Stock Analysis

- United States

- /

- Pharma

- /

- NasdaqGS:COLL

Collegium Pharmaceutical (NASDAQ:COLL) shareholder returns have been stellar, earning 154% in 5 years

When you buy a stock there is always a possibility that it could drop 100%. But on the bright side, you can make far more than 100% on a really good stock. For instance, the price of Collegium Pharmaceutical, Inc. (NASDAQ:COLL) stock is up an impressive 154% over the last five years. It's also good to see the share price up 30% over the last quarter.

Since the stock has added US$63m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

Check out our latest analysis for Collegium Pharmaceutical

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

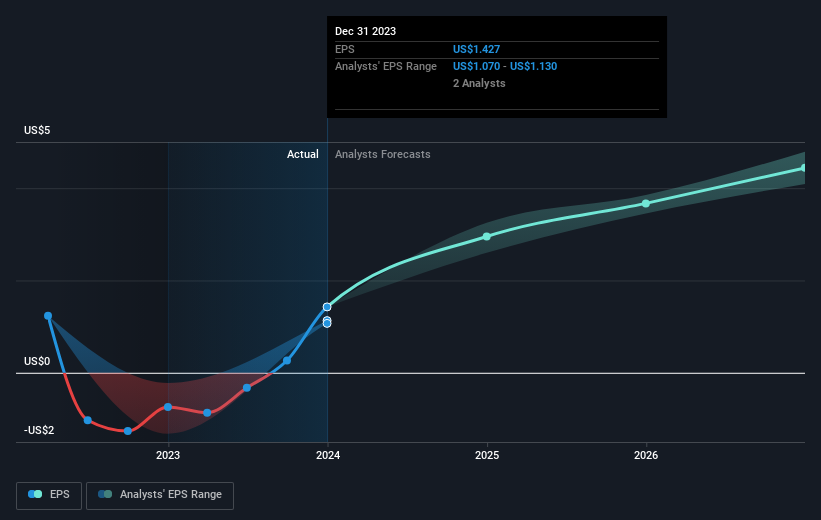

During the five years of share price growth, Collegium Pharmaceutical moved from a loss to profitability. Sometimes, the start of profitability is a major inflection point that can signal fast earnings growth to come, which in turn justifies very strong share price gains. Since the company was unprofitable five years ago, but not three years ago, it's worth taking a look at the returns in the last three years, too. We can see that the Collegium Pharmaceutical share price is up 67% in the last three years. During the same period, EPS grew by 25% each year. This EPS growth is higher than the 19% average annual increase in the share price over the same three years. Therefore, it seems the market has moderated its expectations for growth, somewhat.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that Collegium Pharmaceutical has improved its bottom line lately, but is it going to grow revenue? This free report showing analyst revenue forecasts should help you figure out if the EPS growth can be sustained.

A Different Perspective

It's nice to see that Collegium Pharmaceutical shareholders have received a total shareholder return of 65% over the last year. That gain is better than the annual TSR over five years, which is 20%. Therefore it seems like sentiment around the company has been positive lately. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 2 warning signs for Collegium Pharmaceutical (1 doesn't sit too well with us) that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Collegium Pharmaceutical is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:COLL

Collegium Pharmaceutical

Collegium Pharmaceutical, Inc., a specialty pharmaceutical company, engages in the development and commercialization of medicines for pain management.

Reasonable growth potential and fair value.