- United States

- /

- Biotech

- /

- NasdaqGS:GILD

Gilead Sciences (GILD): Evaluating Valuation After Raised Outlook and Strong Q3 Results

Reviewed by Simply Wall St

Gilead Sciences (GILD) released its third-quarter results showing year-over-year gains in both revenue and net income. The company also raised its full-year earnings guidance for 2025. Investor attention has turned to Gilead’s positive earnings trend and management’s outlook.

See our latest analysis for Gilead Sciences.

After a series of upbeat developments, including a raised earnings outlook, robust quarterly results, and new data for its pipeline therapies, Gilead’s share price continued to climb, gaining over 33% year-to-date and delivering a stellar 40% total shareholder return in the past twelve months. Strong momentum, fueled by both financial strength and product progress, has reinforced investor optimism for the longer-term trajectory.

With Gilead’s streak of good news, it’s worth exploring which other healthcare names are building momentum. Check out the latest opportunities using our See the full list for free..

After such a strong run and a series of positive surprises, is Gilead's current valuation still attractive? Or has the recent rally already captured the company's future growth potential and left little room for upside?

Most Popular Narrative: 3.3% Undervalued

Gilead Sciences is trading just below the most popular fair value estimate, suggesting its recent surge has not fully closed the gap. The narrative weighs both impressive operational results and forward growth assumptions in arriving at its valuation.

The launch and scaling of innovative products (Yeztugo, Trodelvy first-line, Livdelzi) position Gilead to deliver a more favorable product mix and premium pricing. This drives higher gross margins and improves the long-term earnings trajectory as portfolio diversification reduces overexposure to legacy products.

Want to know what future financial leaps underpin this price tag? The surprising assumptions driving this narrative hinge on bold pipeline launches and higher profitability. Craving details on what the analysts believe is possible? Dive in and see how Gilead’s innovation could rewrite its growth story.

Result: Fair Value of $127.23 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, future policy-driven drug pricing changes or setbacks in Gilead’s clinical pipeline could quickly shift the outlook and reduce current growth expectations.

Find out about the key risks to this Gilead Sciences narrative.

Another View: Look Through the Lens of Market Multiples

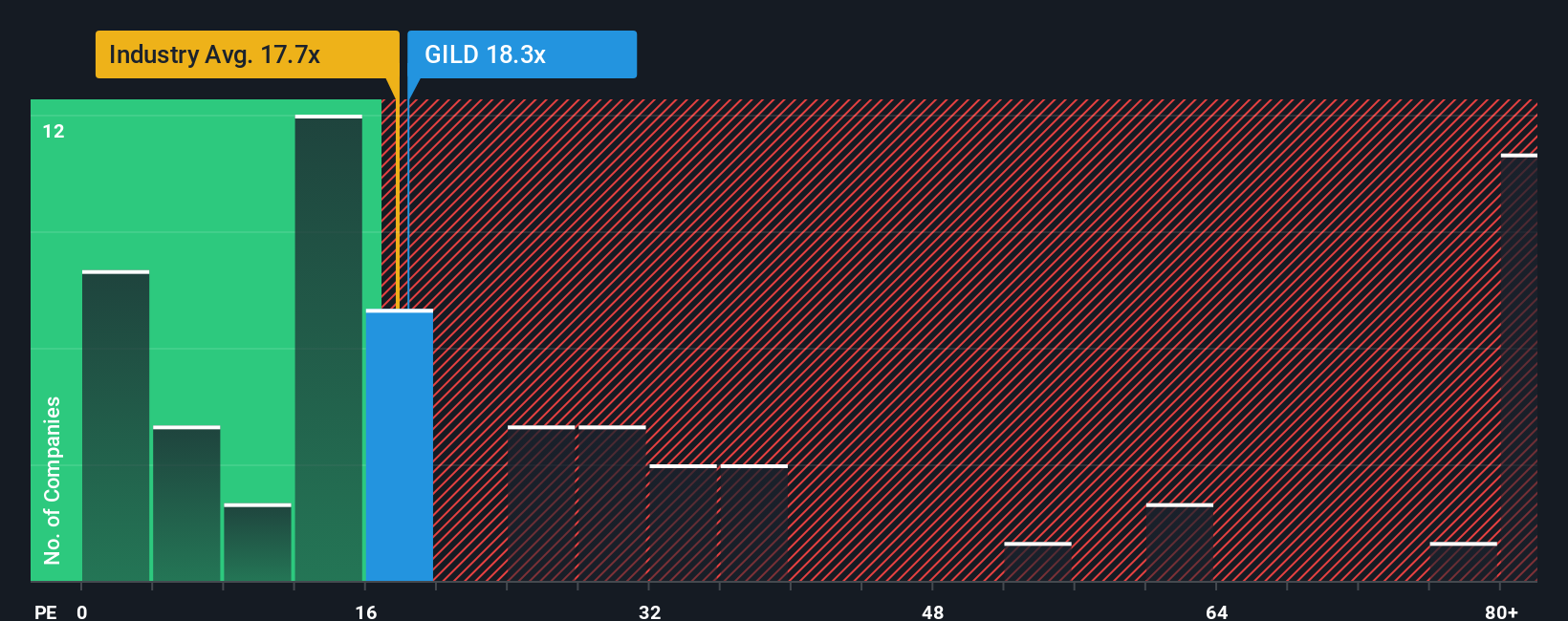

Taking a step back from fair value estimates, Gilead’s price-to-earnings ratio of 18.8x is higher than the average for its U.S. biotech industry peers at 17x but remains far below the peer group average of 57.4x. The current ratio is also well below the fair ratio of 26.9x, which suggests the market could one day re-rate Gilead’s shares. Does this gap point to lingering skepticism or pave the way for a valuation catch-up?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Gilead Sciences Narrative

If you have a different perspective or want to dig into the numbers yourself, you can craft your own data-driven narrative in just a few minutes. Do it your way.

A great starting point for your Gilead Sciences research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Top-Tier Investment Ideas?

Don’t miss out on the next wave of winners. Use the power of Simply Wall Street’s screeners to spot opportunities others might overlook and elevate your portfolio.

- Target growth potential by jumping into these 844 undervalued stocks based on cash flows to uncover companies trading at bargain prices relative to their intrinsic value.

- Capture tomorrow’s technology leaders by checking out these 27 AI penny stocks, which highlights developments in artificial intelligence innovation.

- Lock in attractive yields for consistent income by exploring these 20 dividend stocks with yields > 3%, which offers strong, stable returns above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GILD

Gilead Sciences

A biopharmaceutical company, discovers, develops, and commercializes medicines in the areas of unmet medical need in the United States, Europe, and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives