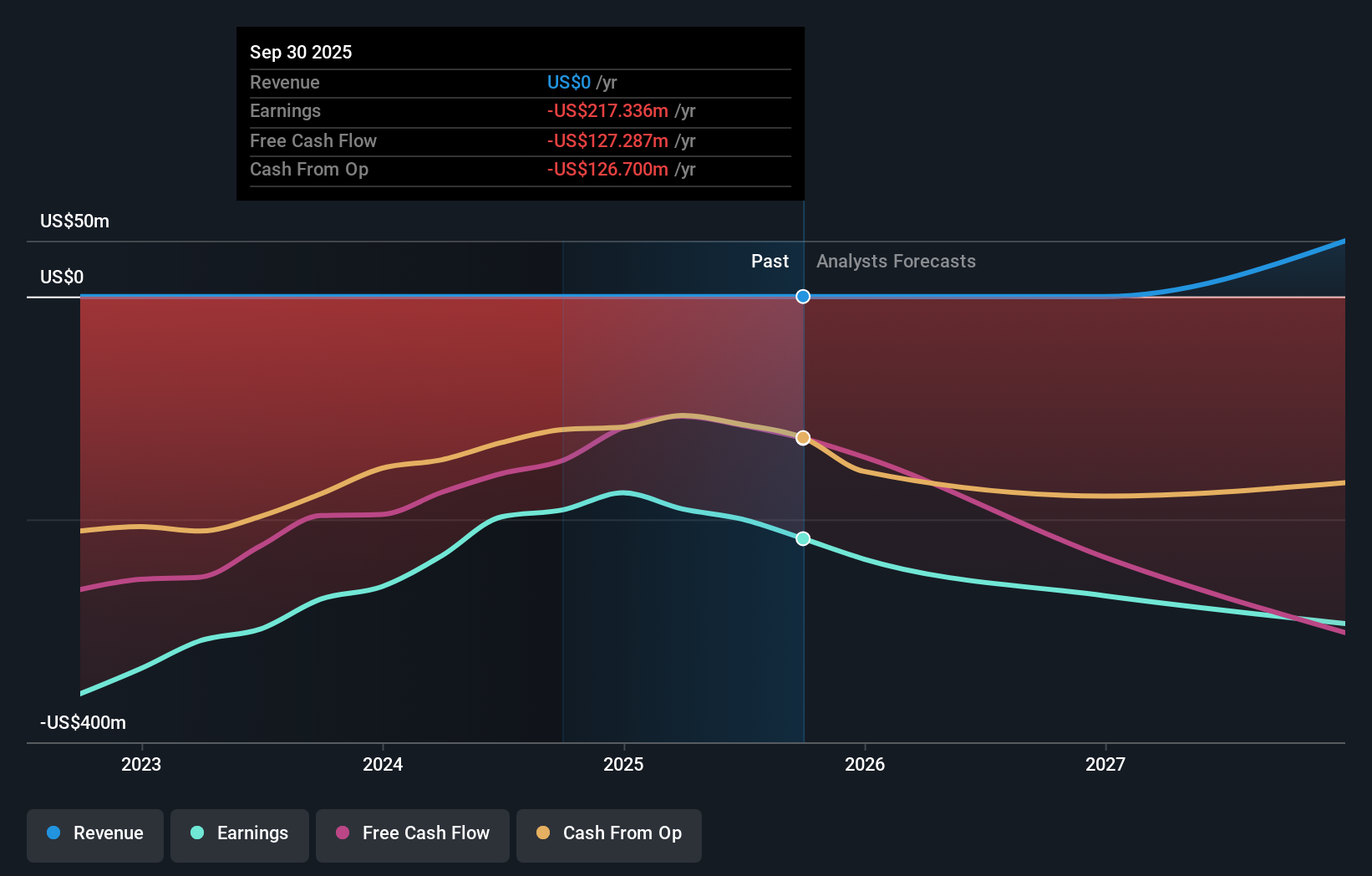

- Kodiak Sciences reported a net loss of US$61.46 million for the third quarter and US$173.23 million for the first nine months of 2025, alongside presenting at the Jefferies London Healthcare Conference.

- Analyst attention has focused on the company’s clinical pipeline for retinal diseases, particularly highlighted by positive Phase 1b results for KSI-101 and anticipation for upcoming Phase 3 trial data.

- We'll explore how growing optimism around Kodiak Sciences’ retinal disease therapies is influencing the company’s overall investment narrative.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Kodiak Sciences' Investment Narrative?

For investors considering Kodiak Sciences, the core belief often centers around the company’s potential to deliver innovative treatments for major retinal diseases, a prospect that rests on continued progress in its clinical pipeline. The latest earnings report highlighted rising net losses, now at US$61.46 million for the recent quarter, which is not unexpected for a biotech at Kodiak's stage but remains a pressing issue given its limited cash runway and lack of revenue. Momentum around KSI-101, especially after recent positive early trial results and anticipation for Phase 3 data, continues to be the real short-term driver for the stock rather than quarterly financials. While the conference presentation in London reinforced analyst optimism, the latest results do not appear to have materially changed the biggest near-term risks: funding uncertainty, development setbacks, and high share price volatility. The key questions for shareholders now are whether upcoming trial results and potential partnership news can offset the current financial pressures, and if optimism around the pipeline justifies the risk profile.

In contrast, funding risks remain important for anyone following the stock. Insights from our recent valuation report point to the potential overvaluation of Kodiak Sciences shares in the market.Exploring Other Perspectives

Build Your Own Kodiak Sciences Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kodiak Sciences research is our analysis highlighting 4 important warning signs that could impact your investment decision.

- Our free Kodiak Sciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kodiak Sciences' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kodiak Sciences might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:KOD

Kodiak Sciences

A clinical stage biopharmaceutical company, engages in the research, development, and commercialization of therapeutics to treat retinal diseases.

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives