- United States

- /

- Biotech

- /

- NasdaqCM:CELC

A Look at Celcuity’s (CELC) Valuation Following Its Recent 50% Share Price Surge

Reviewed by Simply Wall St

See our latest analysis for Celcuity.

Celcuity’s share price momentum is hard to ignore, with a 50.8% gain over the past month and an eye-popping 465% year-to-date price return. This performance far outpaces most biotech peers. Even when looking at the longer term, the company boasts an impressive 371.7% total shareholder return over the past year. This suggests that investors see potential for significant breakthroughs ahead, despite some recent volatility.

If the surge in Celcuity’s stock has you rethinking your strategy, this could be the perfect opportunity to see what’s happening across other innovative healthcare picks. See the full list for free.

The big question facing investors now is whether Celcuity’s surge is just the beginning, with more growth on the horizon, or if the recent rally means all the optimism is already reflected in the price. Is there still a buying opportunity here, or has the market already priced in its future potential?

Price-to-Book of 70.9x: Is it justified?

Celcuity’s shares are currently trading at a lofty price-to-book ratio of 70.9x, a level that is dramatically higher than both the industry and peer averages. This kind of premium pricing implies the market may be betting on a substantial commercial breakthrough that is not reflected in historical financials.

The price-to-book ratio measures the value investors place on a company in relation to its net assets. For a clinical-stage biotech like Celcuity, this ratio can also serve as a barometer of investor optimism about breakthrough product pipelines or future profitability, since the company is not yet generating meaningful revenue.

Compared to the US Biotechs industry average of 2.4x, Celcuity’s 70.9x multiple is strikingly expensive. However, when lined up against its peer group, with an average price-to-book ratio of 94.7x, Celcuity is actually cheaper than many of its direct competitors. That peer discount could signal either skepticism about Celcuity’s near-term prospects or an overlooked value.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 70.9x (OVERVALUED)

However, Celcuity’s lack of current revenue and ongoing net losses mean that future breakthroughs or delays could significantly impact the stock’s momentum.

Find out about the key risks to this Celcuity narrative.

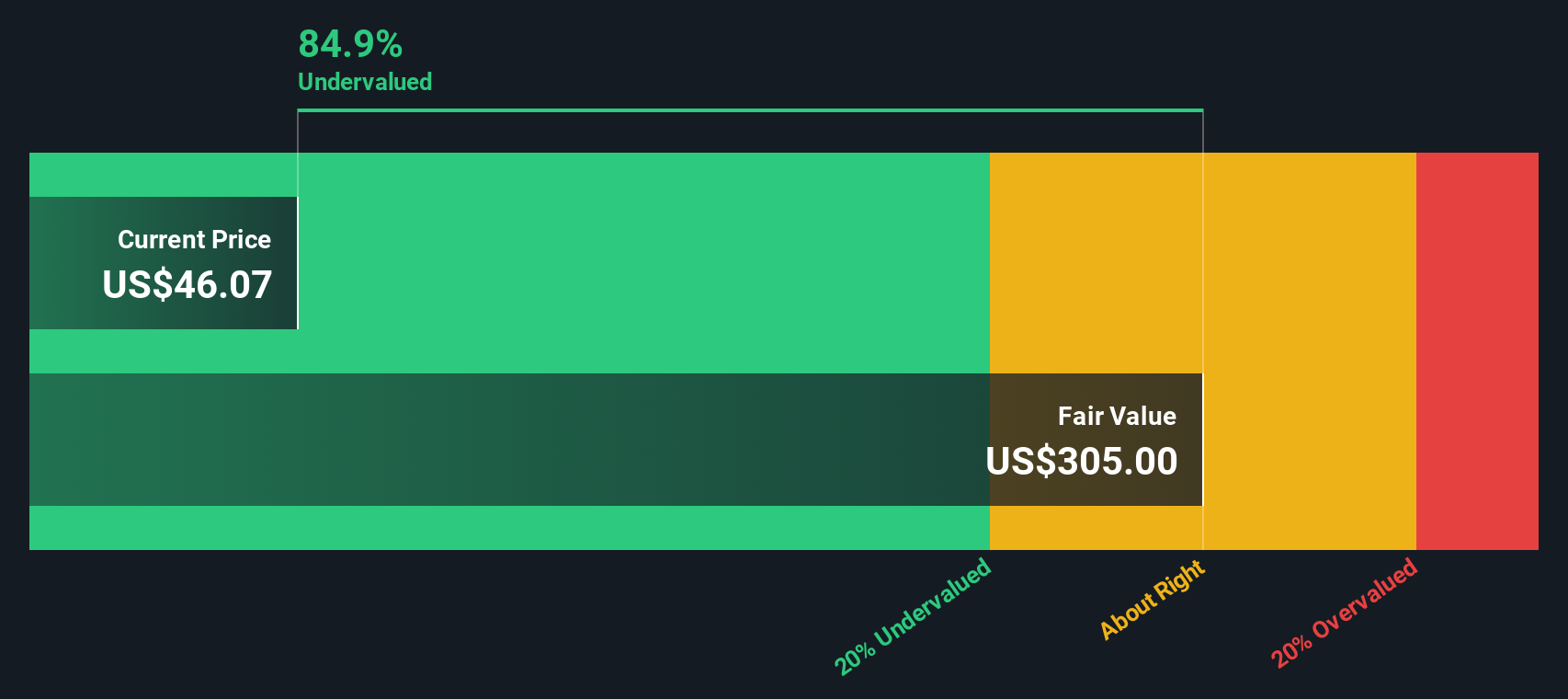

Another View: Discounted Cash Flow Says Deep Value

While Celcuity’s price-to-book ratio looks stretched, our DCF model takes a different stance. It estimates Celcuity’s fair value at $304.48. Shares at $74.20 are trading around 75% below this calculation. Could the market be overlooking something critical, or are DCF assumptions too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Celcuity for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 848 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Celcuity Narrative

If you want to look beneath the surface and form your own view on Celcuity, you can dig into the numbers and build your own perspective in just a few minutes. Do it your way.

A great starting point for your Celcuity research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t limit your opportunities to just one stock. Go beyond Celcuity with these smart, ready-to-action picks and keep your portfolio one step ahead of the crowd:

- Unlock the potential of future tech by tracking industry leaders who are moving the needle in artificial intelligence with these 25 AI penny stocks.

- Catch the next generation of secure and innovative payment platforms by checking out these 82 cryptocurrency and blockchain stocks in the blockchain and crypto universe.

- Boost your income stream by seeking out companies offering reliable returns with yields above 3% using these 17 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CELC

Celcuity

A clinical-stage biotechnology company, focuses on the development of targeted therapies for the treatment of various solid tumors in the United States.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives