- United States

- /

- Biotech

- /

- NasdaqGS:KNSA

The Bull Case For Kiniksa Pharmaceuticals (KNSA) Could Change Following ARCALYST Sales Surge and Return to Profitability

Reviewed by Sasha Jovanovic

- Kiniksa Pharmaceuticals International recently reported third quarter 2025 earnings, delivering US$180.86 million in revenue and achieving net income of US$18.44 million compared to a net loss a year earlier, while raising 2025 ARCALYST sales guidance and sharing that its pipeline asset KPL-387 received FDA Orphan Drug Designation for pericarditis.

- An important development is the 61% year-over-year growth in ARCALYST net product revenue, highlighting rapidly expanding market adoption within a significantly underserved patient population.

- We will explore how Kiniksa’s upgraded ARCALYST revenue outlook and return to profitability could influence its investment story moving forward.

We've found 24 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Kiniksa Pharmaceuticals International Investment Narrative Recap

To be a shareholder in Kiniksa Pharmaceuticals International, you need to believe that ARCALYST’s strong adoption and expanding market potential will sustain the company’s profitability, while pipeline advancements like KPL-387 add future diversification. The recent earnings beat and raised guidance reinforce ARCALYST’s momentum as the critical near-term catalyst, but concentration risk around one product remains; this news does not materially reduce the threat from evolving competition or payer pressures, which continues to be the biggest risk.

The most directly related recent announcement is the FDA granting Orphan Drug Designation to KPL-387 for pericarditis. This regulatory development builds credibility for Kiniksa’s pipeline while positioning KPL-387 as a potential next growth driver, although pivotal trial readouts are still over a year away, so near-term valuation is still closely tied to ARCALYST’s market execution. Despite positive earnings momentum, investors should pay careful attention to how quickly rivals target ARCALYST’s patient base, since ...

Read the full narrative on Kiniksa Pharmaceuticals International (it's free!)

Kiniksa Pharmaceuticals International is projected to reach $992.0 million in revenue and $189.0 million in earnings by 2028. Achieving this requires 23.3% annual revenue growth and a $184.2 million increase in earnings from the current $4.8 million.

Uncover how Kiniksa Pharmaceuticals International's forecasts yield a $50.43 fair value, a 35% upside to its current price.

Exploring Other Perspectives

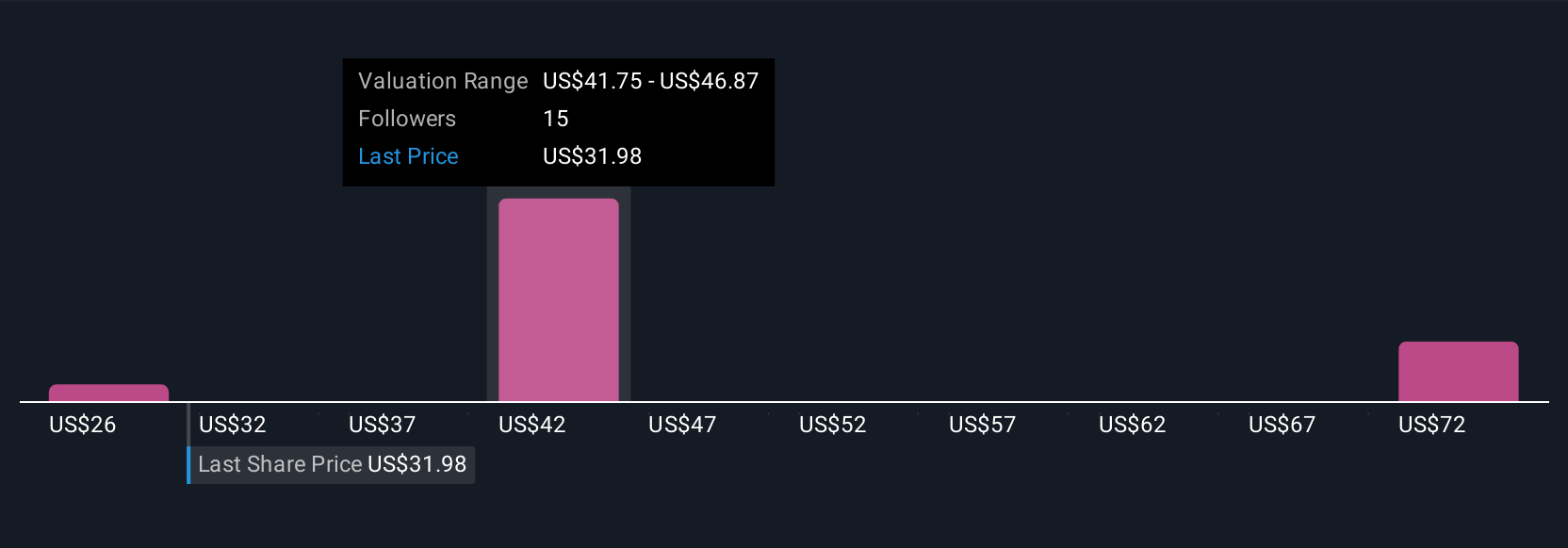

Five members of the Simply Wall St Community placed fair value estimates for Kiniksa Pharmaceuticals International ranging from US$26.39 to US$136.04 per share. These wide differences occur even as ARCALYST’s expanding revenue base remains the focus for most analysts, offering you fresh angles on where the company’s earnings potential could go.

Explore 5 other fair value estimates on Kiniksa Pharmaceuticals International - why the stock might be worth 29% less than the current price!

Build Your Own Kiniksa Pharmaceuticals International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kiniksa Pharmaceuticals International research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Kiniksa Pharmaceuticals International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kiniksa Pharmaceuticals International's overall financial health at a glance.

Seeking Other Investments?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kiniksa Pharmaceuticals International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KNSA

Kiniksa Pharmaceuticals International

A biopharmaceutical company, developing and commercializing novel therapies for diseases with unmet need and focuses on cardiovascular indications worldwide.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives