- United States

- /

- Biotech

- /

- NasdaqGM:CRSP

Can CRISPR Therapeutics' (CRSP) In Vivo Breakthrough Reshape Its Long-Term Cardiovascular Ambitions?

Reviewed by Sasha Jovanovic

- CRISPR Therapeutics recently announced positive Phase 1 clinical trial results for CTX310, its in vivo CRISPR/Cas9 gene-editing therapy targeting ANGPTL3, showing deep and durable reductions in triglycerides and LDL cholesterol with a well-tolerated safety profile; these results were published in The New England Journal of Medicine and presented at the American Heart Association Scientific Sessions.

- This advancement not only highlights CRISPR Therapeutics' growing presence in cardiovascular gene therapies but also adds to its expanding pipeline beyond existing sickle cell and beta thalassemia programs.

- We'll explore how this promising CTX310 data strengthens the company's investment narrative, especially in the context of in vivo gene-editing innovation.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is CRISPR Therapeutics' Investment Narrative?

For anyone interested in CRISPR Therapeutics, the “big picture” rests on confidence in the company’s ability to turn innovative gene-editing breakthroughs into commercial therapies. The recent positive Phase 1 CTX310 results strengthen this core argument, having showcased deep, durable lipid reductions and a strong safety profile. This news is timely, offering a meaningful boost to momentum for CRISPR’s emerging cardiovascular programs: it may shift what matters in the near term, with the pipeline’s ability to generate clinical wins moving into sharper focus as the current growth catalyst. Financially, however, the business remains challenged, as losses have grown and profitability isn’t on the horizon for several years. The greatest risk is execution: CRISPR must show it can translate trial success into later-stage approval and, ultimately, revenue while managing growing operational losses.

However, regulatory and competitive pressures could still reshape outcomes for investors.

Exploring Other Perspectives

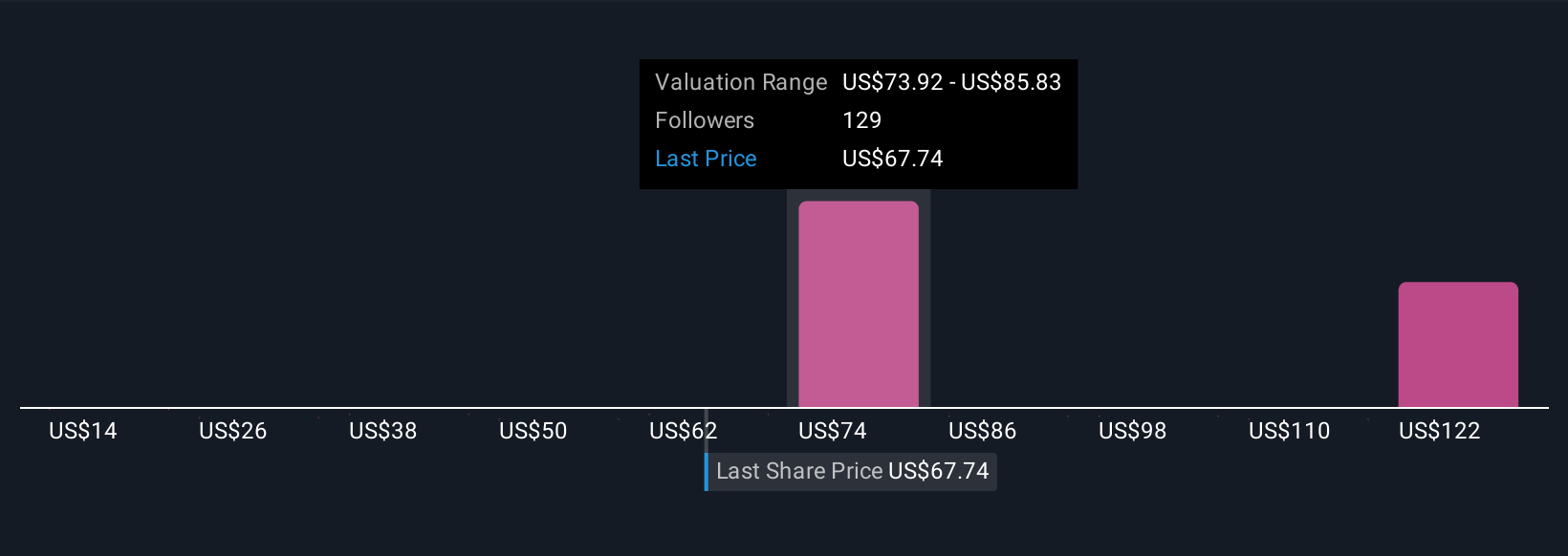

Explore 17 other fair value estimates on CRISPR Therapeutics - why the stock might be worth less than half the current price!

Build Your Own CRISPR Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CRISPR Therapeutics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CRISPR Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CRISPR Therapeutics' overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:CRSP

CRISPR Therapeutics

A gene editing company, focuses on developing gene-based medicines for serious human diseases using its Clustered Regularly Interspaced Short Palindromic Repeats (CRISPR)/CRISPR-associated protein 9 (Cas9) platform.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives