- United States

- /

- Pharma

- /

- NasdaqGM:HRMY

Harmony Biosciences Raises 2025 Revenue Guidance Could Be a Game Changer for HRMY

Reviewed by Sasha Jovanovic

- Harmony Biosciences Holdings, Inc. announced in late October that it raised its full-year 2025 revenue guidance to US$845–865 million, up from the prior range of US$820–860 million, and scheduled its Q3 2025 results release and earnings call for November 4, 2025.

- This updated outlook suggests the company anticipates stronger demand or improved sales execution in its core markets for the remainder of the year.

- With Harmony raising its 2025 revenue expectations, let's explore how stronger projected sales could influence its longer-term investment outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Harmony Biosciences Holdings Investment Narrative Recap

To be a Harmony Biosciences shareholder today, you need to believe that the company’s leadership can extend the commercial success of WAKIX while advancing its broader pipeline. The upward revision of 2025 revenue guidance supports optimism around near-term sales, but this doesn’t substantially mitigate Harmony’s heavy reliance on its lead product or address competitive threats that remain the most critical risks in the short term.

Among recent announcements, Harmony’s September update on ZYN002’s failed Phase 3 trial is particularly relevant. While stronger sales guidance underscores the company’s commercial momentum, limited pipeline diversification means setbacks in late-stage assets like ZYN002 continue to weigh on future growth prospects if WAKIX eventually loses exclusivity or faces tougher competition.

In contrast, watch for how investors weigh the potential impact of generic competition coming after WAKIX’s patent expiry...

Read the full narrative on Harmony Biosciences Holdings (it's free!)

Harmony Biosciences Holdings' outlook projects $1.2 billion in revenue and $333.5 million in earnings by 2028. This is based on 17.0% annual revenue growth and a $152.6 million increase in earnings from the current $180.9 million.

Uncover how Harmony Biosciences Holdings' forecasts yield a $44.55 fair value, a 52% upside to its current price.

Exploring Other Perspectives

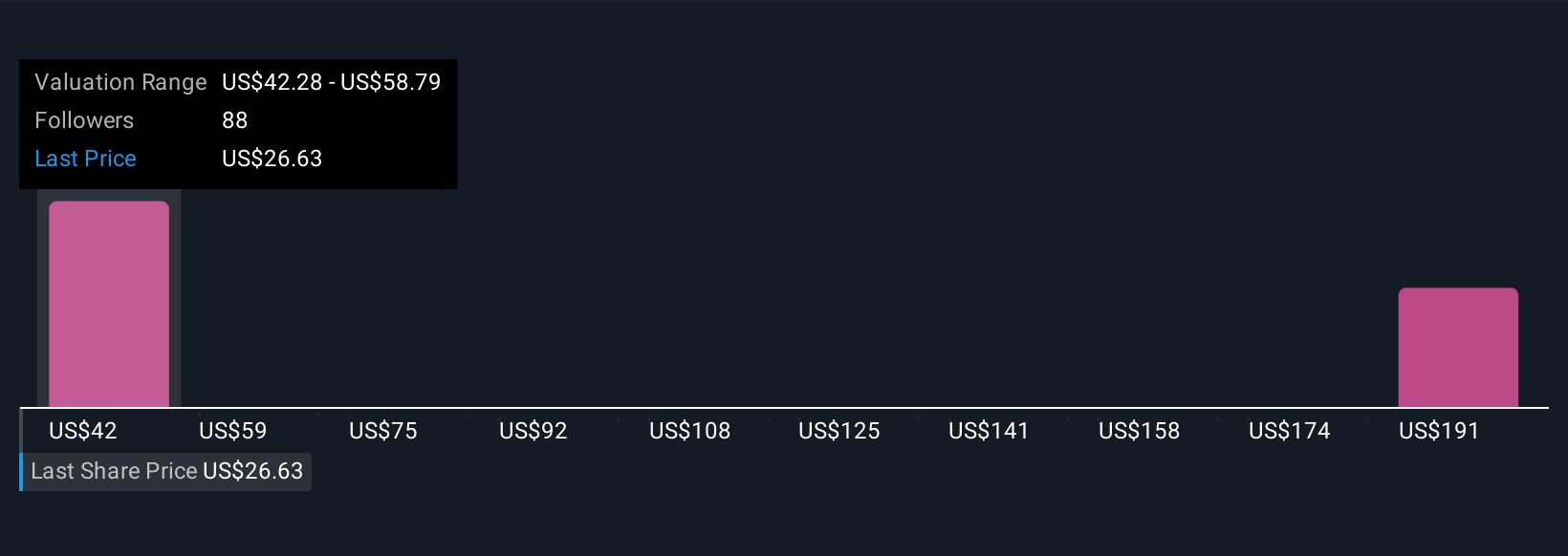

Seven members of the Simply Wall St Community estimate Harmony’s fair value between US$42.28 and US$207.40, highlighting sharply different opinions. With the company still heavily dependent on WAKIX, your view on concentrated revenue exposure could shape expectations for longer-term performance.

Explore 7 other fair value estimates on Harmony Biosciences Holdings - why the stock might be worth over 7x more than the current price!

Build Your Own Harmony Biosciences Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Harmony Biosciences Holdings research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Harmony Biosciences Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Harmony Biosciences Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 38 companies in the world exploring or producing it. Find the list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Harmony Biosciences Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:HRMY

Harmony Biosciences Holdings

A commercial-stage pharmaceutical company, focuses on developing and commercializing therapies for patients with rare and other neurological diseases in the United States.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives