- United States

- /

- Life Sciences

- /

- NasdaqGS:BRKR

Bruker (BRKR) Margin Plunge and $176M One-Off Loss Challenge Profit Recovery Narratives

Reviewed by Simply Wall St

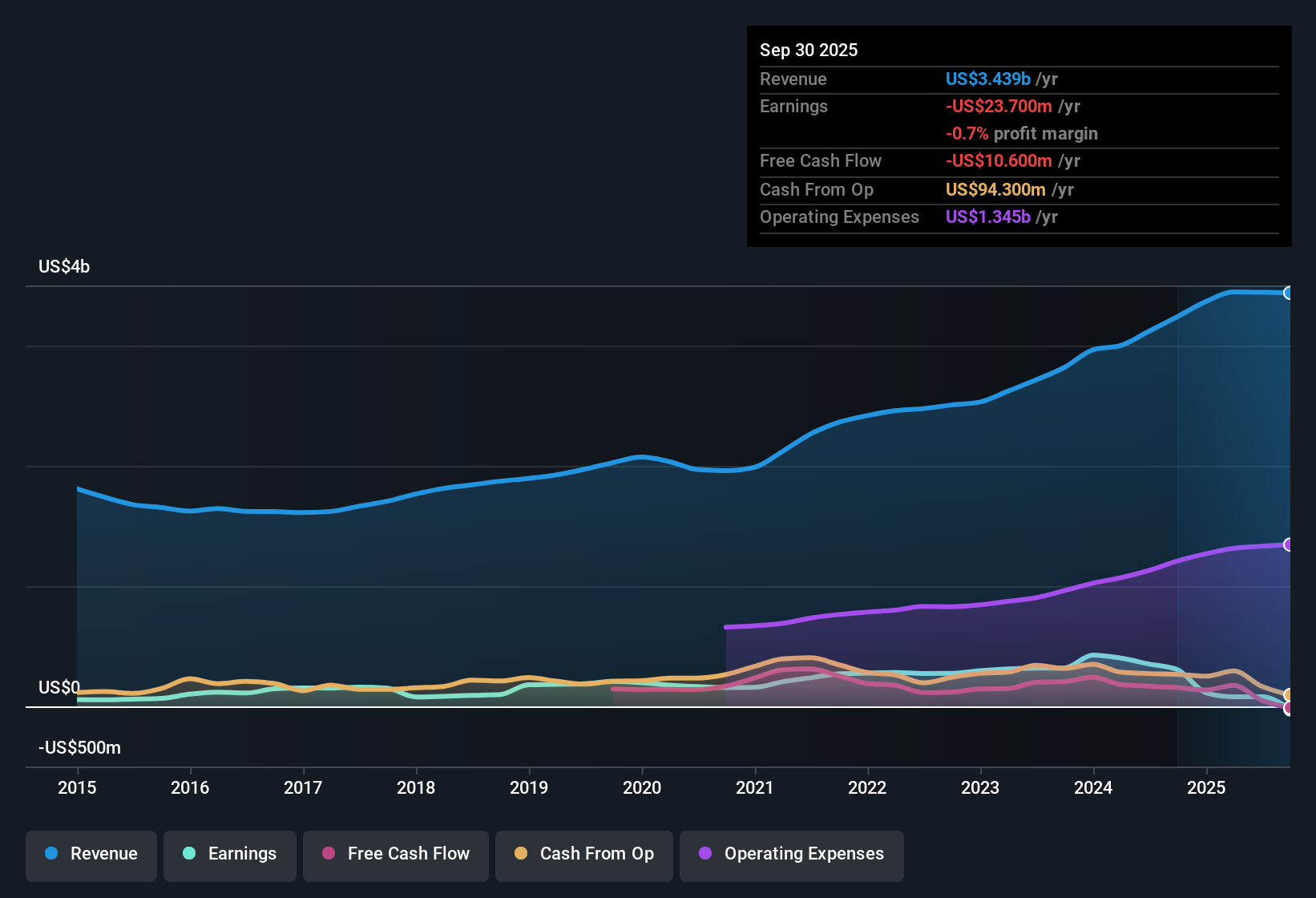

Bruker (BRKR) reported a significant worsening in profitability, as net profit margin dropped to 2.3% from 11.3% the previous year. This decline was primarily due to a one-off loss of $176.3 million over the last twelve months ending June 30, 2025. While earnings have averaged 2% annual growth over the past five years, the most recent year saw negative earnings growth. Revenue is projected to grow at 2.5% annually, which lags behind the broader US market’s 10.5% pace. Looking ahead, earnings are forecast to accelerate at 57.65% per year, which may encourage investors to focus on potential future improvements despite the recent margin contraction.

See our full analysis for Bruker.Next up, we’ll see how the reported numbers line up with the narratives and expectations circulating among investors and analysts.

See what the community is saying about Bruker

Margin Recovery Tied to Cost Cuts

- Bruker's forecast for operating margin expansion of at least 300 basis points depends on a cost reduction program targeting $100 to $120 million in annualized savings, mostly realized by fiscal 2026.

- Analysts' consensus view highlights that ongoing cost-reduction efforts, rather than rapid sales growth, will drive double-digit EPS increases and lift net margins closer to 10.7% within three years.

- Despite muted revenue growth expectations (3.2% annually), consensus narrative argues recurring revenue streams and business mix will support improved margin quality.

- Consensus narrative notes cost savings may be the main pillar of profit growth given persistent weak visibility in new order demand.

Profit Growth Forecast: $404 Million by 2028

- Consensus profit estimates call for earnings to climb from $79.6 million today to $404.1 million by September 2028, which would imply nearly 5x growth over three years even as top-line revenue inches forward at a slower pace.

- Analysts' consensus view expects substantial medium-term upside due to higher recurring revenues and product innovation, but flags several caveats:

- Consensus points out margin gains will only materialize if biopharma research funding stabilizes, but current visibility on recovery remains limited, posing risk to those profit targets.

- Forecasts show that to hit analyst price targets, Bruker will have to deliver both sharp earnings expansion and sustain lower PE multiples, moving from 59.4x today toward 22.3x in 2028.

Shares Trade at a Peer Discount, but Industry Premium

- Bruker's price-to-earnings ratio of 73.8x is well below its peer average of 99.2x, yet considerably higher than the life sciences industry average of 36x, highlighting nuanced valuation risks and opportunity relative to rivals.

- Analysts' consensus view sees analyst price targets at 47.82, which is about 24% higher than the current share price of 38.71. However, conviction is mixed, as targets require top-line and margin assumptions that may be sensitive to sector funding pressures and macro volatility.

- The consensus warns that valuation re-rating depends on Bruker moving closer to sector PE averages as profits scale, rather than sustaining a wide industry premium indefinitely.

- Analysts also note the path to fair value is closely tied not just to margin recovery, but also to renewed revenue momentum post-2025.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Bruker on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Thinking about the figures in a new light? Share your take and form your unique view in just a few minutes. Do it your way.

A great starting point for your Bruker research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Bruker’s reliance on aggressive cost cuts and uncertain margin recovery, combined with weak revenue growth, highlights its lack of reliable and consistent performance across cycles.

If you want more predictability, use stable growth stocks screener (2094 results) to discover companies delivering steady earnings and revenue growth regardless of market fluctuations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bruker might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BRKR

Bruker

Develops, manufactures, and distributes scientific instruments, and analytical and diagnostic solutions in the United States, Europe, the Asia Pacific, and internationally.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Community Narratives