- United States

- /

- Life Sciences

- /

- NasdaqGS:BRKR

Bruker (BRKR): Exploring Valuation After Recent Share Price Rebound and Market Volatility

Reviewed by Simply Wall St

Bruker (BRKR) shares have seen modest movement over the past week, reflecting ongoing investor sentiment toward the scientific instruments sector. The company's recent trading performance offers a fresh perspective for assessing its current valuation.

See our latest analysis for Bruker.

After a challenging start to the year, Bruker has staged an impressive comeback, highlighted by a 21.2% one-month share price return and a 38.8% gain over the past 90 days. However, despite this recent momentum, the one-year total shareholder return remains down 19.4%, which underscores how volatile investor sentiment can be as the company works to rebuild longer-term confidence and valuation appeal.

If Bruker’s sharp reversal got your attention, it could be the right moment to broaden your horizons with the fast growing stocks with high insider ownership.

Given Bruker's recent surge and lingering longer-term losses, is there hidden value waiting to be unlocked, or does the current price already reflect all the growth investors can expect going forward?

Most Popular Narrative: 1.1% Undervalued

Bruker's last close price of $47.27 lines up almost perfectly with the most popular narrative's fair value estimate of $47.82. This sets the stage for a story defined by narrow margins and closely watched turning points.

The expected stabilization and eventual recovery of research and biopharma funding in both the US and China, along with global settlements on tariffs, could trigger a rebound in demand for Bruker's advanced life science and drug discovery instruments. This may support renewed top-line revenue growth post-2025.

Curious why this valuation is so precise? The narrative describes sharply improved margins, bold earnings leaps, and a future profit multiple that is rarely seen in legacy science. Can management really hit those targets, and what numbers are hiding under the hood? Tap in to discover the projections that make this fair value stand out.

Result: Fair Value of $47.82 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, such as weaker academic funding in the US and ongoing trade tensions, which could quickly dampen Bruker’s growth outlook.

Find out about the key risks to this Bruker narrative.

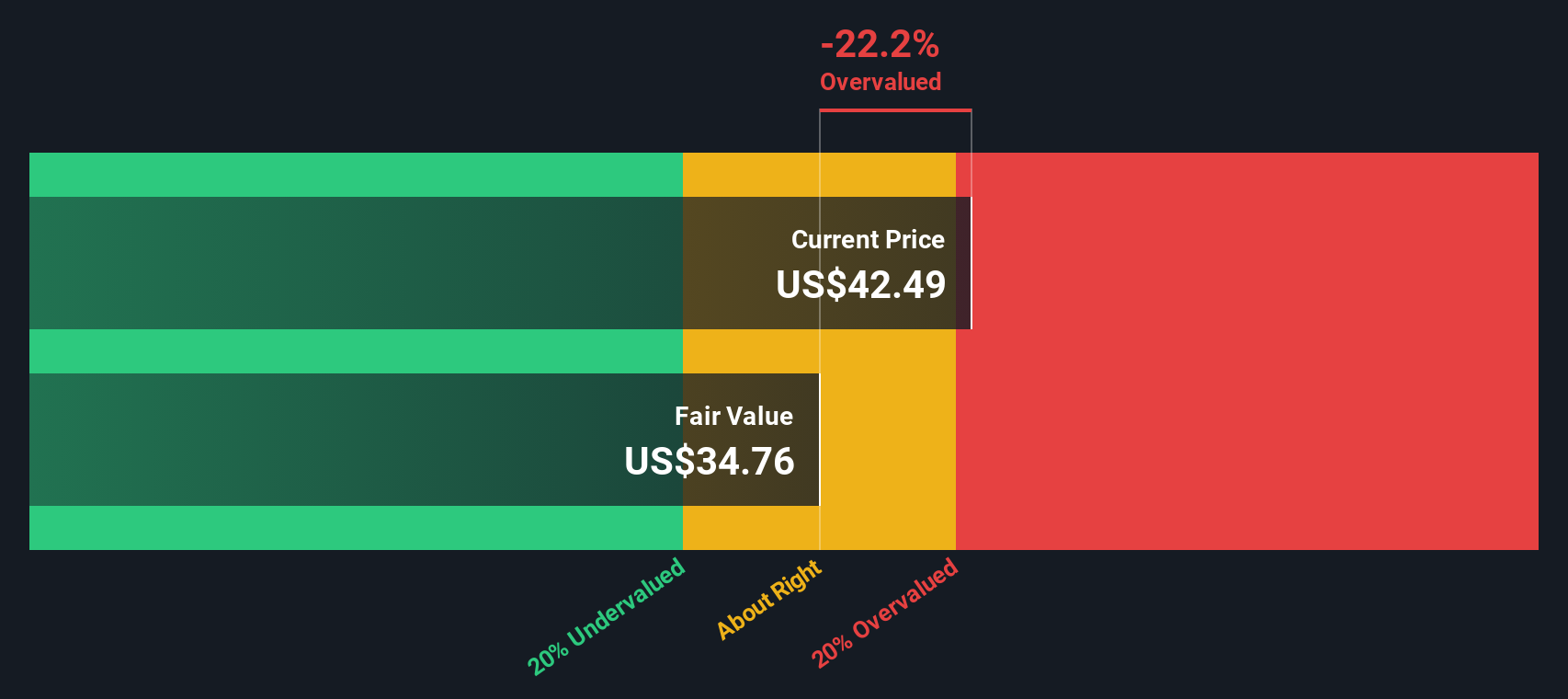

Another View: Our DCF Model Suggests Overvaluation

While the consensus fair value points to Bruker being slightly undervalued, our SWS DCF model implies the opposite. It finds that the shares are trading well above an estimated fair value of $36.73. This raises the question: What might the market be missing about the company's future cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bruker for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 926 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bruker Narrative

If you want to challenge these conclusions or follow your own path through the numbers, it takes just a few minutes to build your own view. Do it your way.

A great starting point for your Bruker research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know that opportunity is always on the move. Expand your horizons now with these next-level stock ideas curated for growth and potential:

- Unlock the power of emerging technology when you check out these 26 AI penny stocks positioned for breakthroughs in artificial intelligence and automation.

- Strengthen your portfolio by targeting stable cash generators, and grab your chance to tap into these 15 dividend stocks with yields > 3% boasting yields above 3%.

- Ride the momentum in digital innovation by exploring these 81 cryptocurrency and blockchain stocks transforming the finance world through secure blockchain and crypto solutions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bruker might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BRKR

Bruker

Develops, manufactures, and distributes scientific instruments, and analytical and diagnostic solutions in the United States, Europe, the Asia Pacific, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives