- United States

- /

- Biotech

- /

- NasdaqGS:COGT

Will Cogent Biosciences' (COGT) Flexible Fundraising Shape Its R&D Ambitions or Investor Confidence?

Reviewed by Sasha Jovanovic

- Cogent Biosciences recently filed a universal shelf registration statement, giving the company flexibility to publicly offer up to five types of securities in the future.

- This filing closely follows the company's third-quarter earnings report, which underscored rising net losses due to increasing research and development investment.

- We’ll explore how the planned fundraising flexibility amid high R&D spending influences Cogent Biosciences’ investment narrative going forward.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Cogent Biosciences' Investment Narrative?

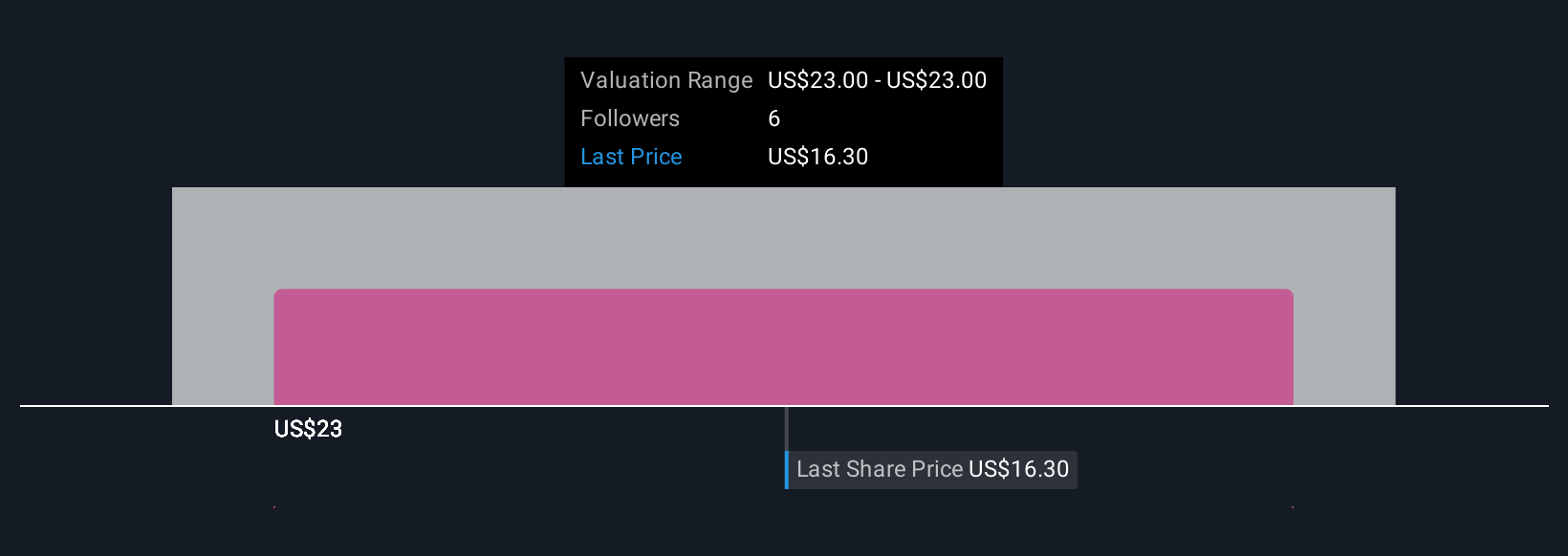

For investors considering Cogent Biosciences, the big picture centers on belief in the company's ability to translate its ambitious research and development into approved and revenue-generating products, particularly with its promising bezuclastinib program. The recent universal shelf registration filing gives Cogent significant latitude in raising capital, likely in response to growing net losses as R&D spending mounts. This flexibility is important given the lack of current revenue and the fact that clinical development, while offering high upside if successful, is capital intensive and uncertain in timing and outcome. The main short-term catalysts remain updates from key clinical trials and potential regulatory advances, and this new capital-raising ability could help ensure these milestones are not slowed by funding gaps. However, new dilution or debt could put extra pressure on valuation and returns, especially for existing shareholders, and shifts the risk profile more sharply toward dependency on successful clinical outcomes and the timing of any future product approvals. Recent share price movement suggests the market is already carefully weighing these funding needs, so while the registration is not a fundamental shift, it might bring further attention to capital structure and execution risks.

However, existing shareholders should be aware of the increasing risk of dilution from future funding.

Exploring Other Perspectives

Explore another fair value estimate on Cogent Biosciences - why the stock might be worth as much as 57% more than the current price!

Build Your Own Cogent Biosciences Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cogent Biosciences research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Cogent Biosciences research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cogent Biosciences' overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COGT

Cogent Biosciences

A biotechnology company, focuses on developing precision therapies for genetically defined diseases.

Excellent balance sheet with low risk.

Market Insights

Community Narratives