- United States

- /

- Biotech

- /

- NasdaqGM:JANX

Is Progress in Prostate Cancer Therapies and Shrinking Losses Altering the Investment Case for Janux Therapeutics (JANX)?

Reviewed by Sasha Jovanovic

- Janux Therapeutics reported a net loss of US$24.31 million for the third quarter of 2025, an improvement from the US$28.06 million loss in the same period last year, alongside updates on continued progress in its oncology pipeline.

- Heightened interest centered on Janux’s prostate cancer program, as early clinical data for T cell-engaging therapies JANX007 and JANX008 indicated improved efficacy and durable responses, prompting renewed analyst confidence ahead of the expected mature Phase 1 trial data release.

- We’ll examine how the encouraging preliminary results for JANX007 and JANX008 shape Janux Therapeutics’ current investment narrative.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Janux Therapeutics' Investment Narrative?

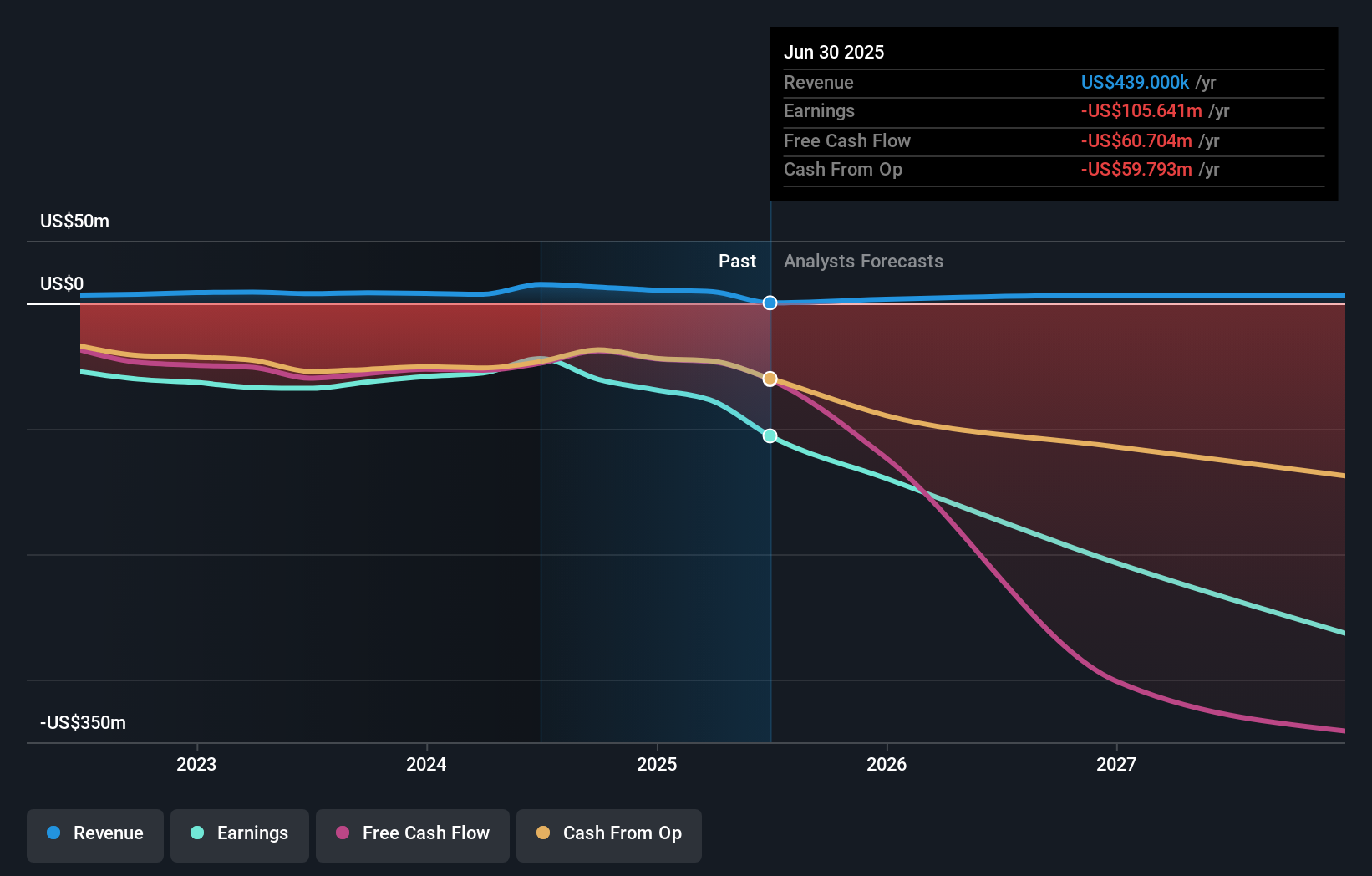

To own shares of Janux Therapeutics right now, you have to believe that their progress in developing novel T cell-engaging therapies can eventually translate promising early-phase prostate cancer data into clinical and commercial validation. This quarter’s news, with narrowed quarterly losses and encouraging initial results for JANX007 and JANX008, provides a short-term catalyst and buoyed some analyst sentiment ahead of the fuller Phase 1 data expected next quarter. The stock’s price strength in recent weeks hints the market is responding to these developments, but big-picture risks still loom. Janux remains unprofitable with negative earnings projected for the next three years, and the jump in nine-month net loss underscores persistent high R&D spending. The executive turnover earlier in the year also kept investors cautious. While this update appears material and could shift risk perceptions if strong data arrives, much still hinges on the outcome, timelines, and commercial path for the key candidates.

But even with excitement rising, ongoing losses remain a fact investors should not ignore.

Exploring Other Perspectives

Explore 3 other fair value estimates on Janux Therapeutics - why the stock might be worth just $48.00!

Build Your Own Janux Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Janux Therapeutics research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Janux Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Janux Therapeutics' overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:JANX

Janux Therapeutics

A clinical stage biopharmaceutical company, develops immunotherapies based on Tumor Activated T Cell Engager (TRACTr) and Tumor Activated Immunomodulator (TRACIr) platforms technology to treat patients with cancer.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives