- United States

- /

- Biotech

- /

- NasdaqGS:GOSS

Gossamer Bio, Inc.'s (NASDAQ:GOSS) 28% Share Price Surge Not Quite Adding Up

Gossamer Bio, Inc. (NASDAQ:GOSS) shareholders have had their patience rewarded with a 28% share price jump in the last month. The last 30 days were the cherry on top of the stock's 355% gain in the last year, which is nothing short of spectacular.

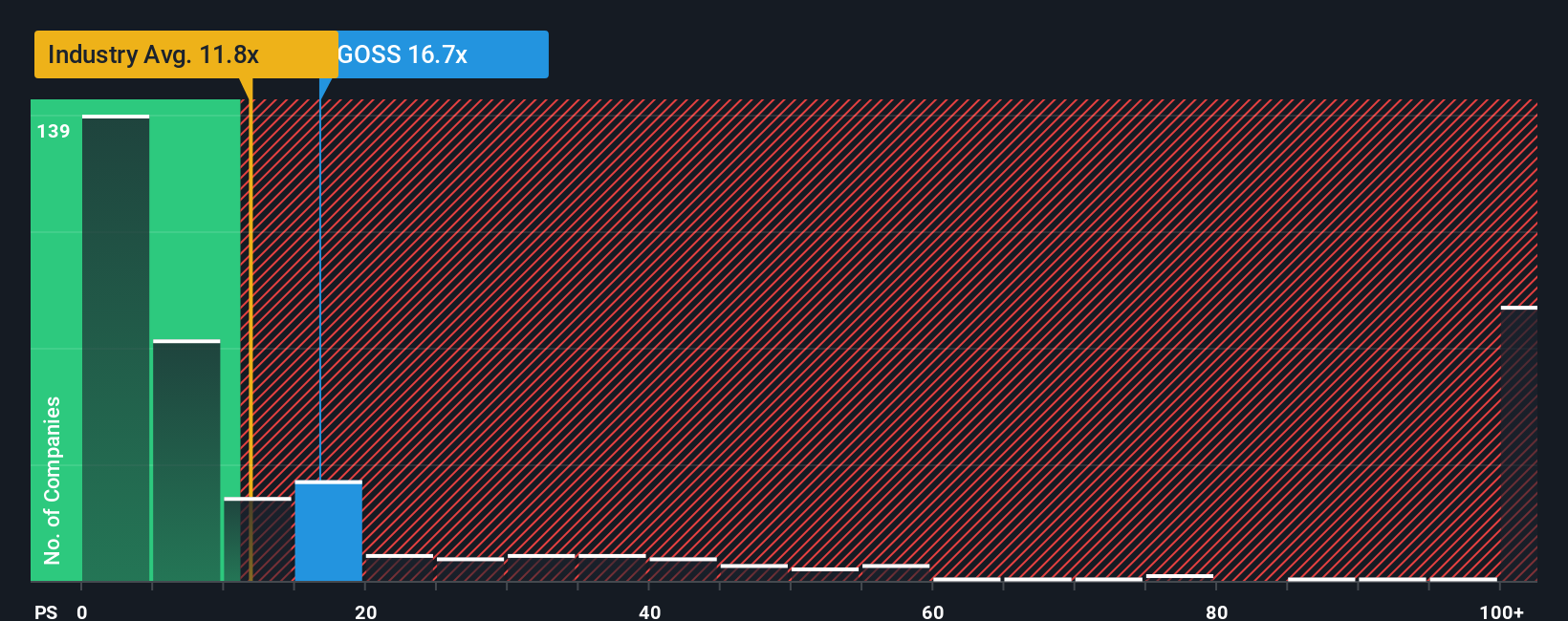

Since its price has surged higher, Gossamer Bio's price-to-sales (or "P/S") ratio of 16.7x might make it look like a sell right now compared to the wider Biotechs industry in the United States, where around half of the companies have P/S ratios below 11.8x and even P/S below 4x are quite common. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Gossamer Bio

How Gossamer Bio Has Been Performing

Gossamer Bio hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Gossamer Bio will help you uncover what's on the horizon.How Is Gossamer Bio's Revenue Growth Trending?

There's an inherent assumption that a company should outperform the industry for P/S ratios like Gossamer Bio's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 58%. Unfortunately, that's brought it right back to where it started three years ago with revenue growth being virtually non-existent overall during that time. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 77% per annum over the next three years. That's shaping up to be materially lower than the 125% each year growth forecast for the broader industry.

With this in consideration, we believe it doesn't make sense that Gossamer Bio's P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

The large bounce in Gossamer Bio's shares has lifted the company's P/S handsomely. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Gossamer Bio, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you take the next step, you should know about the 2 warning signs for Gossamer Bio (1 doesn't sit too well with us!) that we have uncovered.

If these risks are making you reconsider your opinion on Gossamer Bio, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:GOSS

Gossamer Bio

A clinical-stage biopharmaceutical company, focuses on developing and commercializing seralutinib for the treatment of pulmonary arterial hypertension (PAH) in the United States.

High growth potential and good value.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success