- United States

- /

- Life Sciences

- /

- NasdaqGS:ILMN

How China’s Easing of the Export Ban Has Changed Illumina’s (ILMN) Investment Story

Reviewed by Sasha Jovanovic

- The Chinese Ministry of Commerce has lifted the export ban on Illumina, Inc., allowing the company to resume shipments to China as of today, although Illumina remains on the Unreliable Entities List and will require government approval for instrument purchases.

- This regulatory change potentially reopens a significant revenue stream for Illumina, marking a shift in the company's operating landscape in a market that has long contributed to its global growth efforts.

- We'll look at how renewed market access in China may influence Illumina's future growth potential and investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Illumina Investment Narrative Recap

To own Illumina stock, investors must believe that clinical sequencing adoption and innovation in genomics will drive recurring revenues, despite ongoing regulatory and competitive risk. The recent lifting of the Chinese export ban does not remove the major short-term risk tied to regulatory hurdles in China, as instrument sales still require government approval, and this uncertainty may continue to weigh on international revenue potential.

Among recent company announcements, the revised earnings guidance in late October, raising 2025 revenue expectations, stands out, as it partially reflects renewed confidence following regulatory shifts like the news from China. This update is especially relevant as China has historically been a key market for Illumina, and any progress in restoring access could support management’s improved outlook.

By contrast, it’s important for investors to be aware that while export restrictions are eased, ongoing approval requirements may still affect…

Read the full narrative on Illumina (it's free!)

Illumina's outlook anticipates $4.8 billion in revenue and $873.5 million in earnings by 2028. This implies 3.6% annual revenue growth but a decrease in earnings of $426.5 million from the current $1.3 billion.

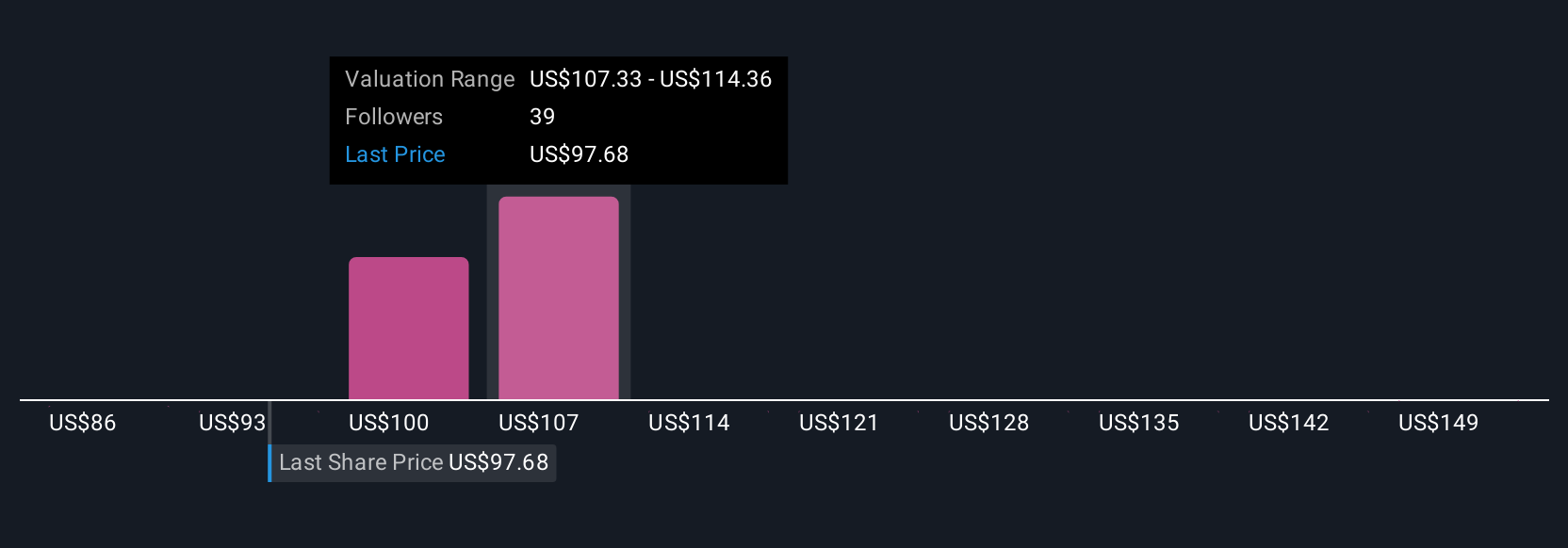

Uncover how Illumina's forecasts yield a $113.58 fair value, a 7% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members posted five fair value estimates for Illumina ranging from US$86.26 to US$156.51, highlighting a broad spectrum of views. Opinions differ widely, especially given the ongoing concerns about regulatory risks in China and what this could mean for Illumina's prospects; explore these contrasting viewpoints as you form your own judgement.

Explore 5 other fair value estimates on Illumina - why the stock might be worth as much as 28% more than the current price!

Build Your Own Illumina Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Illumina research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Illumina research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Illumina's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ILMN

Illumina

Provides sequencing- and array-based solutions for genetic and genomic analysis in the Americas, Europe, Greater China, the Asia Pacific, the Middle East, and Africa.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives