Stock Analysis

- United States

- /

- Biotech

- /

- NasdaqGS:KNSA

Kiniksa Pharmaceuticals International And Two More Firms Possibly Priced Below Market Value Estimates

Reviewed by Simply Wall St

As global markets exhibit mixed reactions with a notable pivot towards value and small-cap stocks, investors are keenly observing shifts in market dynamics. Amid these changing tides, identifying potentially undervalued stocks could offer intriguing opportunities for those looking to diversify their portfolios in line with current economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sachem Capital (NYSEAM:SACH) | US$2.69 | US$5.35 | 49.7% |

| Pylon (SET:PYLON) | THB2.02 | THB4.03 | 49.8% |

| Vista Energy. de (BMV:VISTA A) | MX$861.00 | MX$1716.24 | 49.8% |

| Duckhorn Portfolio (NYSE:NAPA) | US$7.26 | US$14.44 | 49.7% |

| West China Cement (SEHK:2233) | HK$1.08 | HK$2.15 | 49.7% |

| Sea (NYSE:SE) | US$66.98 | US$133.89 | 50% |

| Auction Technology Group (LSE:ATG) | £4.83 | £9.65 | 49.9% |

| Musti Group Oyj (HLSE:MUSTI) | €26.65 | €53.24 | 49.9% |

| Harvard Bioscience (NasdaqGM:HBIO) | US$3.30 | US$6.56 | 49.7% |

| Lotus Resources (ASX:LOT) | A$0.28 | A$0.56 | 49.9% |

We're going to check out a few of the best picks from our screener tool.

Kiniksa Pharmaceuticals International (NasdaqGS:KNSA)

Overview: Kiniksa Pharmaceuticals International, plc is a global biopharmaceutical company engaged in developing and commercializing therapies for patients with severe diseases lacking adequate treatment options, with a market capitalization of approximately $1.52 billion.

Operations: The company generates revenue primarily through the development and delivery of therapeutic medicines, totaling approximately $301.77 million.

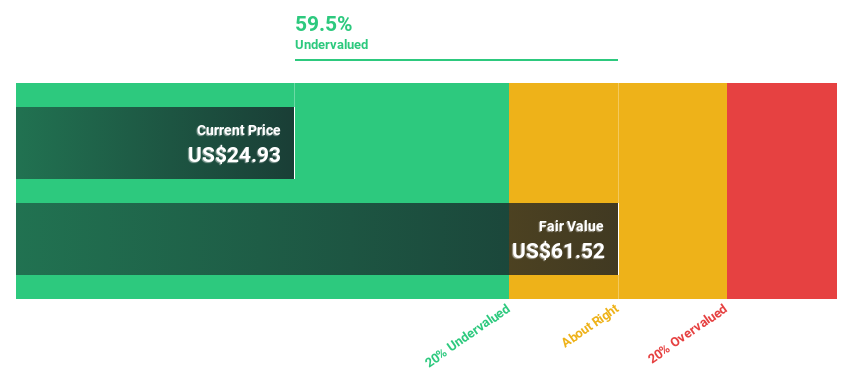

Estimated Discount To Fair Value: 36.8%

Kiniksa Pharmaceuticals International recently reported a significant revenue increase to US$188.49 million for the first half of 2024, yet faced a shift from net income to a net loss of US$21.61 million. Despite recent volatility, including delisting plans and fluctuating index classifications, the company is undervalued based on discounted cash flow analysis, trading at 36.8% below estimated fair value with promising revenue growth forecasts significantly above the market average. This positions Kiniksa as potentially attractive for investors seeking growth in biopharmaceuticals despite current financial inconsistencies.

- Insights from our recent growth report point to a promising forecast for Kiniksa Pharmaceuticals International's business outlook.

- Unlock comprehensive insights into our analysis of Kiniksa Pharmaceuticals International stock in this financial health report.

Piramal Pharma (NSEI:PPLPHARMA)

Overview: Piramal Pharma Limited is a global pharmaceutical company with operations across North America, Europe, Japan, and India, boasting a market capitalization of approximately ₹207.06 billion.

Operations: The company generates revenue primarily from its pharmaceutical segment, which reported earnings of ₹81.71 billion.

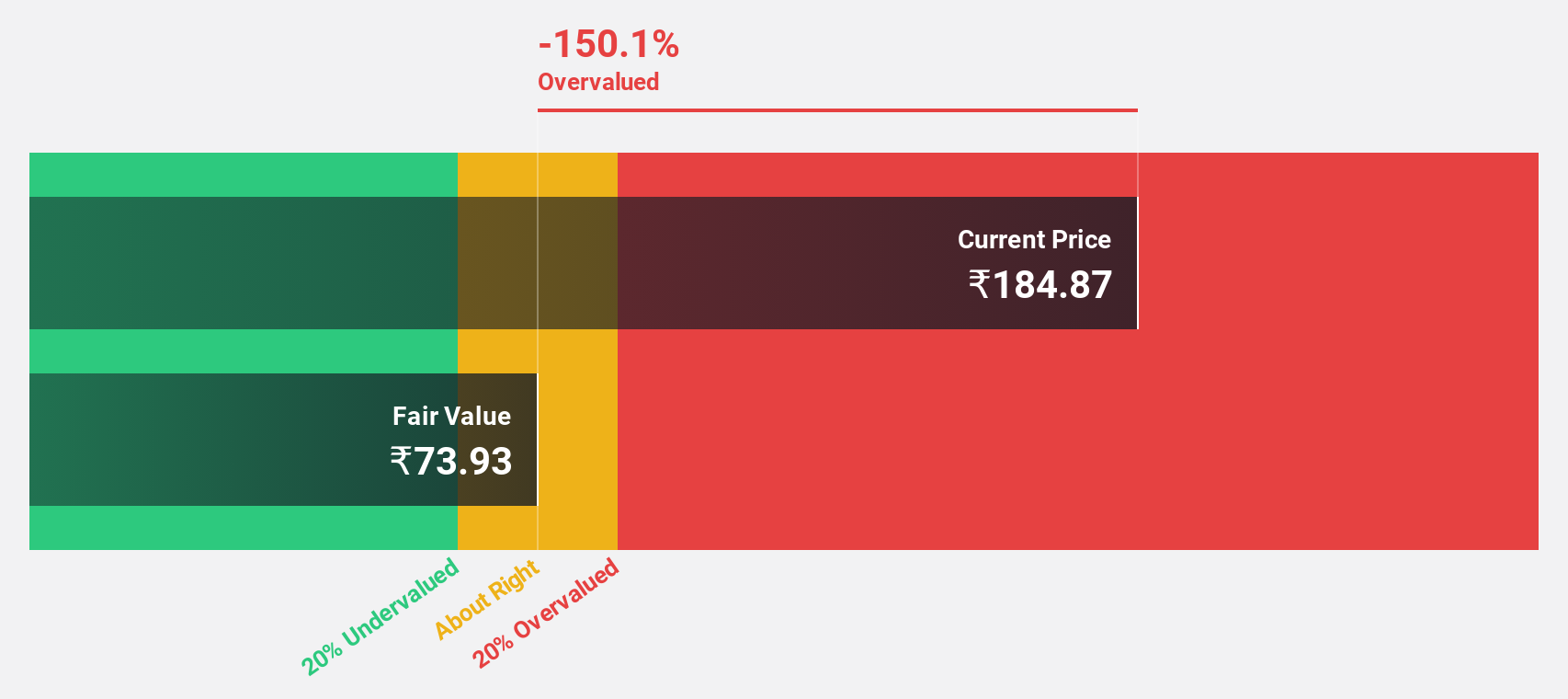

Estimated Discount To Fair Value: 30.8%

Piramal Pharma is currently trading at ₹166.55, significantly below its estimated fair value of ₹240.54, indicating a potential undervaluation by 30.8%. Despite recent penalties related to tax classifications and service credits which do not materially impact its operations, the company's earnings are expected to grow by 67.15% annually over the next three years. However, revenue growth projections are modest at 11.8% per year and interest payments are poorly covered by earnings, suggesting some financial caution is warranted.

- In light of our recent growth report, it seems possible that Piramal Pharma's financial performance will exceed current levels.

- Get an in-depth perspective on Piramal Pharma's balance sheet by reading our health report here.

Suzhou TFC Optical Communication (SZSE:300394)

Overview: Suzhou TFC Optical Communication Co., Ltd. is a company specializing in the research, development, and manufacturing of optical communication products, with a market capitalization of approximately CN¥50.73 billion.

Operations: The company generates CN¥2.37 billion in revenue from its optical communication device segment.

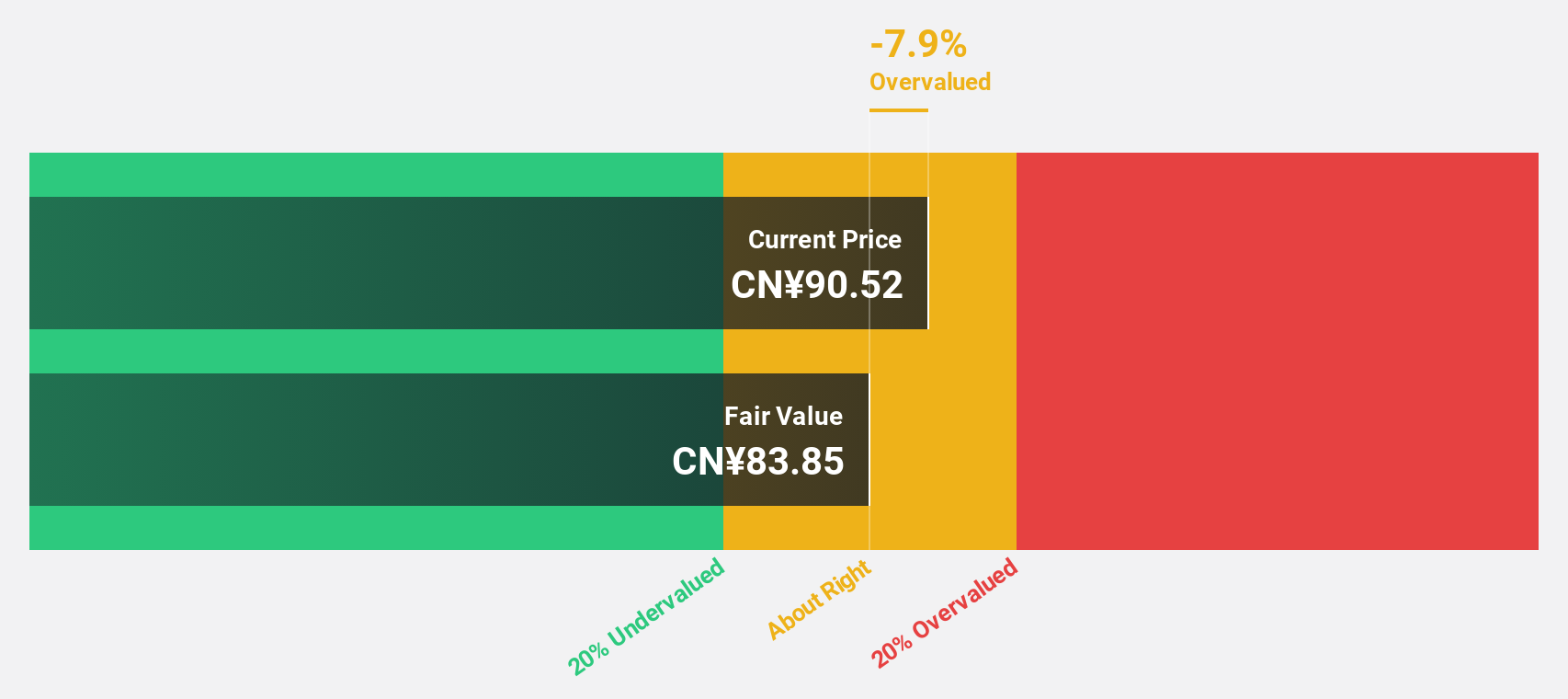

Estimated Discount To Fair Value: 23.7%

Suzhou TFC Optical Communication is currently priced at CN¥93.68, below the estimated fair value of CN¥122.77, suggesting a 23.7% undervaluation. The company's earnings are expected to increase by 31.2% annually over the next few years, outpacing the Chinese market forecast of 22.1%. Despite its unstable dividend track record and high share price volatility recently, revenue growth is also projected to exceed market expectations at a rate of 31.9% per year.

- Our growth report here indicates Suzhou TFC Optical Communication may be poised for an improving outlook.

- Dive into the specifics of Suzhou TFC Optical Communication here with our thorough financial health report.

Where To Now?

- Gain an insight into the universe of 975 Undervalued Stocks Based On Cash Flows by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Kiniksa Pharmaceuticals International is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KNSA

Kiniksa Pharmaceuticals International

A biopharmaceutical company, focuses on discovering, acquiring, developing, and commercializing therapeutic medicines for patients suffering from debilitating diseases with significant unmet medical needs worldwide.

Flawless balance sheet and good value.