- United States

- /

- Biotech

- /

- NasdaqGS:IMGN

Is ImmunoGen (NASDAQ:IMGN) In A Good Position To Deliver On Growth Plans?

We can readily understand why investors are attracted to unprofitable companies. For example, although software-as-a-service business Salesforce.com lost money for years while it grew recurring revenue, if you held shares since 2005, you'd have done very well indeed. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

So should ImmunoGen (NASDAQ:IMGN) shareholders be worried about its cash burn? For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). First, we'll determine its cash runway by comparing its cash burn with its cash reserves.

Check out our latest analysis for ImmunoGen

Does ImmunoGen Have A Long Cash Runway?

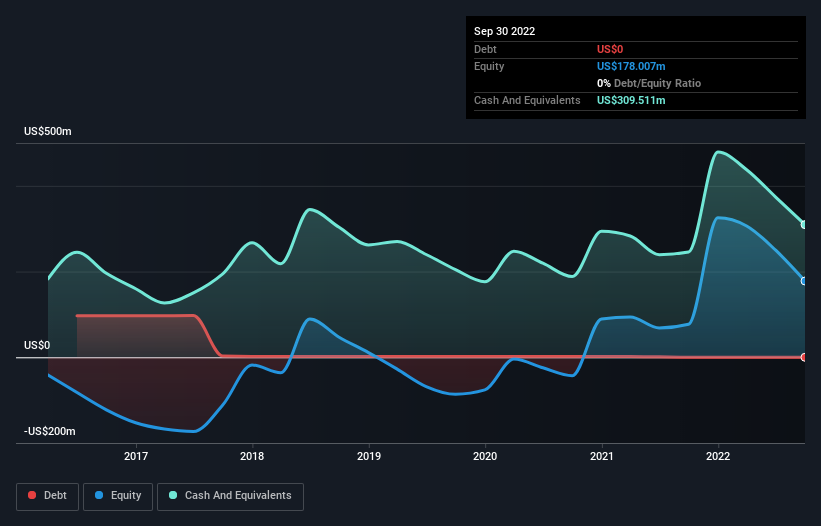

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. In September 2022, ImmunoGen had US$310m in cash, and was debt-free. Looking at the last year, the company burnt through US$217m. So it had a cash runway of approximately 17 months from September 2022. Importantly, analysts think that ImmunoGen will reach cashflow breakeven in 4 years. That means unless the company reduces its cash burn quickly, it may well look to raise more cash. The image below shows how its cash balance has been changing over the last few years.

How Well Is ImmunoGen Growing?

ImmunoGen actually ramped up its cash burn by a whopping 87% in the last year, which shows it is boosting investment in the business. While that's concerning on it's own, the fact that operating revenue was actually down 25% over the same period makes us positively tremulous. Taken together, we think these growth metrics are a little worrying. While the past is always worth studying, it is the future that matters most of all. So you might want to take a peek at how much the company is expected to grow in the next few years.

How Easily Can ImmunoGen Raise Cash?

ImmunoGen revenue is declining and its cash burn is increasing, so many may be considering its need to raise more cash in the future. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Many companies end up issuing new shares to fund future growth. By comparing a company's annual cash burn to its total market capitalisation, we can estimate roughly how many shares it would have to issue in order to run the company for another year (at the same burn rate).

ImmunoGen's cash burn of US$217m is about 26% of its US$823m market capitalisation. That's not insignificant, and if the company had to sell enough shares to fund another year's growth at the current share price, you'd likely witness fairly costly dilution.

So, Should We Worry About ImmunoGen's Cash Burn?

On this analysis of ImmunoGen's cash burn, we think its cash runway was reassuring, while its increasing cash burn has us a bit worried. One real positive is that analysts are forecasting that the company will reach breakeven. Summing up, we think the ImmunoGen's cash burn is a risk, based on the factors we mentioned in this article. Its important for readers to be cognizant of the risks that can affect the company's operations, and we've picked out 1 warning sign for ImmunoGen that investors should know when investing in the stock.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:IMGN

ImmunoGen

ImmunoGen, Inc., a commercial-stage biotechnology company, focuses on developing and commercializing the antibody-drug conjugates (ADCs) for cancer patients.

Exceptional growth potential with adequate balance sheet.