- United States

- /

- Biotech

- /

- NasdaqCM:BYSI

BeyondSpring (NASDAQ:BYSI) shareholder returns have been stellar, earning 230% in 1 year

When you buy shares in a company, there is always a risk that the price drops to zero. But if you pick the right business to buy shares in, you can make more than you can lose. For example, the BeyondSpring Inc. (NASDAQ:BYSI) share price had more than doubled in just one year - up 230%. It's also good to see the share price up 215% over the last quarter. The company reported its financial results recently; you can catch up on the latest numbers by reading our company report. In contrast, the longer term returns are negative, since the share price is 68% lower than it was three years ago.

Since the stock has added US$23m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

View our latest analysis for BeyondSpring

BeyondSpring recorded just US$1,751,000 in revenue over the last twelve months, which isn't really enough for us to consider it to have a proven product. As a result, we think it's unlikely shareholders are paying much attention to current revenue, but rather speculating on growth in the years to come. For example, they may be hoping that BeyondSpring comes up with a great new product, before it runs out of money.

Companies that lack both meaningful revenue and profits are usually considered high risk. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. Of course, if you time it right, high risk investments like this can really pay off, as BeyondSpring investors might know.

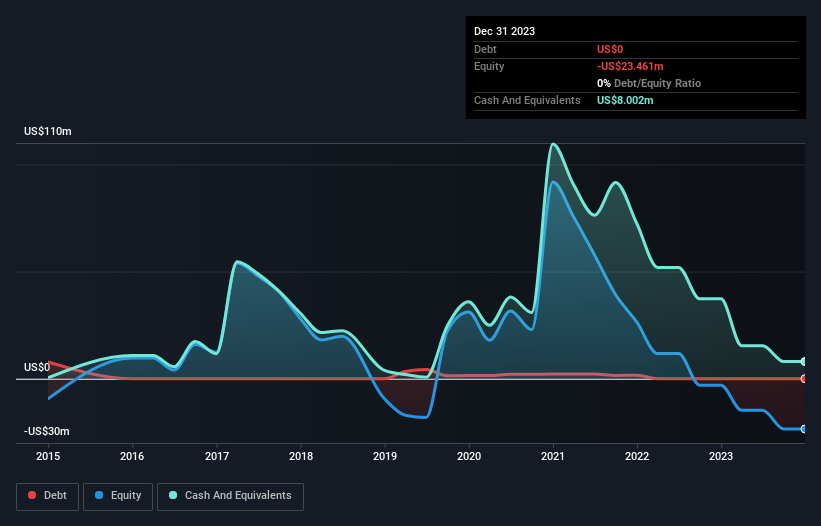

BeyondSpring had liabilities exceeding cash by US$40m when it last reported in December 2023, according to our data. That makes it extremely high risk, in our view. So the fact that the stock is up 68% in the last year shows that high risks can lead to high rewards, sometimes. Investors must really like its potential. You can click on the image below to see (in greater detail) how BeyondSpring's cash levels have changed over time.

Of course, the truth is that it is hard to value companies without much revenue or profit. However you can take a look at whether insiders have been buying up shares. It's often positive if so, assuming the buying is sustained and meaningful. You can click here to see if there are insiders buying.

A Different Perspective

We're pleased to report that BeyondSpring shareholders have received a total shareholder return of 230% over one year. There's no doubt those recent returns are much better than the TSR loss of 12% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for BeyondSpring (of which 3 don't sit too well with us!) you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if BeyondSpring might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:BYSI

BeyondSpring

A clinical stage biopharmaceutical company, together with its subsidiaries, focuses on the development of cancer therapies.

Slight with worrying balance sheet.