- United States

- /

- Biotech

- /

- NasdaqGS:ENTA

Enanta Pharmaceuticals (ENTA) Is Up 33.3% After Positive Phase 2b RSV Results Propel Zelicapavir Forward

Reviewed by Sasha Jovanovic

- In late September 2025, Enanta Pharmaceuticals announced positive topline results from its Phase 2b trial of zelicapavir for treating respiratory syncytial virus (RSV) in high-risk adults, observing faster symptom resolution and a lower hospitalization rate despite not meeting the trial's primary endpoint.

- This proof-of-concept success provides the company with clear support to advance zelicapavir into Phase 3 development, potentially addressing significant unmet needs in the RSV market for vulnerable populations.

- We'll examine how the strong symptom improvement results from the Phase 2b RSV trial may impact Enanta's investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Enanta Pharmaceuticals' Investment Narrative?

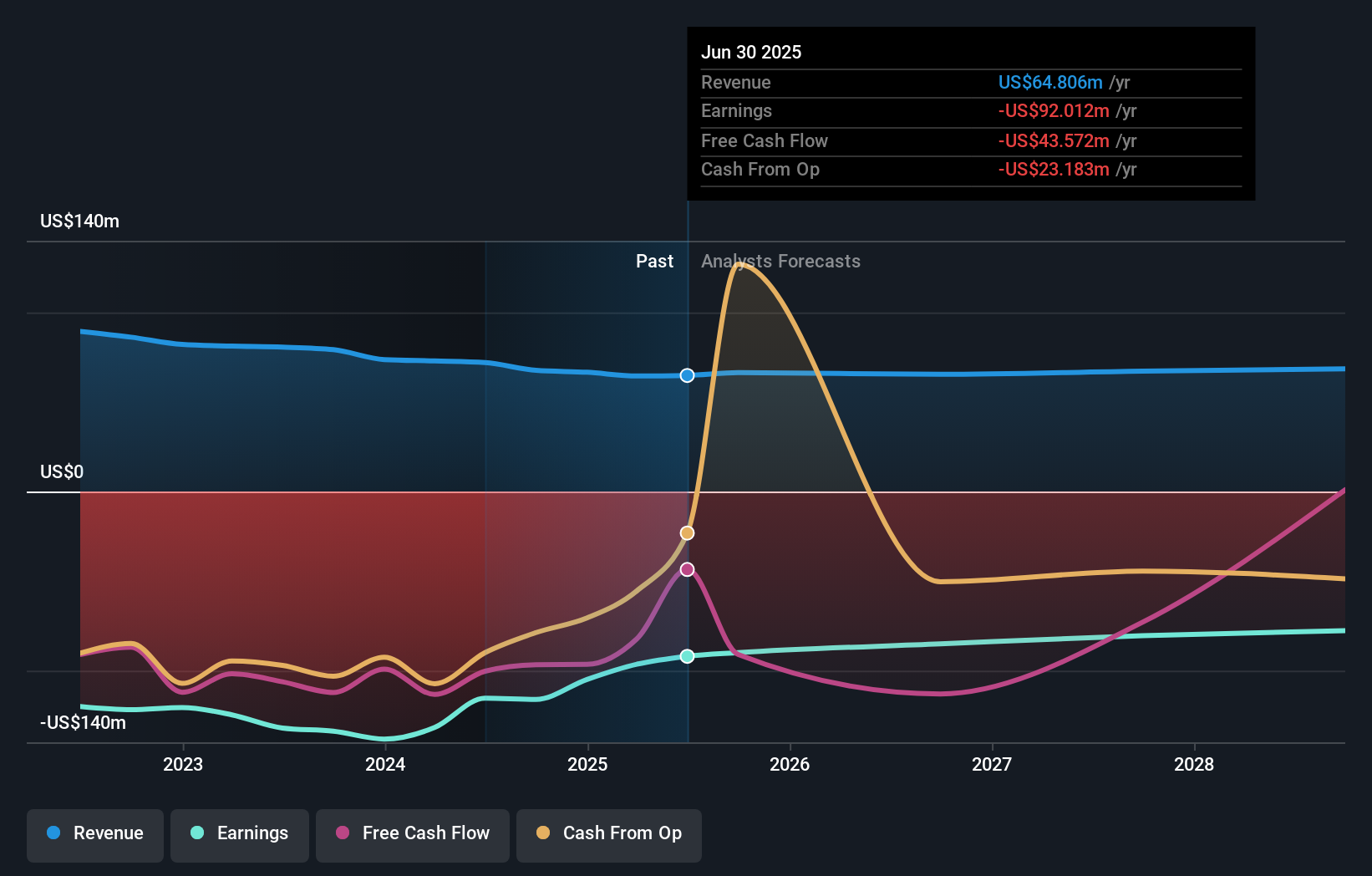

For anyone considering Enanta Pharmaceuticals, the investment thesis hinges on a belief that the company’s pipeline can create significant value, despite ongoing losses and a history of market underperformance. The positive Phase 2b results for zelicapavir in high-risk RSV patients mark an important shift, offering a fresh catalyst and potentially reducing near-term clinical development risk. This news arrives alongside a sizeable equity raise, which strengthens the balance sheet and may support further development. Previously, Enanta’s immediate risks centered on funding gaps, long product development cycles, and a need for clear clinical wins after years of losses. With recent trial results, one of the largest uncertainties around clinical progress has eased, for now, though the company still faces execution risks, competition in RSV, and the challenge of moving a candidate to market amid ongoing cash burn. The next major milestones are likely centered on advancing zelicapavir through Phase 3, FDA interactions, and keeping investor confidence during ongoing losses and recent management transitions. Yet, even with positive momentum, big setbacks remain a possibility as the company remains unprofitable and further clinical or regulatory hurdles could arise.

Our valuation report here indicates Enanta Pharmaceuticals may be undervalued.Exploring Other Perspectives

Explore 2 other fair value estimates on Enanta Pharmaceuticals - why the stock might be a potential multi-bagger!

Build Your Own Enanta Pharmaceuticals Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Enanta Pharmaceuticals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Enanta Pharmaceuticals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Enanta Pharmaceuticals' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enanta Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ENTA

Enanta Pharmaceuticals

A biotechnology company, discovers and develops small molecule drugs for the treatment of viral infections and liver diseases.

Adequate balance sheet with low risk.

Market Insights

Community Narratives