- United States

- /

- Biotech

- /

- NasdaqCM:CDTX

How Investors Are Reacting To Cidara Therapeutics (CDTX) Securing Major Funding and FDA Breakthrough for CD388

Reviewed by Sasha Jovanovic

- Cidara Therapeutics recently announced progress in its Phase 3 ANCHOR study for CD388, securing a US$45 million milestone payment from Janssen, a BARDA award valued up to US$339.2 million to support manufacturing, and receiving FDA Breakthrough Therapy designation.

- These updates highlight the growing validation and financial support behind CD388, a promising immunotherapeutic candidate for influenza prevention and serious diseases.

- We'll explore how the combination of clinical and funding milestones advances Cidara's investment narrative given the significance of the BARDA award.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

What Is Cidara Therapeutics' Investment Narrative?

To back Cidara Therapeutics, you need conviction in its ability to translate recent clinical and funding wins into lasting value. The US$339.2 million BARDA award and FDA Breakthrough Therapy designation for CD388 are significant, directly bolstering Cidara’s financial resources and clinical momentum. These developments shift the near-term focus to the timely execution and results from the Phase 3 ANCHOR trial, now a pivotal catalyst. The influx of non-dilutive funding and a major milestone payment from Janssen also help address the persistent risk of capital needs, although Cidara remains unprofitable and has posted a sharp increase in quarterly losses. While these major awards may reduce immediate funding pressure, the biggest risks remain tied to clinical trial outcomes, commercial execution, and future dilution if results or partnerships disappoint. Investors should watch for interim Phase 3 data and regulatory milestones in 2026. On the other hand, short-term financial losses are still climbing, a risk not to lose sight of.

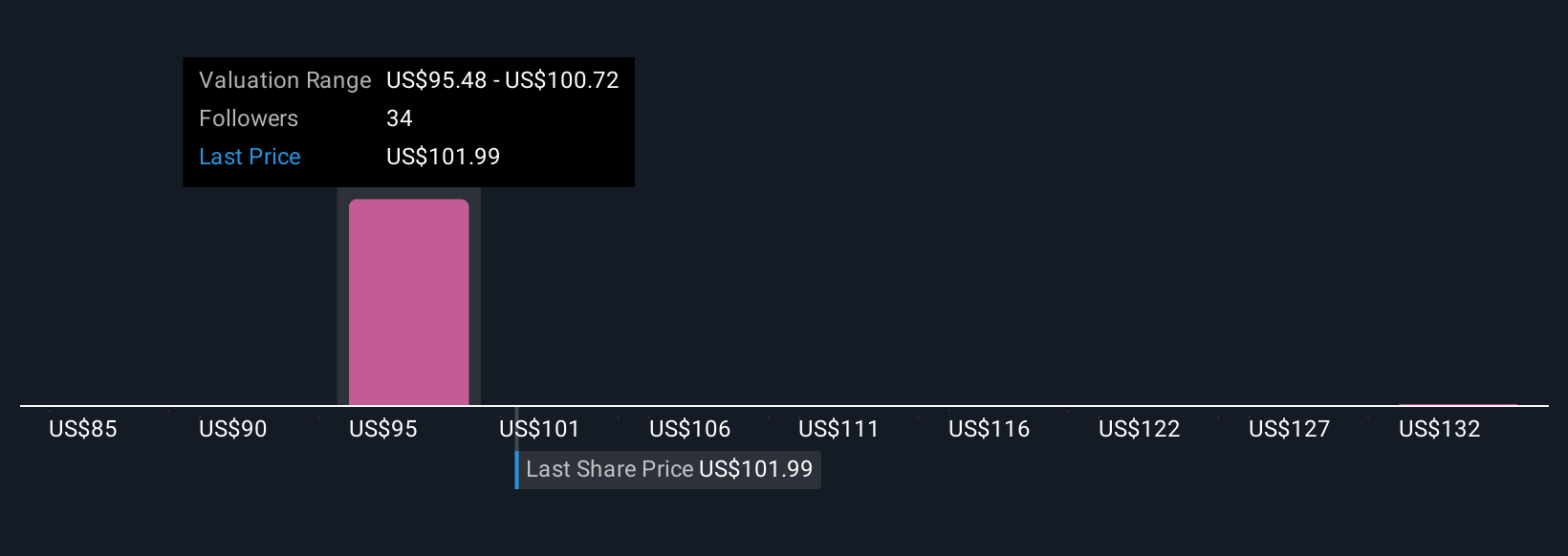

In light of our recent valuation report, it seems possible that Cidara Therapeutics is trading beyond its estimated value.Exploring Other Perspectives

Explore 4 other fair value estimates on Cidara Therapeutics - why the stock might be worth 19% less than the current price!

Build Your Own Cidara Therapeutics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cidara Therapeutics research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Cidara Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cidara Therapeutics' overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CDTX

Cidara Therapeutics

Operates as a biotechnology company that focuses on developing targeted therapies for patients facing cancers and other serious diseases.

Flawless balance sheet with low risk.

Market Insights

Community Narratives