- United States

- /

- Life Sciences

- /

- NasdaqGS:FTRE

Fortrea Holdings (FTRE): Evaluating Valuation After Raised 2025 Revenue Guidance and Improved Q3 Results

Reviewed by Simply Wall St

Fortrea Holdings (FTRE) shared its third quarter earnings, showing an uptick in revenue and a narrower net loss compared to last year. The company also raised its full-year 2025 revenue guidance, signaling greater confidence in upcoming performance.

See our latest analysis for Fortrea Holdings.

After Fortrea Holdings announced improved third-quarter results and a raised revenue outlook, the market responded with a 67.5% share price gain over the past 90 days. Still, its year-to-date share price return is down 40.9% and one-year total shareholder return sits at -39%, reflecting the company’s longer-term turnaround challenges even as short-term momentum builds.

If Fortrea’s rebound has you watching for the next wave of opportunity, now is a smart time to discover fast growing stocks with high insider ownership.

The question now is whether Fortrea’s recent surge reflects a genuine bargain for investors or if the market has already factored in all the positive momentum, leaving little room for future upside.

Most Popular Narrative: 15.7% Overvalued

Compared to Fortrea Holdings’ last close of $11.02, the most widely followed valuation narrative pins fair value at $9.53, placing the current price well above consensus expectations. Here is how narrative-driven assumptions are shaping sentiment right now.

Fortrea is well positioned to benefit from global demographic changes (such as aging populations and increased healthcare access in emerging markets), demonstrated by robust demand for its clinical pharmacology services and strong execution on large-scale trials. This should drive sustainable top-line revenue growth.

Want to know what drives this cautious outlook? The most critical variables behind this fair value are hidden in long-term industry shifts and ambitious revenue targets. Curious about what growth trajectory the narrative is baking in? The answers may surprise you.

Result: Fair Value of $9.53 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent customer concentration and intense price competition could quickly undermine Fortrea’s progress and stall hoped-for earnings growth in the near future.

Find out about the key risks to this Fortrea Holdings narrative.

Another View: Deep Discount on Revenue

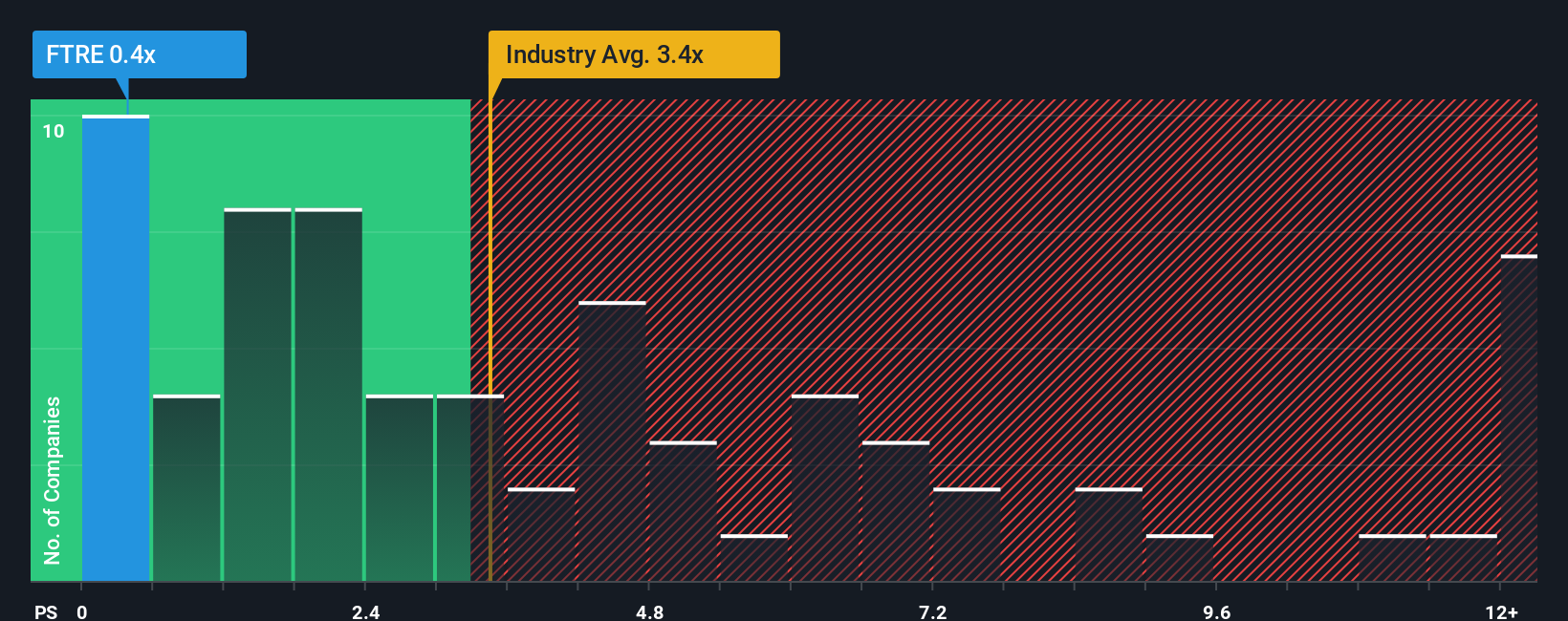

While the most popular narrative sees Fortrea as overvalued, a closer look at its price-to-sales ratio tells a different story. Fortrea trades at just 0.4x sales, far below both the US Life Sciences industry average of 3.8x and its fair ratio of 1.7x. This wide gap signals the market may be significantly undervaluing its future revenue potential or pricing in substantial risk. Is the pessimism overdone, or are investors missing a hidden opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fortrea Holdings Narrative

If you think there is more to Fortrea’s story or want to weigh the numbers for yourself, you can build a personalized view in just a few minutes. Do it your way

A great starting point for your Fortrea Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Winning Ideas?

Don’t limit your search to just one opportunity. Take the lead on smart investing with handpicked ideas across lucrative trends that are shaping tomorrow’s market.

- Kickstart your hunt for untapped growth by checking out these 861 undervalued stocks based on cash flows poised to outperform as market optimism returns.

- Spot the next wave in healthcare transformation through these 32 healthcare AI stocks as it is set to redefine medical innovation and patient outcomes.

- Supercharge your passive income by tapping into these 17 dividend stocks with yields > 3% which offers reliable yields above 3% and solid fundamentals for long-term stability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FTRE

Fortrea Holdings

A contract research organization, provides biopharmaceutical product and medical device development solutions to pharmaceutical, biotechnology, and medical device customers worldwide.

Undervalued with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives