- United States

- /

- Biotech

- /

- NasdaqGS:IBRX

Is ImmunityBio’s (IBRX) Shrinking Losses Evidence of an Emerging Turnaround Story?

Reviewed by Sasha Jovanovic

- ImmunityBio reported its third quarter 2025 results, highlighting a jump in revenue to US$32.06 million from US$6.11 million a year earlier and a reduced net loss of US$67.25 million for the period.

- This marked the continuation of a trend over the nine-month period, during which the company recorded a very large year-over-year revenue increase and a sizable improvement in net losses.

- We'll examine how ImmunityBio's growing revenue base could influence the company's overall investment narrative and future performance outlook.

Find companies with promising cash flow potential yet trading below their fair value.

What Is ImmunityBio's Investment Narrative?

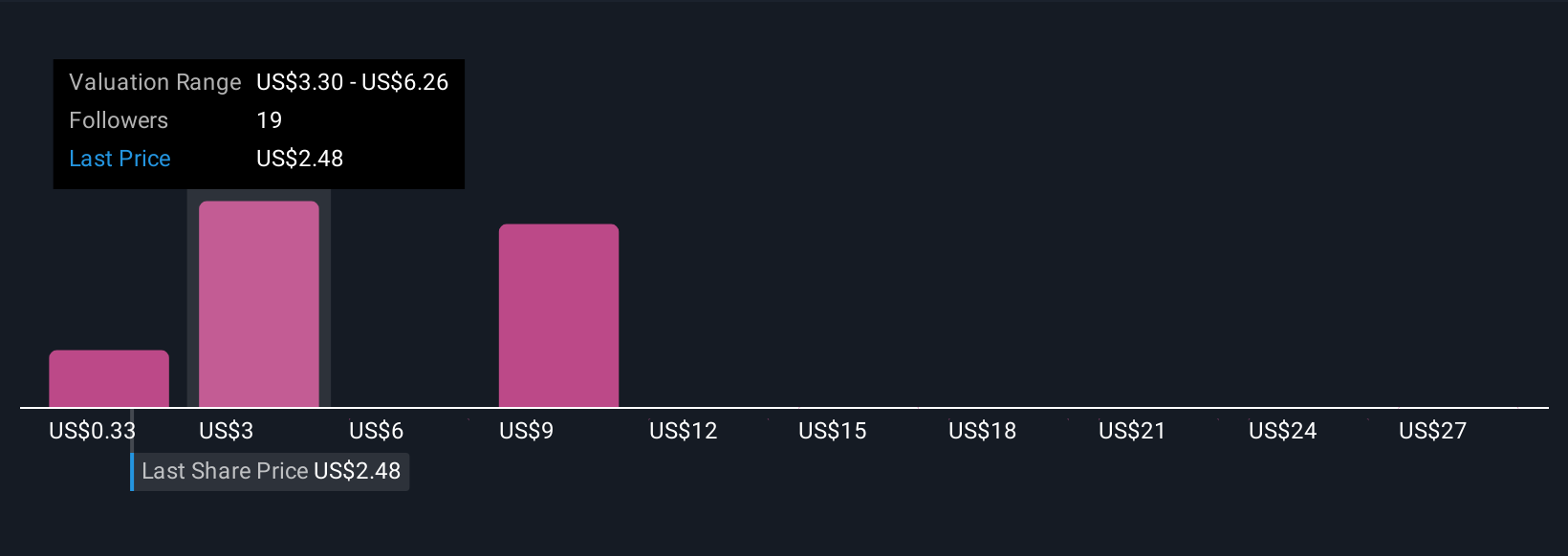

For those of us keeping a close eye on ImmunityBio, the latest financial results add a real point of interest to the stock’s story. With third quarter revenue jumping to US$32.06 million and net losses narrowing, the company continues its streak of significant year-on-year revenue growth and improving margins. This provides some validation for those who believe in ImmunityBio’s ability to scale revenues through its clinical pipeline, especially in cancer treatments like ANKTIVA. However, the company remains unprofitable and continues to face sizable risks, particularly around cash burn, shareholder dilution, and its relatively high price-to-sales ratio compared to peers. For now, the latest update changes the conversation somewhat: it may lessen the urgency of liquidity risks in the short term, but profitability is still out of reach for at least the next few years. The news reinforces revenue momentum as a short-term catalyst, but does not eliminate the need to monitor ongoing losses and future dilution.

However, the risk of further shareholder dilution remains an important consideration for investors.

Exploring Other Perspectives

Explore 11 other fair value estimates on ImmunityBio - why the stock might be a potential multi-bagger!

Build Your Own ImmunityBio Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ImmunityBio research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free ImmunityBio research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ImmunityBio's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:IBRX

ImmunityBio

A commercial stage biotechnology company, develops next-generation therapies that bolster the natural immune systems to defeat cancers and infectious diseases.

Fair value with low risk.

Similar Companies

Market Insights

Community Narratives