- United States

- /

- Pharma

- /

- NasdaqGS:INDV

Reassessing Indivior (NasdaqGS:INDV) Valuation After SUBLOCADE Data and Upgraded Earnings Guidance

Reviewed by Simply Wall St

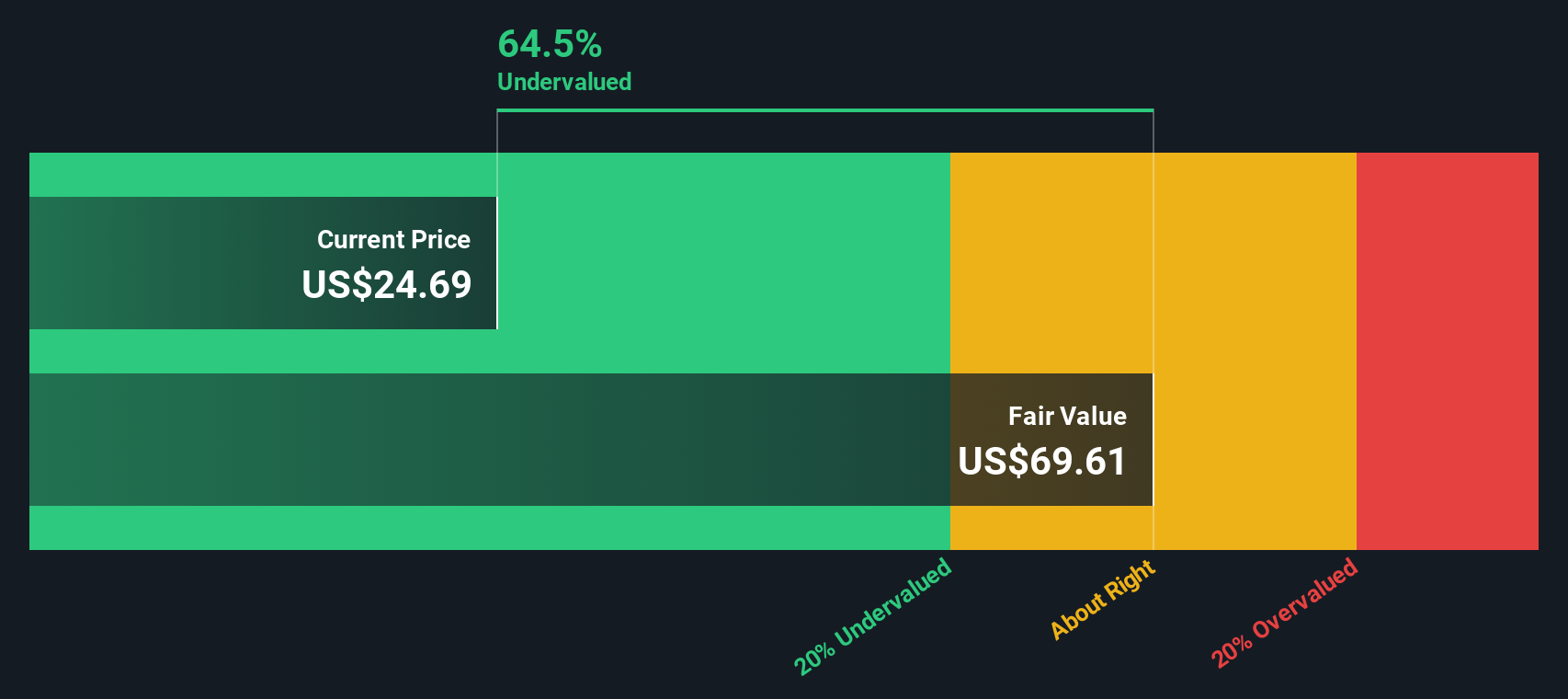

Indivior (NasdaqGS:INDV) is in the spotlight after presenting new real-world data on its monthly injectable buprenorphine, SUBLOCADE, at a major industry conference. The company also raised its earnings guidance for the year.

See our latest analysis for Indivior.

It’s been a huge year for Indivior, with positive clinical results and an upgraded earnings outlook fueling momentum. The stock’s 1-year share price return is up an eye-catching 150.7%, and total shareholder return reached an impressive 198.2%. The strong Q3 numbers and promising SUBLOCADE data add weight to the company’s growth narrative, reinforcing investor confidence for the longer term.

If Indivior’s results have you looking for other rising names in healthcare, check out the full list of standout opportunities in our sector screener: See the full list for free.

With the stock’s surge and upgraded guidance, investors may wonder whether Indivior is still trading at an attractive valuation or if all the future growth is already factored into the current price.

Price-to-Earnings of 52.9x: Is it justified?

Indivior shares currently trade at a price-to-earnings (P/E) ratio of 52.9x, which is markedly above the industry average and its peer group. This signals a premium price relative to earnings, even after factoring in the company's recent run-up.

The price-to-earnings ratio reflects how much investors are willing to pay for each dollar of Indivior's earnings. It is a common metric for pharmaceuticals, where future growth potential can result in high valuations.

While Indivior has delivered substantial earnings growth and impressive returns, the current P/E ratio is steep compared to the US Pharmaceuticals industry average of 17.9x and the peer group’s 32.1x. Even when compared with the estimated fair P/E of 32.8x, the current level stands out as elevated and raises the question of whether future growth has already been fully priced in.

Explore the SWS fair ratio for Indivior

Result: Price-to-Earnings of 52.9x (OVERVALUED)

However, if revenue growth slows down or the company misses future earnings targets, sentiment could quickly shift and challenge the current momentum around Indivior.

Find out about the key risks to this Indivior narrative.

Another View: Discounted Cash Flow Suggests Opportunity

If we take a step back from the current price-to-earnings ratio and look at Indivior through the lens of our DCF model, the picture shifts. The SWS DCF model estimates fair value at $105.33 per share, which is well above the present trading price. This implies Indivior could be deeply undervalued based on its future cash flows. Could the market be underestimating its potential, or is there a reason for this gap?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Indivior for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 882 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Indivior Narrative

If you prefer to chart your own course or dig deeper into the numbers, you can quickly build your own narrative in just a few minutes. Do it your way

A great starting point for your Indivior research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Make the most of today’s momentum by checking out handpicked stock lists offering distinct opportunities. Don’t watch from the sidelines while others spot tomorrow’s winners first.

- Unlock potential high yield by evaluating these 16 dividend stocks with yields > 3%. These options offer above-average income streams and are ideal for those wanting steady payouts alongside growth.

- Catalyze your portfolio’s future with these 25 AI penny stocks, which highlight leaders in breakthroughs in artificial intelligence, automation, and smart technologies.

- Capitalize on value by scanning these 882 undervalued stocks based on cash flows, which the market may be underappreciating. This could give you a crucial edge before consensus catches up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INDV

Indivior

Develops, manufactures, and sells buprenorphine-based prescription drugs for the treatment of opioid dependence and related disorders in the United States, Europe, Canada, Australia, and internationally.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives