- United States

- /

- Pharma

- /

- NasdaqGS:INVA

A Look at Innoviva’s (INVA) Valuation Following Strong Earnings, FDA Priority Review, and New Buyback Program

Reviewed by Simply Wall St

Innoviva (INVA) shares reacted after the company reported strong gains in third quarter revenue and net income, received FDA priority review for a new drug, and announced a $125 million buyback program.

See our latest analysis for Innoviva.

Innoviva’s stock has seen renewed momentum, with a 20.2% share price gain over the past month reflecting investor excitement after the company’s buyback announcement and FDA news. The one-year total shareholder return remains fairly modest at 3.4%. Longer-term holders have still enjoyed a 53% total return over three years, showing the company’s ability to build value over time as it advances new treatments and rewards shareholders.

If Innoviva’s recent progress piques your interest, you might want to broaden your search and discover fast growing stocks with high insider ownership.

With shares rallying and Innoviva’s fundamentals improving, the question for investors is clear: is the recent surge a sign that the stock is still undervalued, or has the market already priced in its growth prospects?

Price-to-Earnings of 12.2x: Is it justified?

At the current price of $20.86, Innoviva trades at a price-to-earnings (P/E) ratio of 12.2x, signaling a discount versus both peers and the wider pharmaceuticals industry.

The P/E ratio compares the company's share price to its annual earnings per share, serving as a key signal of investor expectations for growth and profitability. In the biotech and pharma sector, a lower P/E often reflects market skepticism or underappreciated earnings power.

In Innoviva's case, its 12.2x P/E stands out against the industry average of 17.4x and the peer average of 15.4x. Additionally, a fair value model suggests the multiple could move up to around 16.7x, which indicates a significant value gap that the market may yet close if anticipated growth is realized.

Explore the SWS fair ratio for Innoviva

Result: Price-to-Earnings of 12.2x (UNDERVALUED)

However, investors should be mindful that unexpected regulatory setbacks or slower than expected revenue growth could quickly undermine recent optimism.

Find out about the key risks to this Innoviva narrative.

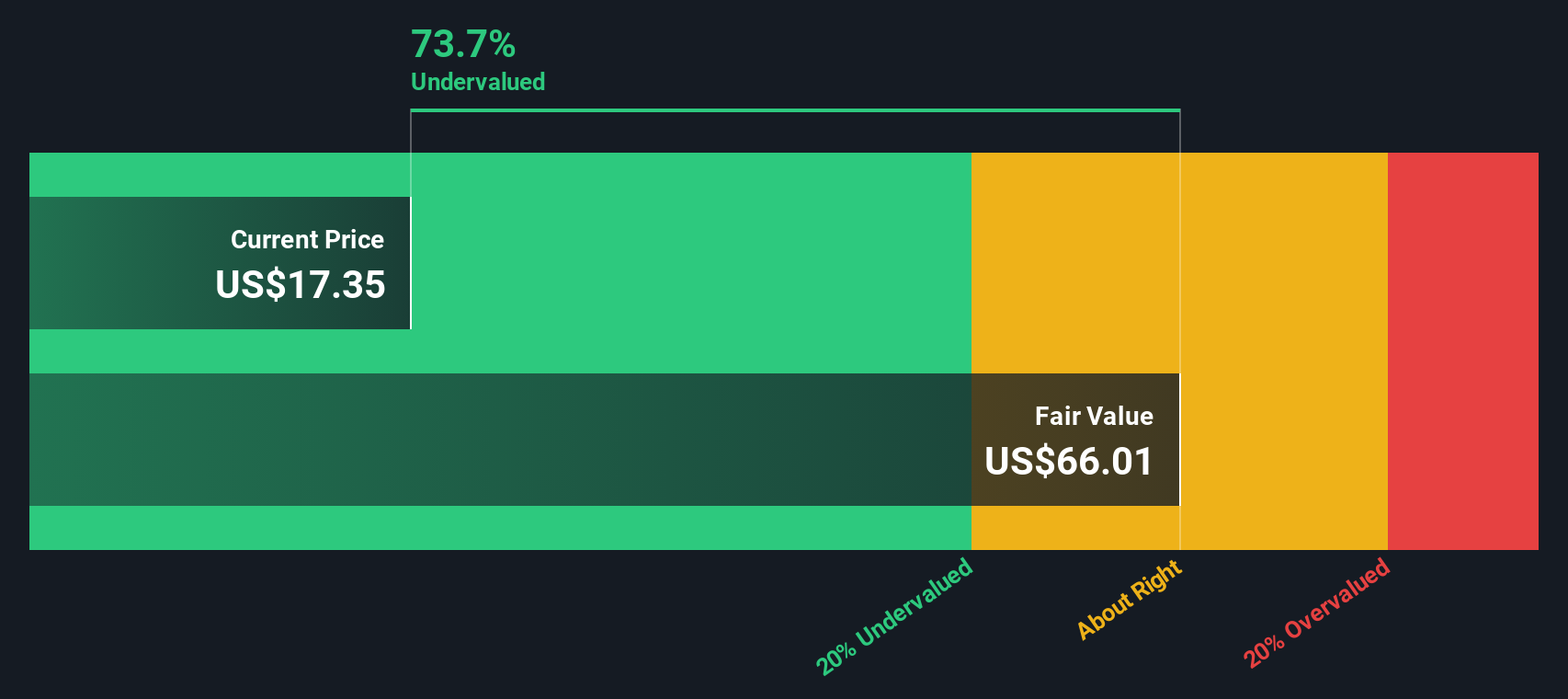

Another View: SWS DCF Model

Looking from another angle, our DCF model estimates Innoviva’s fair value at $55.21 per share, which is significantly higher than the current price. This suggests the stock could be substantially undervalued, depending on the assumptions you believe best reflect the company’s prospects. Will the future play out as the model expects, or is the market discounting real risks?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Innoviva for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Innoviva Narrative

If you want to examine Innoviva’s potential from your own viewpoint, the data is at your fingertips and you can build your own take in just minutes. Do it your way

A great starting point for your Innoviva research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more smart investment ideas?

Don't let market opportunities slip through your fingers. Talented investors always have their watchlists ready. Broaden your outlook by checking out these handpicked stock themes:

- Capture the potential of artificial intelligence by scanning these 25 AI penny stocks that are transforming industries and seizing market share ahead of the curve.

- Strengthen your portfolio with these 16 dividend stocks with yields > 3% offering robust yields and a steady stream of income even during volatile markets.

- Move early on breakthrough technology by researching these 28 quantum computing stocks, with companies pushing boundaries in next-generation computing for a decisive edge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INVA

Innoviva

Engages in the development and commercialization of pharmaceutical products in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives