- United States

- /

- Pharma

- /

- NasdaqGM:CRMD

Are CorMedix Shares Attractively Priced After This Year’s 31% Surge and Regulatory Buzz?

Reviewed by Bailey Pemberton

- Wondering if CorMedix is a hidden gem or if its price already reflects the opportunity? Let’s break down the numbers and see what the latest figures are really telling us.

- This year alone, CorMedix shares are up 30.9%, but the ride hasn’t been all smooth with a 6.8% drop over the past week and a 10.6% decline in the past year.

- The headlines have been buzzing around regulatory updates and product milestones, adding fuel to recent price swings. Investors are watching closely as the company navigates new drug approvals and expansion news, both of which could have meaningful impacts on sentiment.

- CorMedix scores a perfect 6/6 on our valuation checks. Still, there is more to the story than just scoring high. It is worth exploring how different valuation methods compare, and if you stick around to the end, I will share a smarter way to judge value that you may find useful.

Find out why CorMedix's -10.6% return over the last year is lagging behind its peers.

Approach 1: CorMedix Discounted Cash Flow (DCF) Analysis

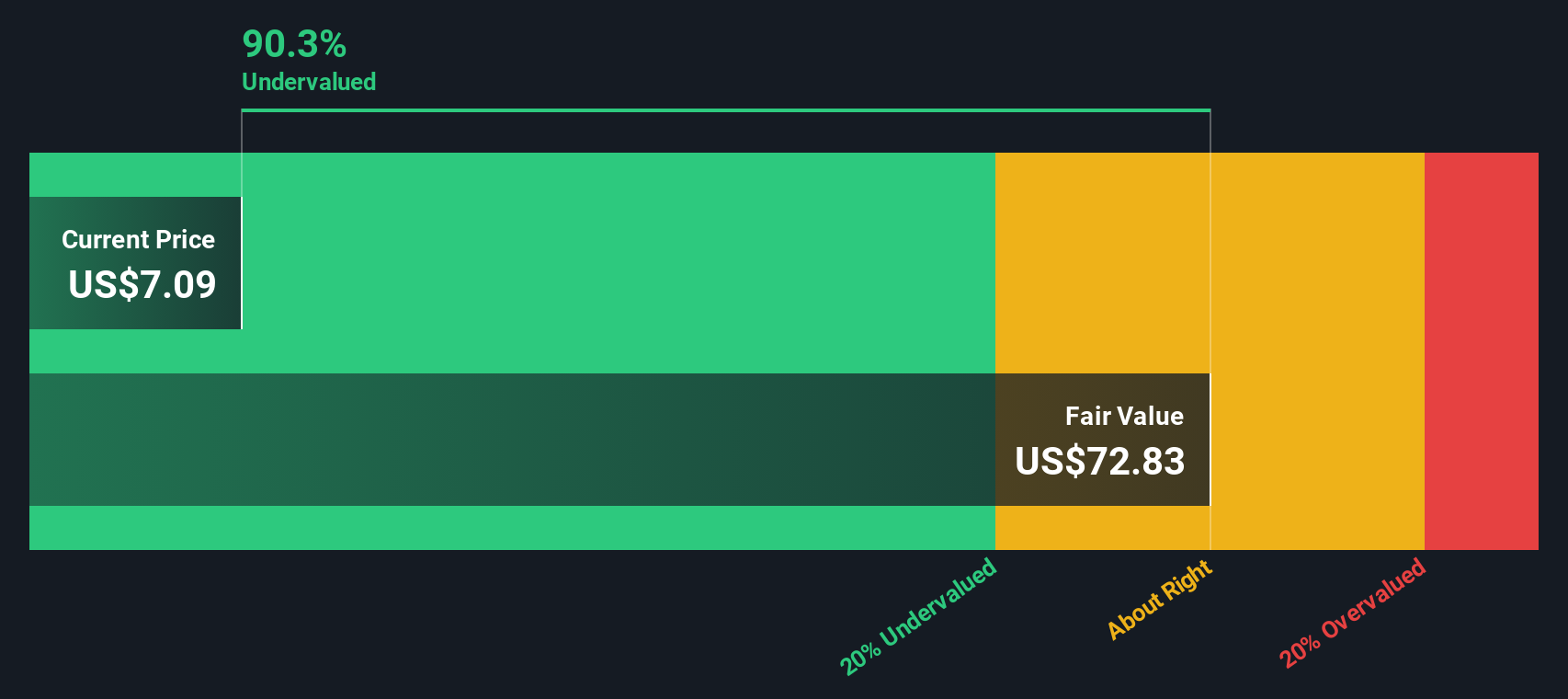

A Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and then discounting them back to today’s dollars using a rate that reflects the risk involved. This approach aims to measure what CorMedix is truly worth based on its financial potential rather than just relying on current market sentiment.

CorMedix’s current Free Cash Flow is $29.8 million. According to analyst forecasts and extrapolations, its annual Free Cash Flow is projected to experience considerable growth, reaching $202.1 million by 2026 and climbing to over $1.3 billion in 2035. For the first five years, projections are based on direct analyst estimates. Simply Wall St’s model extends these trends further using in-house calculations for longer-term growth.

With these forecasts discounted to today’s dollars, the DCF valuation estimates CorMedix’s intrinsic value at $320.10 per share. At present, the implied discount is a striking 96.6 percent, indicating the stock is trading well below its estimated fair value.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests CorMedix is undervalued by 96.6%. Track this in your watchlist or portfolio, or discover 883 more undervalued stocks based on cash flows.

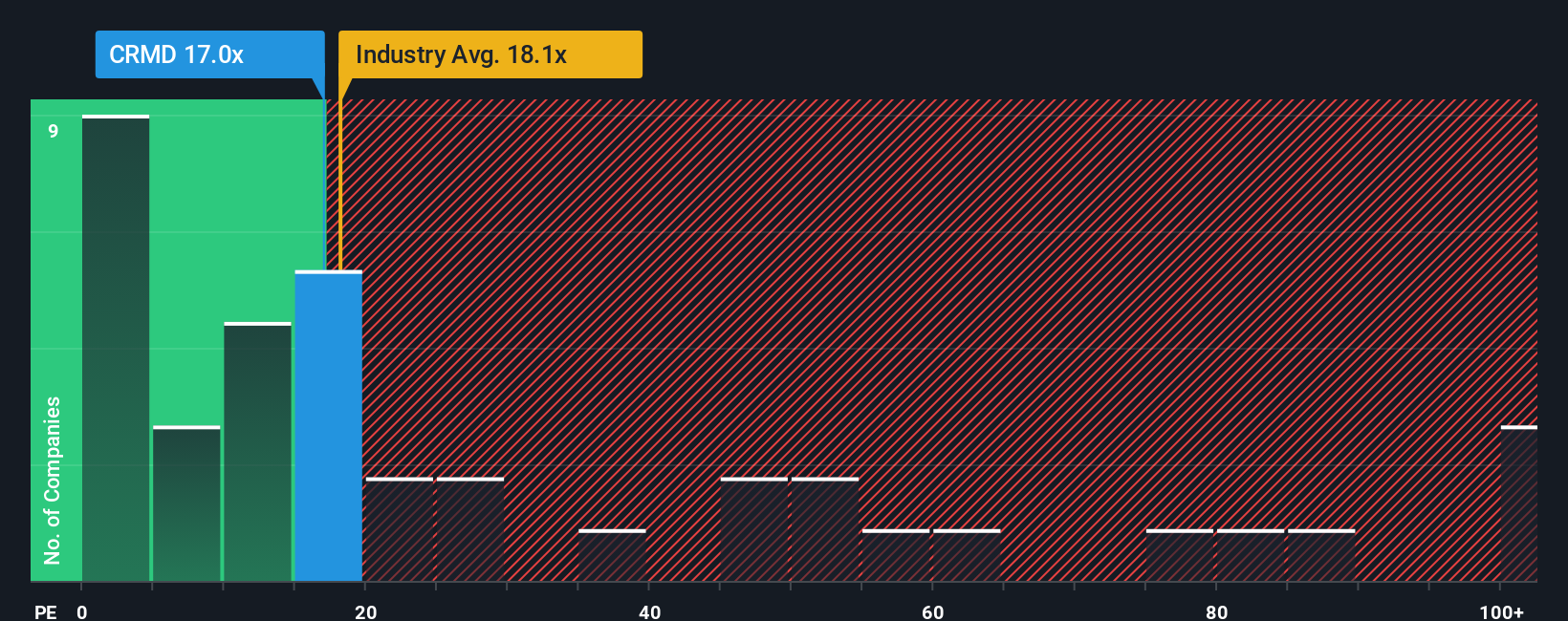

Approach 2: CorMedix Price vs Earnings

The Price-to-Earnings (PE) ratio is the preferred valuation metric when analyzing profitable companies like CorMedix. The PE ratio helps investors see how much they are paying for each dollar of the company’s current earnings, making it especially relevant for businesses that have moved beyond early-stage losses and are generating steady profits.

Growth expectations and perceived risk play a big part in determining what is considered a “normal” PE ratio. Fast-growing, stable companies usually trade at higher multiples, as investors are willing to pay more up front for future earnings. Conversely, companies with limited growth or higher risk often trade at lower PE ratios. This reflects uncertainty or slower profit expansion.

CorMedix currently trades at a PE ratio of 16.5x. For context, this sits just below both the peer average of 21.4x and the broader Pharmaceuticals industry average of 17.9x. However, Simply Wall St’s Fair Ratio model, which weighs factors such as CorMedix’s earnings growth prospects, profit margins, industry positioning and company size, places the fair PE ratio at 24.3x. The Fair Ratio goes beyond simply comparing against peers or the industry because it incorporates the company’s unique growth outlook and risk profile to offer a more personalized benchmark.

Comparing the Fair Ratio of 24.3x to CorMedix’s current 16.5x, the stock is trading noticeably below what might be considered fair based on its fundamentals and individual characteristics.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1403 companies where insiders are betting big on explosive growth.

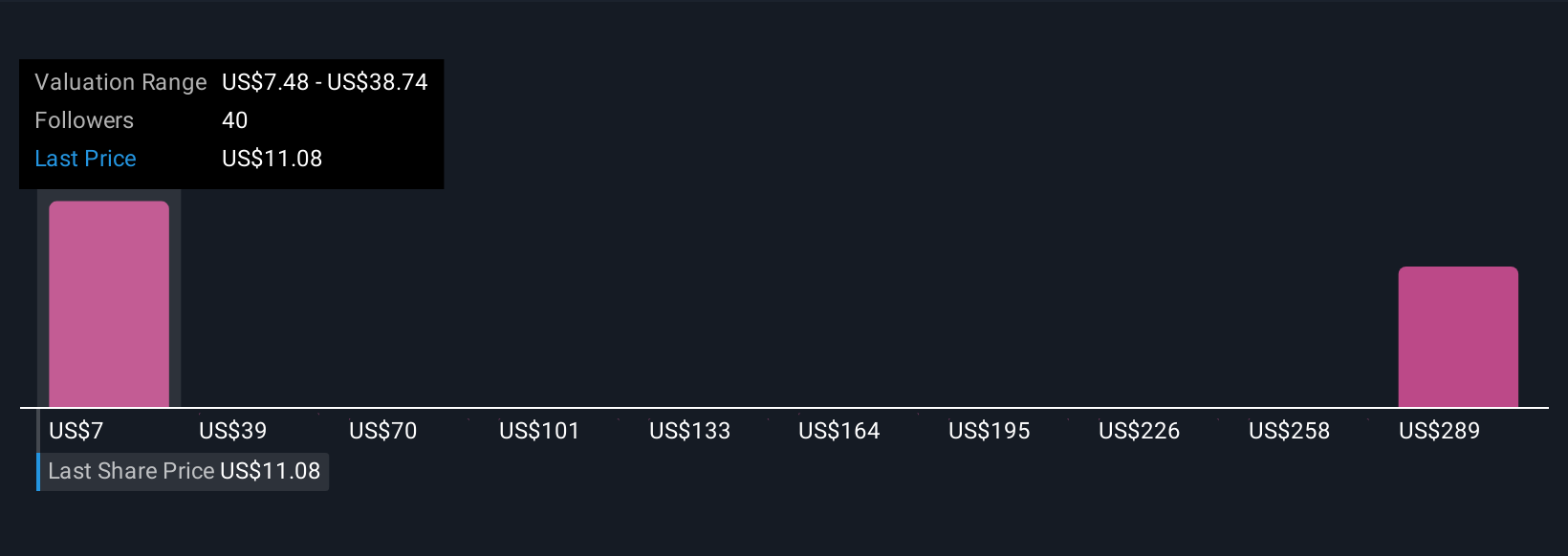

Upgrade Your Decision Making: Choose your CorMedix Narrative

Earlier we mentioned that there’s an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple yet powerful tool that lets you connect your personal view of a company’s prospects, the “story” behind CorMedix, to your own forecasts for its future revenue, earnings, margins, and ultimately, its fair value. Narratives make the link between your perspective on the business (for example, how you think new products or acquisitions will play out), your financial predictions, and whether or not the current stock price is attractive.

Used by millions on Simply Wall St’s Community page, Narratives give you a clear, visual model that updates automatically whenever news or results are announced, so your investment view stays relevant and dynamic. By comparing your fair value estimate with the current share price, Narratives help you easily decide if CorMedix is a buy, hold, or sell for your strategy.

To illustrate, one investor’s Narrative for CorMedix might focus on robust infection control growth and successful integration, resulting in a high fair value and suggesting the stock is a strong opportunity. Another, more cautious Narrative might emphasize regulatory risks and heavy reliance on key drugs, which could yield a much lower fair value and signal caution.

Do you think there's more to the story for CorMedix? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:CRMD

CorMedix

A biopharmaceutical company, focuses on developing and commercializing therapeutic products for life-threatening diseases and conditions in the United States.

Very undervalued with flawless balance sheet.

Market Insights

Community Narratives