- United States

- /

- Biotech

- /

- NasdaqGS:BGNE

High Growth Tech Stocks to Watch in October 2024

Reviewed by Simply Wall St

The United States market has remained flat over the past week but has seen a significant 40% increase over the past year, with earnings projected to grow by 15% annually in the coming years. In this context, identifying high growth tech stocks involves looking for companies that demonstrate strong potential for innovation and scalability, aligning with these promising market conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 21.08% | 28.73% | ★★★★★★ |

| Sarepta Therapeutics | 23.85% | 44.09% | ★★★★★★ |

| TG Therapeutics | 28.54% | 41.50% | ★★★★★★ |

| Invivyd | 42.91% | 70.39% | ★★★★★★ |

| Ardelyx | 27.19% | 66.44% | ★★★★★★ |

| Amicus Therapeutics | 20.26% | 62.89% | ★★★★★★ |

| Blueprint Medicines | 25.82% | 68.05% | ★★★★★★ |

| Travere Therapeutics | 29.24% | 70.77% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 248 stocks from our US High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Capricor Therapeutics (NasdaqCM:CAPR)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Capricor Therapeutics, Inc. is a clinical-stage biotechnology company dedicated to developing transformative cell and exosome-based therapeutics for treating Duchenne muscular dystrophy and other diseases with unmet medical needs, with a market cap of $972.45 million.

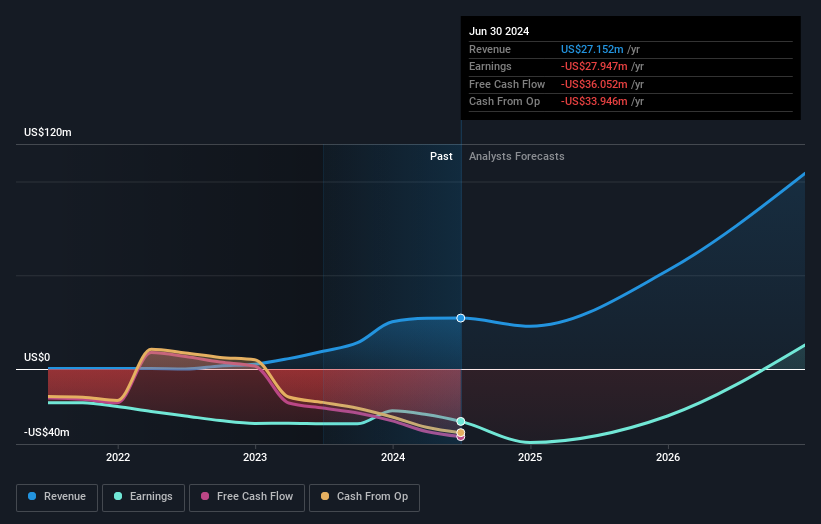

Operations: Capricor Therapeutics focuses on developing cell and exosome-based therapeutics, primarily targeting Duchenne muscular dystrophy. The company's revenue is derived entirely from its biotechnology segment, amounting to $27.15 million.

Capricor Therapeutics, despite being unprofitable, is navigating an ambitious path with a forecasted revenue growth of 48.1% annually, significantly outpacing the US market average of 8.9%. This growth trajectory is bolstered by its recent strategic moves including a $75 million equity offering and significant R&D investments into its innovative therapies like deramiocel for Duchenne muscular dystrophy (DMD) cardiomyopathy. With earnings expected to surge by 65.6% annually, Capricor's aggressive expansion in biotech underlines its potential to reshape treatment paradigms in rare diseases, though shareholder dilution remains a concern.

- Click here and access our complete health analysis report to understand the dynamics of Capricor Therapeutics.

Evaluate Capricor Therapeutics' historical performance by accessing our past performance report.

BeiGene (NasdaqGS:BGNE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BeiGene, Ltd. is an oncology company focused on discovering and developing cancer treatments for patients across the United States, China, Europe, and other international markets with a market cap of $23.47 billion.

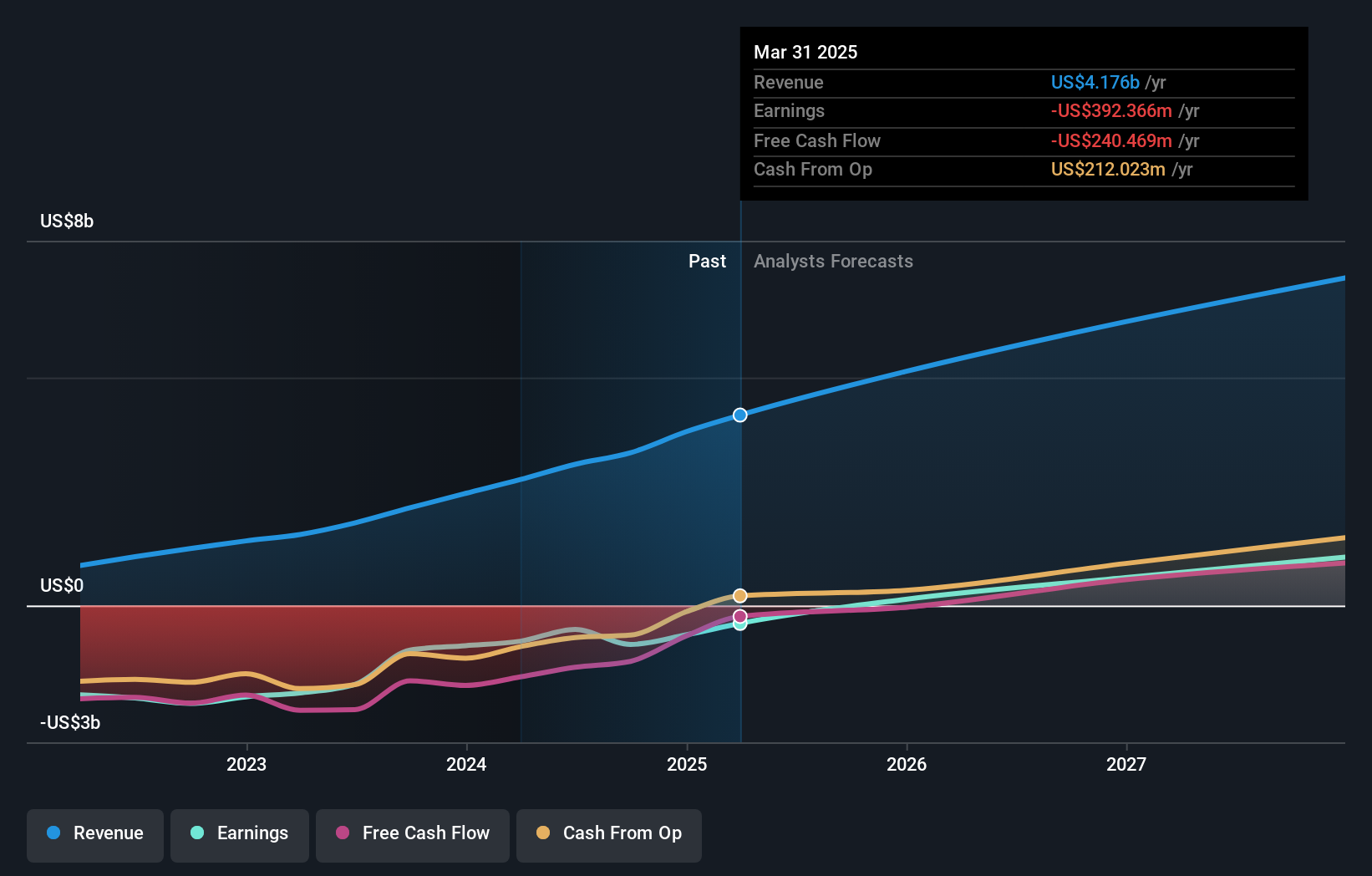

Operations: BeiGene generates revenue primarily from its pharmaceutical products, amounting to approximately $3.10 billion. The company is engaged in the discovery and development of cancer treatments across various international markets.

BeiGene, though currently unprofitable, is on a promising trajectory with expected revenue growth of 19% annually, outstripping the US market average of 8.9%. This growth is underpinned by substantial R&D investments which accounted for a significant portion of their expenses, aligning with their strategic focus on developing oncology treatments like TEVIMBRA®. The recent FDA advisory committee's favorable view on TEVIMBRA for certain cancer treatments highlights BeiGene's potential to impact therapeutic areas significantly. Moreover, earnings are anticipated to surge by 66% annually over the next few years, showcasing the company’s potential to transition into profitability and secure a competitive stance in biotechnology.

- Navigate through the intricacies of BeiGene with our comprehensive health report here.

Examine BeiGene's past performance report to understand how it has performed in the past.

Humacyte (NasdaqGS:HUMA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Humacyte, Inc. focuses on developing and manufacturing off-the-shelf, implantable, bioengineered human tissues for various therapeutic areas, with a market cap of $715.19 million.

Operations: The company specializes in creating implantable, bioengineered human tissues designed for diverse therapeutic applications. With a focus on off-the-shelf products, it aims to address medical needs across various anatomical sites.

Humacyte, Inc., despite its current unprofitability and a highly volatile share price, is positioned for significant growth with anticipated revenue increases of 67.2% annually, outpacing the U.S. market average of 8.9%. This growth trajectory is supported by aggressive R&D investments which are crucial as the company transitions towards profitability within three years. Recent strategic moves include a follow-on equity offering raising $30 million and securing a new U.S. patent for its innovative BioVascular Pancreas product, aimed at revolutionizing type 1 diabetes treatment through advanced tissue engineering technologies. These developments underscore Humacyte's potential to lead in high-stakes medical innovations while navigating financial stabilization.

- Get an in-depth perspective on Humacyte's performance by reading our health report here.

Understand Humacyte's track record by examining our Past report.

Summing It All Up

- Investigate our full lineup of 248 US High Growth Tech and AI Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BeiGene might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BGNE

BeiGene

An oncology company, engages in discovering and developing various treatments for cancer patients in the United States, China, Europe, and internationally.

Undervalued with reasonable growth potential.