- United States

- /

- Biotech

- /

- NasdaqCM:HRTX

Heron Therapeutics (HRTX): Share Dilution Tempers Optimism Despite Profitability and Revenue Growth Forecasts

Reviewed by Simply Wall St

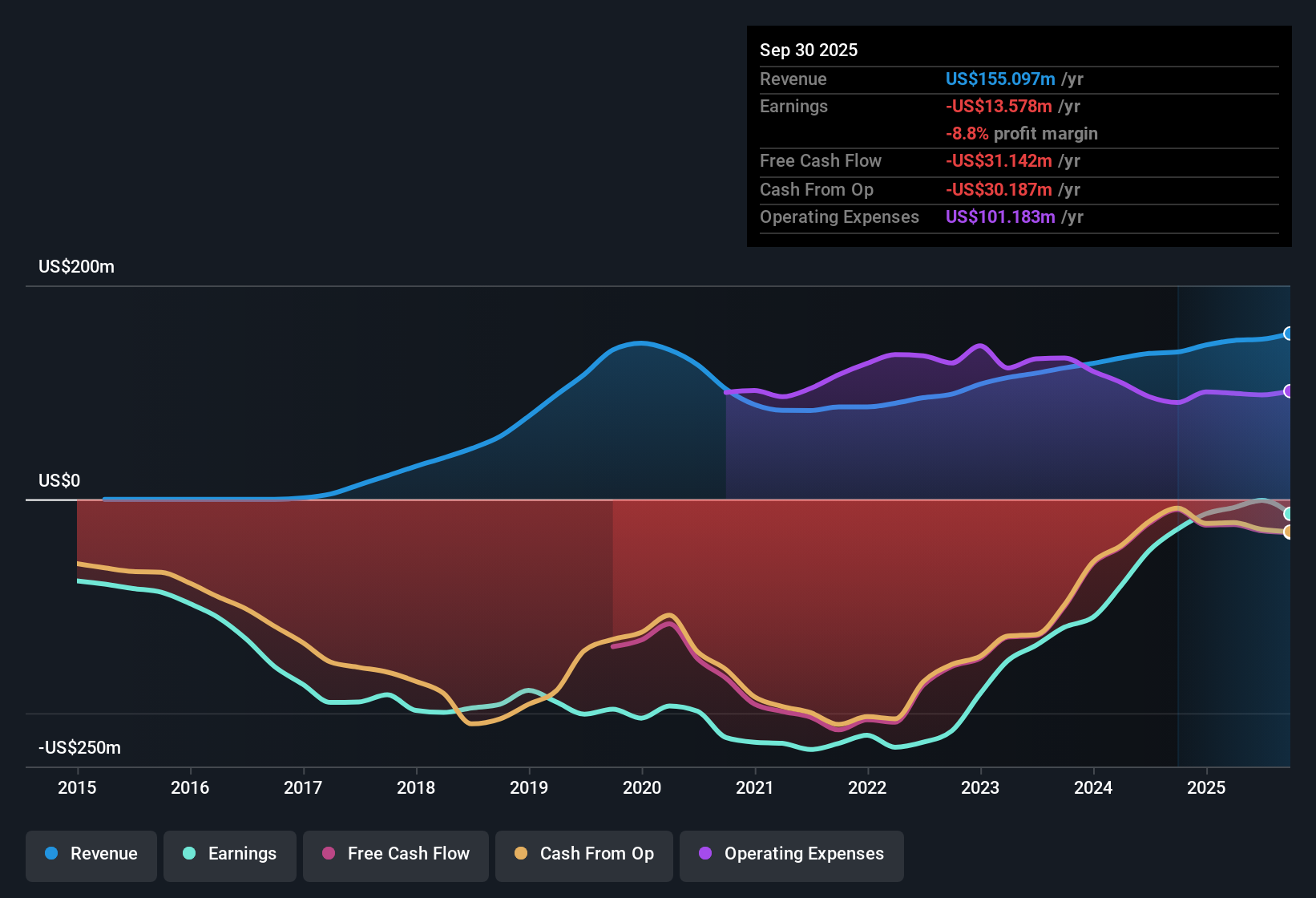

Heron Therapeutics (HRTX) is forecast to deliver standout earnings momentum, with annual earnings growth of 60.89% expected and a projected move into profitability within the next three years. Over the past five years, the company remained in the red but steadily narrowed its losses, cutting them by an average of 39.8% per year. Revenue growth is forecast at 15.9% per year, outpacing the broader US market’s 10.5% yearly expectation. Heron’s Price-to-Sales Ratio of 1.3x points to better value compared to both the US biotech sector average (10.8x) and its peers (3.9x). While the company continues to show operational progress and improving fundamentals, recent share dilution will be a key consideration for investors focused on ownership and valuation dynamics.

See our full analysis for Heron Therapeutics.The big question now is how these latest numbers match up with the stories investors have been telling. Next, we’ll see where the data supports the consensus narrative and where it might spark a rethink.

See what the community is saying about Heron Therapeutics

Margins Set to Swing from -0.6% to 24.0%

- Analysts are projecting profit margins to rise dramatically from -0.6% today to 24.0% within the next three years, marking one of the most significant expected margin expansions in the US biotech peer set.

- According to the analysts' consensus view, operational restructuring and improved sales team efficiency, such as the targeted rollout for ZYNRELEF and APONVIE, are major drivers behind these margin gains.

- Extra efficiency comes as dedicated sales teams and clinical educator deployment help control SG&A expenses. Expanding hospital access and reimbursement clarity also support top-line growth.

- Still, the consensus view cautions that ongoing debt costs and the risk of future dilution could limit net margin improvement if growth expectations are not met.

- Recent performance directly supports the consensus view by showing that management’s cost containment efforts are feeding through to earnings leverage. However, the margin boost remains highly sensitive to continued demand and policy tailwinds. To see how this margin expansion fits into the bigger picture, check out the full consensus narrative for Heron Therapeutics. 📊 Read the full Heron Therapeutics Consensus Narrative.

Share Dilution Raises Ownership Concerns

- The number of shares outstanding is expected to rise by 0.79% annually for the next three years, an issue that compounds existing dilution from recent financing deals and increases the risk of diluted future earnings per share for current shareholders.

- Bears highlight that continued share issuance, combined with a heavy debt load and high interest rates on new credit (above 10%), could put more pressure on future EPS and limit share price upside potential.

- Recent large-scale dilution, with pro forma shares up to 208 million, means any EPS growth will need to exceed the dilution effect for real gains to reach existing investors.

- Heightened debt service costs can draw cash away from new projects and R&D, raising the stakes if sales momentum for core products starts to falter.

Valuation Discount vs Peers and Sector

- Heron’s Price-to-Sales Ratio of 1.3x stands out as significantly lower than the US biotech industry average of 10.8x and its immediate peer group at 3.9x, implying the stock trades at a notable discount to both sector and peers on a revenue basis.

- The analysts' consensus view emphasizes how this revenue-based valuation gap, if sustained alongside forecasted revenue growth of 15.9% per year, could drive a re-rating in the stock if investors increasingly value the company’s progress toward profitability.

- However, the same consensus view notes the current share price of $1.14 remains far below the average analyst price target of $4.50, suggesting significant market skepticism persists around execution risk and longer-term earnings quality.

- The risk of margin improvement slowing or dilution exceeding projections keeps some analysts cautious about closing the valuation gap in the near term.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Heron Therapeutics on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a fresh take on the figures? In just a few minutes, you can share your perspective and shape your narrative. Do it your way

A great starting point for your Heron Therapeutics research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite Heron Therapeutics’ progress on margins and revenue, heavy debt and recurring share dilution could threaten future earnings and undermine long-term shareholder value.

For those seeking stronger financial stability and less dilution risk, start your search with companies offering robust fundamentals and resilience via solid balance sheet and fundamentals stocks screener (1981 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Heron Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:HRTX

Heron Therapeutics

A commercial-stage biotechnology company, engages in developing and commercializing therapeutic that enhances medical care.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives