- United States

- /

- Life Sciences

- /

- NasdaqGS:FTRE

Fortrea Holdings (FTRE) Is Up 7.6% After Raising 2025 Guidance and Surpassing Q3 Revenue Estimates

Reviewed by Sasha Jovanovic

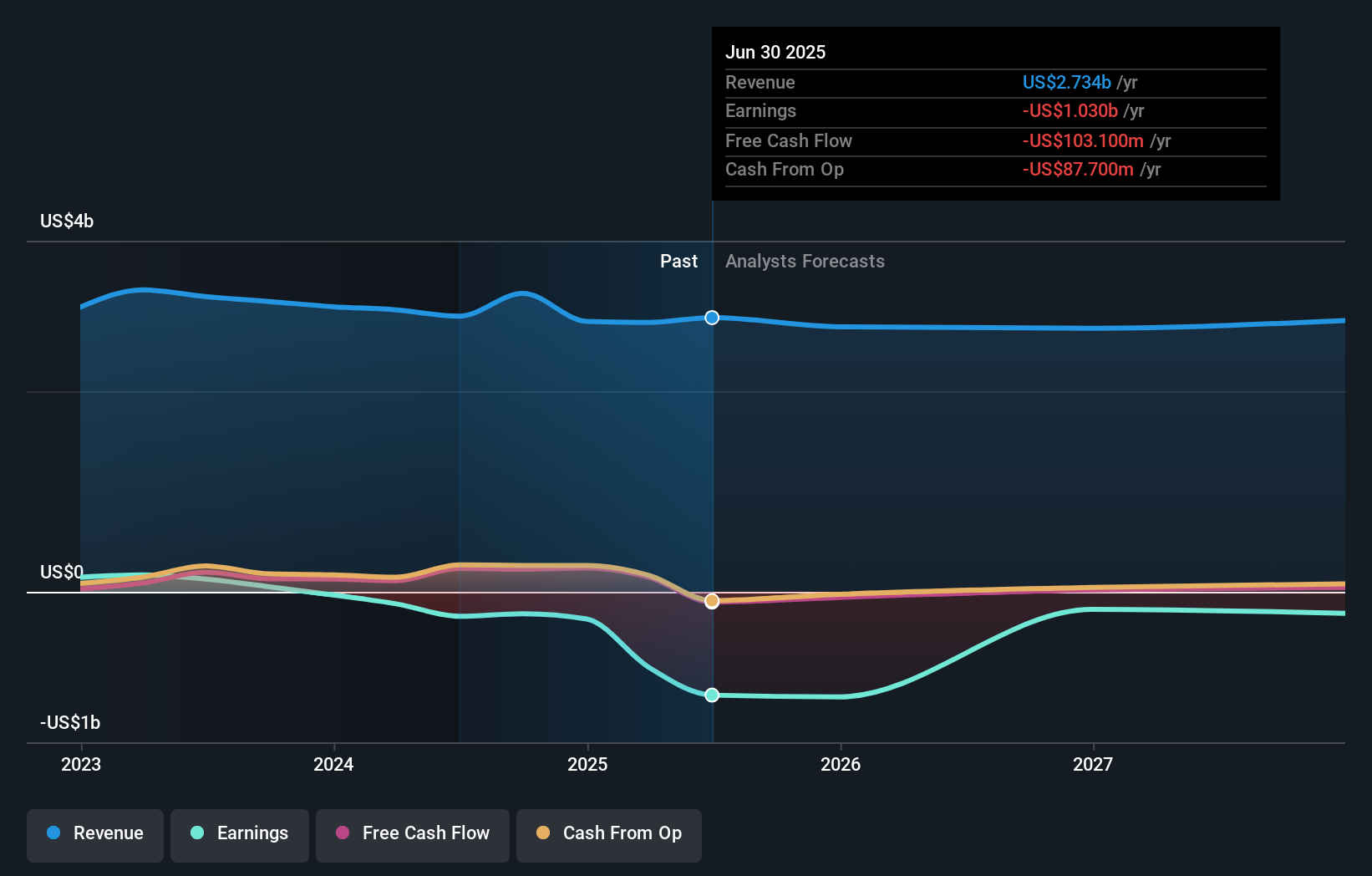

- In November 2025, Fortrea Holdings raised its full-year 2025 revenue guidance to a range of US$2.7 billion to US$2.75 billion after reporting third-quarter revenues of US$701.3 million, which exceeded analyst expectations, despite a GAAP net loss of US$15.9 million for the quarter.

- A unique aspect of the report was the company's significant improvement in win rates among biotech clients, coupled with a backlog of US$7.64 billion and a book-to-bill ratio of 1.13x, reflecting robust demand and operational progress.

- We'll explore how Fortrea's increased revenue guidance and strong biotech client win rates may influence its future investment outlook.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Fortrea Holdings Investment Narrative Recap

To be a Fortrea Holdings shareholder today, you need confidence in the company’s ability to capture clinical research growth by sustaining increased win rates with biotech clients, while executing cost savings and technology investments. The recent uplift in revenue guidance, following strong third-quarter sales and a robust backlog, signals positive momentum, yet the short-term catalyst, biotech client wins, must be weighed against ongoing net losses and potential pressure from larger clients shifting spend. These new results modestly improve the risk profile, but don't materially resolve revenue concentration concerns.

Of Fortrea’s recent actions, the initiation of a tender offer to buy back up to US$75.74 million of senior secured notes stands out. While this step could improve the balance sheet and support flexibility, its significance hinges on how well Fortrea manages persistent profitability challenges and continues growing its core biotech pipeline, now a primary short-term driver of performance.

By contrast, investors should be aware that risks remain if the top customers reduce spending or change CRO providers, especially as ...

Read the full narrative on Fortrea Holdings (it's free!)

Fortrea Holdings' outlook anticipates $2.7 billion in revenue and $388.5 million in earnings by 2028. This scenario assumes a -0.1% annual revenue decline and an earnings increase of $1.39 billion from current earnings of -$1.0 billion.

Uncover how Fortrea Holdings' forecasts yield a $9.53 fair value, a 15% downside to its current price.

Exploring Other Perspectives

Fair value estimates from two Simply Wall St Community members range widely from US$9.53 to US$20.04 per share. Against the backdrop of increased biotech win rates, such differences reflect how opinions on Fortrea’s ability to build reliable revenue remain far apart, take a look at several viewpoints for a fuller picture.

Explore 2 other fair value estimates on Fortrea Holdings - why the stock might be worth 15% less than the current price!

Build Your Own Fortrea Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Fortrea Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Fortrea Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Fortrea Holdings' overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FTRE

Fortrea Holdings

A contract research organization, provides biopharmaceutical product and medical device development solutions to pharmaceutical, biotechnology, and medical device customers worldwide.

Undervalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives