- United States

- /

- Pharma

- /

- NasdaqGS:ITCI

Companies Like Intra-Cellular Therapies (NASDAQ:ITCI) Can Afford To Invest In Growth

Just because a business does not make any money, does not mean that the stock will go down. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

Given this risk, we thought we'd take a look at whether Intra-Cellular Therapies (NASDAQ:ITCI) shareholders should be worried about its cash burn. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

Check out our latest analysis for Intra-Cellular Therapies

When Might Intra-Cellular Therapies Run Out Of Money?

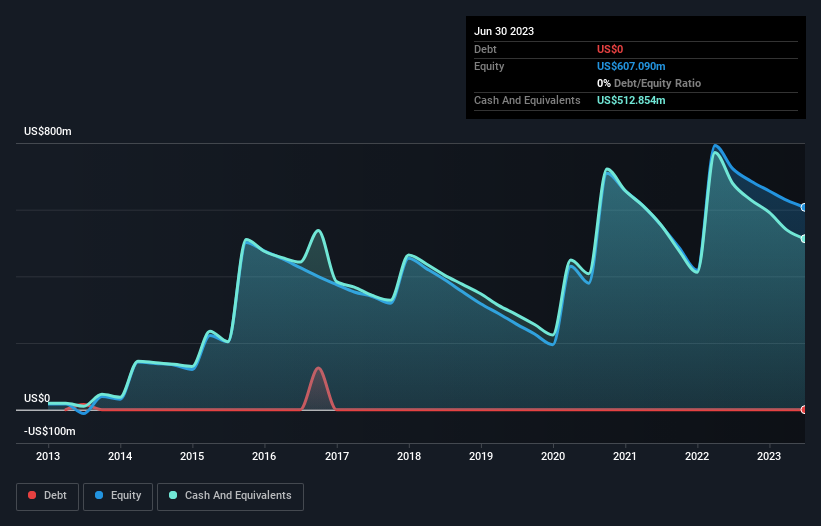

A company's cash runway is the amount of time it would take to burn through its cash reserves at its current cash burn rate. As at June 2023, Intra-Cellular Therapies had cash of US$513m and no debt. Looking at the last year, the company burnt through US$190m. Therefore, from June 2023 it had 2.7 years of cash runway. Notably, however, analysts think that Intra-Cellular Therapies will break even (at a free cash flow level) before then. In that case, it may never reach the end of its cash runway. You can see how its cash balance has changed over time in the image below.

How Well Is Intra-Cellular Therapies Growing?

It was fairly positive to see that Intra-Cellular Therapies reduced its cash burn by 43% during the last year. But the operating revenue growth of 164% was even better. We think it is growing rather well, upon reflection. Clearly, however, the crucial factor is whether the company will grow its business going forward. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How Hard Would It Be For Intra-Cellular Therapies To Raise More Cash For Growth?

There's no doubt Intra-Cellular Therapies seems to be in a fairly good position, when it comes to managing its cash burn, but even if it's only hypothetical, it's always worth asking how easily it could raise more money to fund growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Commonly, a business will sell new shares in itself to raise cash and drive growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Intra-Cellular Therapies has a market capitalisation of US$5.6b and burnt through US$190m last year, which is 3.4% of the company's market value. That's a low proportion, so we figure the company would be able to raise more cash to fund growth, with a little dilution, or even to simply borrow some money.

Is Intra-Cellular Therapies' Cash Burn A Worry?

As you can probably tell by now, we're not too worried about Intra-Cellular Therapies' cash burn. In particular, we think its revenue growth stands out as evidence that the company is well on top of its spending. But it's fair to say that its cash burn reduction was also very reassuring. It's clearly very positive to see that analysts are forecasting the company will break even fairly soon. Taking all the factors in this report into account, we're not at all worried about its cash burn, as the business appears well capitalized to spend as needs be. When you don't have traditional metrics like earnings per share and free cash flow to value a company, many are extra motivated to consider qualitative factors such as whether insiders are buying or selling shares. Please Note: Intra-Cellular Therapies insiders have been trading shares, according to our data. Click here to check whether insiders have been buying or selling.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ITCI

Intra-Cellular Therapies

A biopharmaceutical company, focuses on the discovery, clinical development, and commercialization of small molecule drugs that address medical needs primarily in neuropsychiatric and neurological disorders by targeting intracellular signaling mechanisms in the central nervous system (CNS) in the United States.

Exceptional growth potential with excellent balance sheet.