- United States

- /

- Biotech

- /

- NasdaqGS:HALO

How Halozyme’s ENHANZE Licensing Deal With Merus May Strengthen Royalty Pipeline for HALO Investors

Reviewed by Sasha Jovanovic

- Merus N.V. and Halozyme Therapeutics recently announced a global non-exclusive collaboration, granting Merus rights to Halozyme's ENHANZE drug delivery technology for the development and potential commercialization of a subcutaneous formulation of petosemtamab, an EGFR x LGR5 bispecific antibody in clinical trials for multiple solid tumors.

- This agreement brings Halozyme upfront and milestone payments, as well as future royalties, reflecting the increasing demand for subcutaneous biologic therapies and the material importance of licensing revenues to Halozyme's business model.

- We'll examine how this new licensing collaboration with Merus could reinforce Halozyme's investment narrative around expanding royalty streams and technology adoption.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Halozyme Therapeutics Investment Narrative Recap

To be a shareholder in Halozyme Therapeutics today, you need to believe in the company's ability to capitalize on the rising adoption of subcutaneous biologic therapies, with platform royalty growth as a central value driver. The newly announced Merus agreement adds another potential royalty stream, reinforcing the narrative of technology adoption, but it does not materially change the most important short-term catalyst, continued uptake of existing partnered products, nor does it offset the biggest risk, which is concentrated partner exposure. One relevant recent announcement is Halozyme’s raised revenue guidance for 2025, where expectations for royalty income have been lifted, reflecting steady performance from key partnerships that underpin the near-term catalyst of rising adoption rates for subcutaneous formulations. However, investors should also factor in the risk that heightened regulatory scrutiny over biologic pricing and reimbursement, such as potential changes driven by the IRA or CMS draft guidance, could still impact future royalty growth if...

Read the full narrative on Halozyme Therapeutics (it's free!)

Halozyme Therapeutics is projected to reach $2.0 billion in revenue and $1.1 billion in earnings by 2028. This outlook assumes annual revenue growth of 18.7% and an increase in earnings of about $542 million from the current $557.3 million.

Uncover how Halozyme Therapeutics' forecasts yield a $74.44 fair value, a 6% upside to its current price.

Exploring Other Perspectives

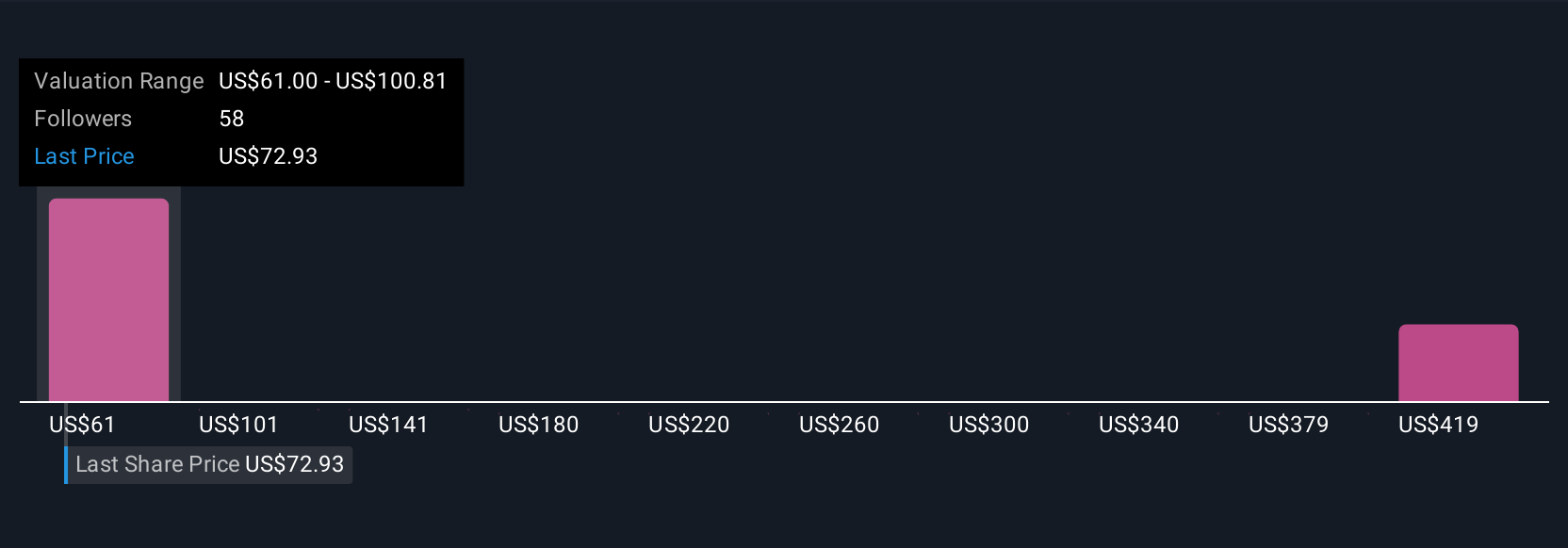

Simply Wall St Community members have submitted eight fair value estimates for Halozyme ranging from US$70.33 to US$204.46 per share. While many see upside, continued royalty revenue growth from subcutaneous therapy adoption remains central to performance, so your outlook may depend on how you weigh partnership concentration risks.

Explore 8 other fair value estimates on Halozyme Therapeutics - why the stock might be worth over 2x more than the current price!

Build Your Own Halozyme Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Halozyme Therapeutics research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Halozyme Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Halozyme Therapeutics' overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Halozyme Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HALO

Halozyme Therapeutics

A biopharmaceutical company, researches, develops, and commercializes of proprietary enzymes and devices in the United States and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives