- United States

- /

- Biotech

- /

- NasdaqGS:GILD

Does Gilead Sciences Offer Strong Value After Breakthroughs in Antiviral Treatments?

Reviewed by Bailey Pemberton

- Wondering if Gilead Sciences might be the right stock to add to your portfolio? Let's dive into what could make it a standout value pick.

- The stock has been on quite a run, climbing 28.9% year-to-date and up 37.3% over the last year. Even with a slight -1.9% dip in the past week, that might have caught some eyes.

- Recent headlines have focused on Gilead's breakthroughs in antiviral treatments and strategic partnerships within the biotech sector, putting the company firmly in the spotlight. These innovations have not only boosted investor confidence but also provided extra momentum behind recent share price moves.

- Right now, Gilead scores a 4 out of 6 on key valuation checks. This suggests there is still plenty of room to assess whether it is truly undervalued. We will break down the standard valuation approaches in a moment, but stay tuned for an even smarter way to size up its true worth at the end of this article.

Approach 1: Gilead Sciences Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a core method used to estimate a company’s value by taking its expected future cash flows and discounting them back to today’s value. This approach helps investors get a sense of what the business is truly worth, based on realistic projections rather than just current market sentiment.

For Gilead Sciences, the latest reported Free Cash Flow stands at $9.3 billion. Analysts expect the company’s cash flow to keep growing, with estimates suggesting it could reach about $15.4 billion by 2029. The first five years of this projection are based directly on analyst forecasts, while estimates beyond that period are carefully extrapolated to reflect a reasonable long-term growth path. Over a ten-year period, forecasts show Free Cash Flow climbing steadily, providing a foundation for valuation.

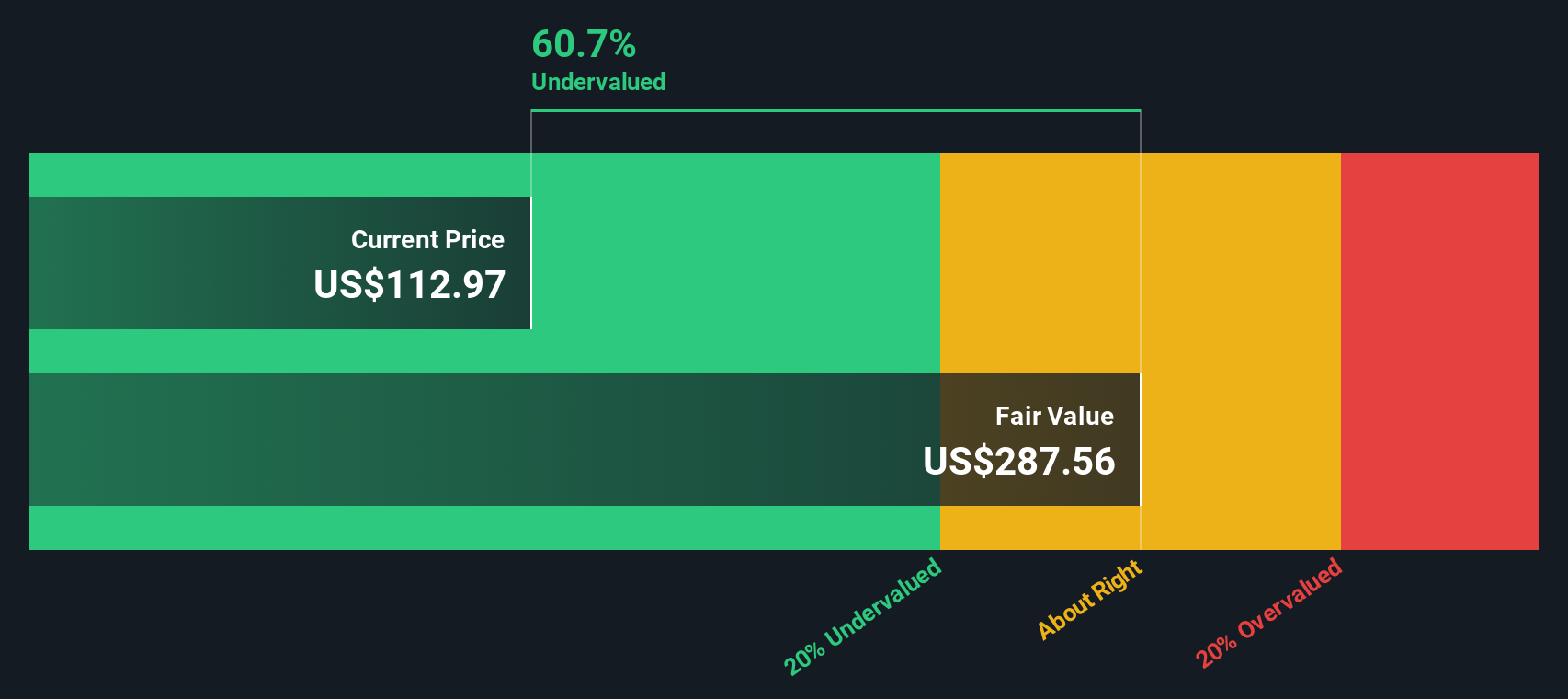

Based on this analysis, the estimated intrinsic value for Gilead Sciences comes out to $285.26 per share. When compared to the current share price, the DCF suggests the stock trades at a 58.5% discount to its fair value, making it look significantly undervalued on this measure.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Gilead Sciences is undervalued by 58.5%. Track this in your watchlist or portfolio, or discover 831 more undervalued stocks based on cash flows.

Approach 2: Gilead Sciences Price vs Earnings

The Price-to-Earnings (PE) ratio is a reliable way to value profitable companies like Gilead Sciences because it connects current share price with company earnings in a single, familiar metric. When a company is generating steady profits, the PE ratio lets investors quickly gauge whether they are paying too much, too little, or a fair price for each dollar of earnings.

Growth expectations and perceived risks have a direct impact on the “normal” or fair PE ratio a stock should command. Generally, faster growth and lower risk mean a company can justify a higher PE, while slower growth or higher uncertainty push that fair multiple lower.

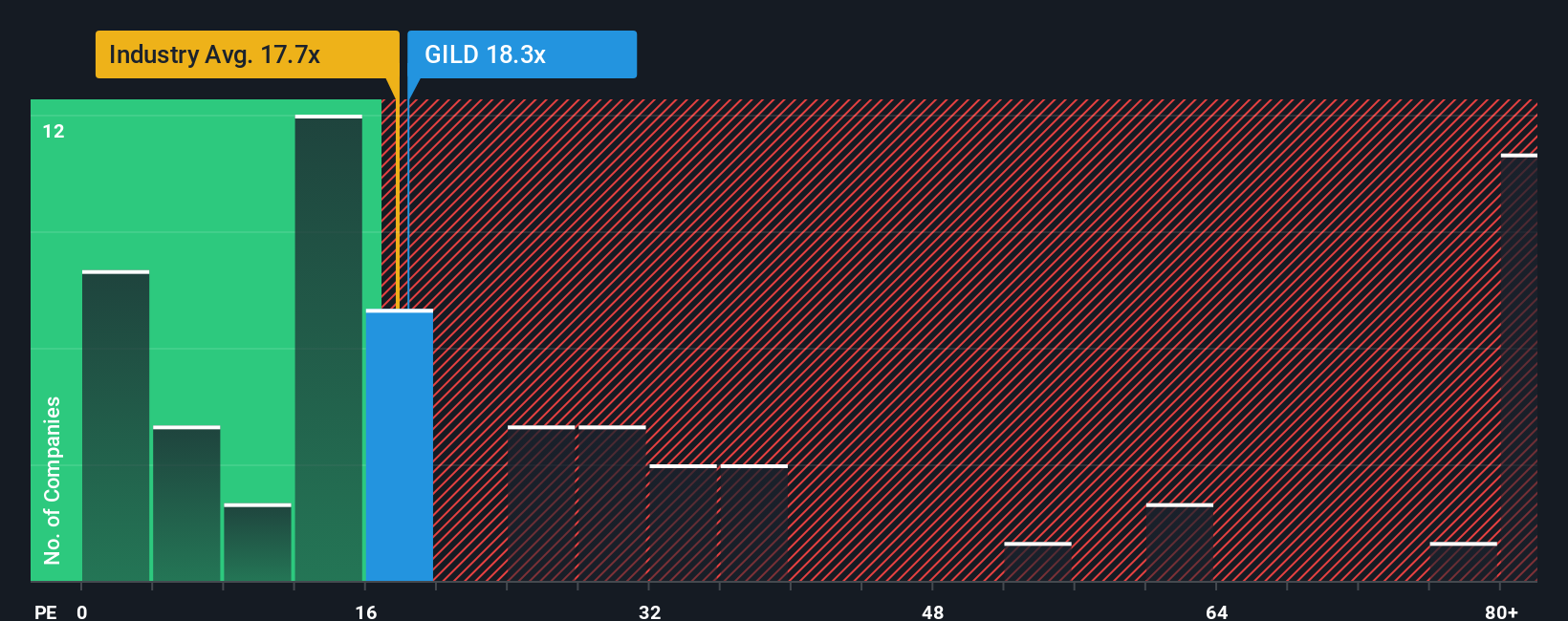

Right now, Gilead Sciences trades on a PE ratio of 23.3x. That puts it higher than the biotech industry average PE of 17.4x, but below the average among its closest peers, which sits at 44.1x. Simply Wall St’s Fair Ratio for Gilead, calculated from factors like the company’s future earnings growth, stability, profit margins, and size, is 26.1x.

This Fair Ratio is a more precise valuation anchor than basic peer or industry comparisons because it factors in the company’s unique mix of growth prospects, risks, profit margins, industry characteristics, and scale. By adjusting the target multiple to these specifics, investors get a clearer and more tailored view of underlying value.

Comparing the Fair Ratio of 26.1x with Gilead’s current multiple of 23.3x suggests the stock is slightly undervalued based on earnings, but not dramatically so.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1394 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Gilead Sciences Narrative

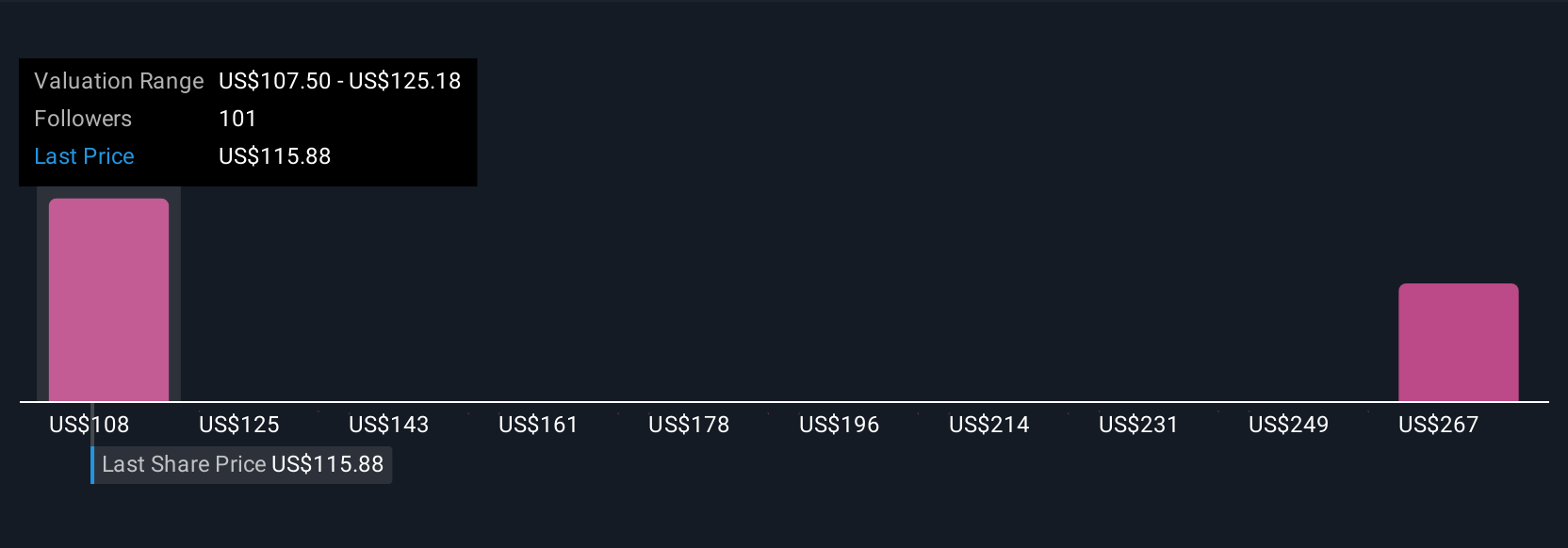

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your own story or perspective about a company: where you think it's heading, what you believe its fair value is, and how its future revenue, earnings, and profit margins might unfold. By connecting this story to a financial forecast and then to a fair value, Narratives let you move beyond just static numbers to see how your outlook (or someone else's) translates into a target price for Gilead Sciences.

On Simply Wall St’s Community page, Narratives are an easy, accessible tool already used by millions of investors. They simplify the tough part of investing by linking your view of the company’s business drivers directly to a dynamic valuation, and then showing you when its current share price suggests a buy or sell opportunity based on your assumptions. Best of all, Narratives update in real time. When big news, earnings reports, or market shifts happen, your valuation instantly reflects those changes.

For example, one Gilead Sciences Narrative reflects a bullish scenario with a fair value of $140 per share, based on aggressive growth in HIV and oncology launches, while a more cautious view sets fair value at $91 per share, factoring in reliance on legacy drugs and regulatory risks.

Do you think there's more to the story for Gilead Sciences? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GILD

Gilead Sciences

A biopharmaceutical company, discovers, develops, and commercializes medicines in the areas of unmet medical need in the United States, Europe, and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives