Stock Analysis

- United States

- /

- Biotech

- /

- NasdaqGS:CYTK

Investing in Cytokinetics (NASDAQ:CYTK) five years ago would have delivered you a 313% gain

It hasn't been the best quarter for Cytokinetics, Incorporated (NASDAQ:CYTK) shareholders, since the share price has fallen 11% in that time. But that doesn't undermine the fantastic longer term performance (measured over five years). Indeed, the share price is up a whopping 313% in that time. Arguably, the recent fall is to be expected after such a strong rise. Of course what matters most is whether the business can improve itself sustainably, thus justifying a higher price. While the long term returns are impressive, we do have some sympathy for those who bought more recently, given the 23% drop, in the last year.

With that in mind, it's worth seeing if the company's underlying fundamentals have been the driver of long term performance, or if there are some discrepancies.

See our latest analysis for Cytokinetics

Cytokinetics wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last 5 years Cytokinetics saw its revenue grow at 21% per year. That's well above most pre-profit companies. Arguably, this is well and truly reflected in the strong share price gain of 33%(per year) over the same period. It's never too late to start following a top notch stock like Cytokinetics, since some long term winners go on winning for decades. So we'd recommend you take a closer look at this one, but keep in mind the market seems optimistic.

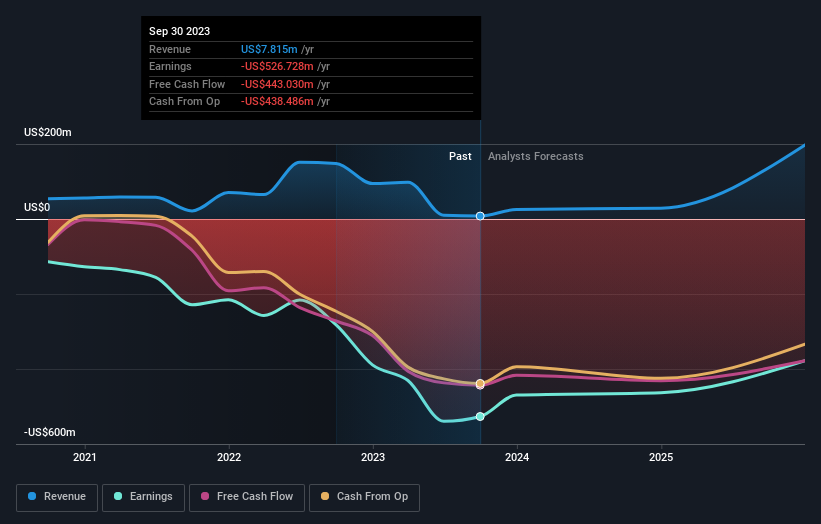

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Cytokinetics is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. If you are thinking of buying or selling Cytokinetics stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

While the broader market gained around 15% in the last year, Cytokinetics shareholders lost 23%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Longer term investors wouldn't be so upset, since they would have made 33%, each year, over five years. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 4 warning signs for Cytokinetics (1 can't be ignored) that you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Cytokinetics is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:CYTK

Cytokinetics

Cytokinetics, Incorporated, a late-stage biopharmaceutical company, focuses on discovering, developing, and commercializing muscle activators and inhibitors as potential treatments for debilitating diseases.

Slightly overvalued with limited growth.