- United States

- /

- Biotech

- /

- NasdaqGM:IOVA

Iovance Biotherapeutics (IOVA) Rises 16.8% on Strong Amtagvi Sales and Promising Lifileucel Data—What's Next?

Reviewed by Sasha Jovanovic

- Iovance Biotherapeutics recently reported third-quarter 2025 results, highlighting US$67.46 million in revenue and an improved gross margin driven by increased demand for Amtagvi, alongside the release of interim Phase 2 data for lifileucel showing a 25.6% objective response rate in advanced nonsquamous non-small cell lung cancer.

- This dual update signals expanding utilization of the company’s therapies across both commercial markets and clinical trial settings, with further potential supported by positive regulatory developments and expanded treatment center networks.

- We will explore how these promising lifileucel trial results may impact Iovance Biotherapeutics’ investment narrative and growth outlook.

Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

Iovance Biotherapeutics Investment Narrative Recap

To be a shareholder in Iovance Biotherapeutics, the investment thesis rests on expanding adoption of Amtagvi, anticipated pipeline diversification beyond melanoma, and management's ability to sustain top-line revenue growth while controlling mounting losses. The latest earnings and trial updates do not materially shift the most important near-term catalyst, broadening Amtagvi's market penetration, but ongoing net losses remain a major risk, especially given the company’s continued reliance on a single commercial therapy for revenue.

Among recent announcements, the Phase 2 lifileucel trial results are most relevant, showing a 25.6% objective response rate in advanced nonsquamous non-small cell lung cancer. This data reinforces the ongoing effort to diversify beyond Amtagvi, but until further approvals or launches occur, short-term results will likely hinge on U.S. Amtagvi performance and expense control.

In contrast, investors should be aware that even with promising trial data, Iovance's heavy dependence on Amtagvi leaves it exposed if...

Read the full narrative on Iovance Biotherapeutics (it's free!)

Iovance Biotherapeutics' outlook projects $744.8 million in revenue and $35.6 million in earnings by 2028. This is based on a forecasted annual revenue growth rate of 45.6% and a $425.5 million increase in earnings from current earnings of $-389.9 million.

Uncover how Iovance Biotherapeutics' forecasts yield a $8.00 fair value, a 248% upside to its current price.

Exploring Other Perspectives

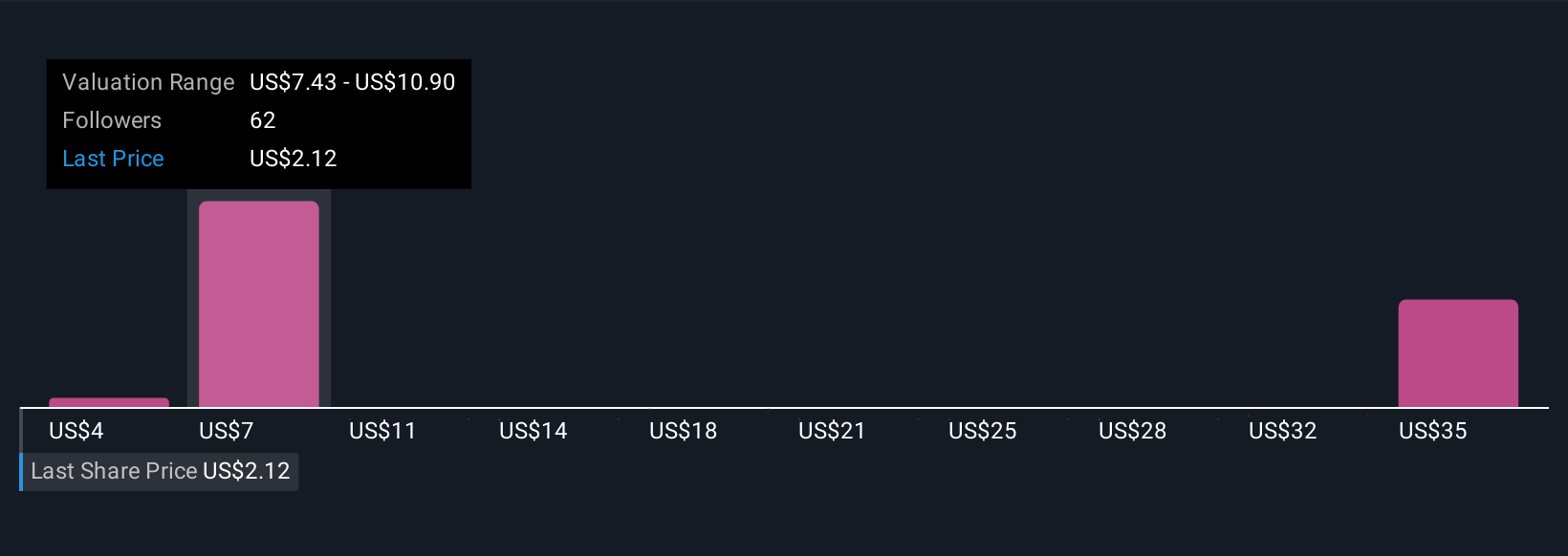

Twelve recent fair value estimates from the Simply Wall St Community span a wide band, from US$3.97 to above US$35 per share. Yet, as pipeline diversification remains a key catalyst, wide-ranging opinions echo how earnings performance could quickly sway sentiment, consider both the numbers and the reasons behind them.

Explore 12 other fair value estimates on Iovance Biotherapeutics - why the stock might be a potential multi-bagger!

Build Your Own Iovance Biotherapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Iovance Biotherapeutics research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Iovance Biotherapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Iovance Biotherapeutics' overall financial health at a glance.

Ready For A Different Approach?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:IOVA

Iovance Biotherapeutics

A commercial-stage biopharmaceutical company, develops and commercializes cell therapies using autologous tumor infiltrating lymphocyte for the treatment of metastatic melanoma and other solid tumor cancers in the United States.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives