- United States

- /

- Pharma

- /

- NasdaqCM:BLTE

Belite Bio (BLTE): Valuation Insights After UK Green Lights Tinlarebant’s Conditional Marketing Review for Stargardt Disease

Reviewed by Simply Wall St

Belite Bio (NasdaqCM:BLTE) has drawn investor attention after the UK’s Medicines and Healthcare Products Regulatory Agency agreed to review a Conditional Marketing Authorization application for Tinlarebant, the company’s lead therapy targeting Stargardt disease.

See our latest analysis for Belite Bio.

After months of anticipation around its lead therapy’s global progress, Belite Bio’s share price has taken off, jumping nearly 20% in a week and boasting a stunning 69.5% return over three months. The 61% total shareholder return over the past year reflects growing optimism, likely fueled by regulatory breakthroughs and strong momentum following last month's successful shelf registration filing.

If Belite Bio’s surge has you wondering what other innovative healthcare plays are making waves, you might enjoy our curated list of standout stocks See the full list for free.

With shares on a tear and fresh analyst optimism, investors are now debating the critical question: Is Belite Bio’s valuation still playing catch-up with its scientific progress, or has the market already anticipated what's next?

Price-to-Book of 24.6x: Is it justified?

Belite Bio’s stock fetches a price-to-book ratio of 24.6x, far above the peer group and industry averages. This is because the surge in share price has outpaced underlying balance sheet growth.

The price-to-book ratio measures how much investors are willing to pay for each dollar of a company's net assets. For Belite Bio, this figure signals investors are paying a hefty premium, likely anticipating future breakthroughs and revenue growth.

This premium is difficult to justify based on current market norms, especially since the US Pharmaceuticals industry's average is just 2.4x. In other words, Belite Bio's current valuation stands at nearly ten times that of its peers. Unlike some early-stage biotechs, the company has no meaningful revenue yet. There is also insufficient data to assess what a fair price-to-book ratio would be for Belite Bio, making the case for the high valuation less clear.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 24.6x (OVERVALUED)

However, there are concerns around the lack of current revenue and a significant discount to analyst price targets. This could trigger volatility ahead.

Find out about the key risks to this Belite Bio narrative.

Another View: Discounted Cash Flow Paints a Different Picture

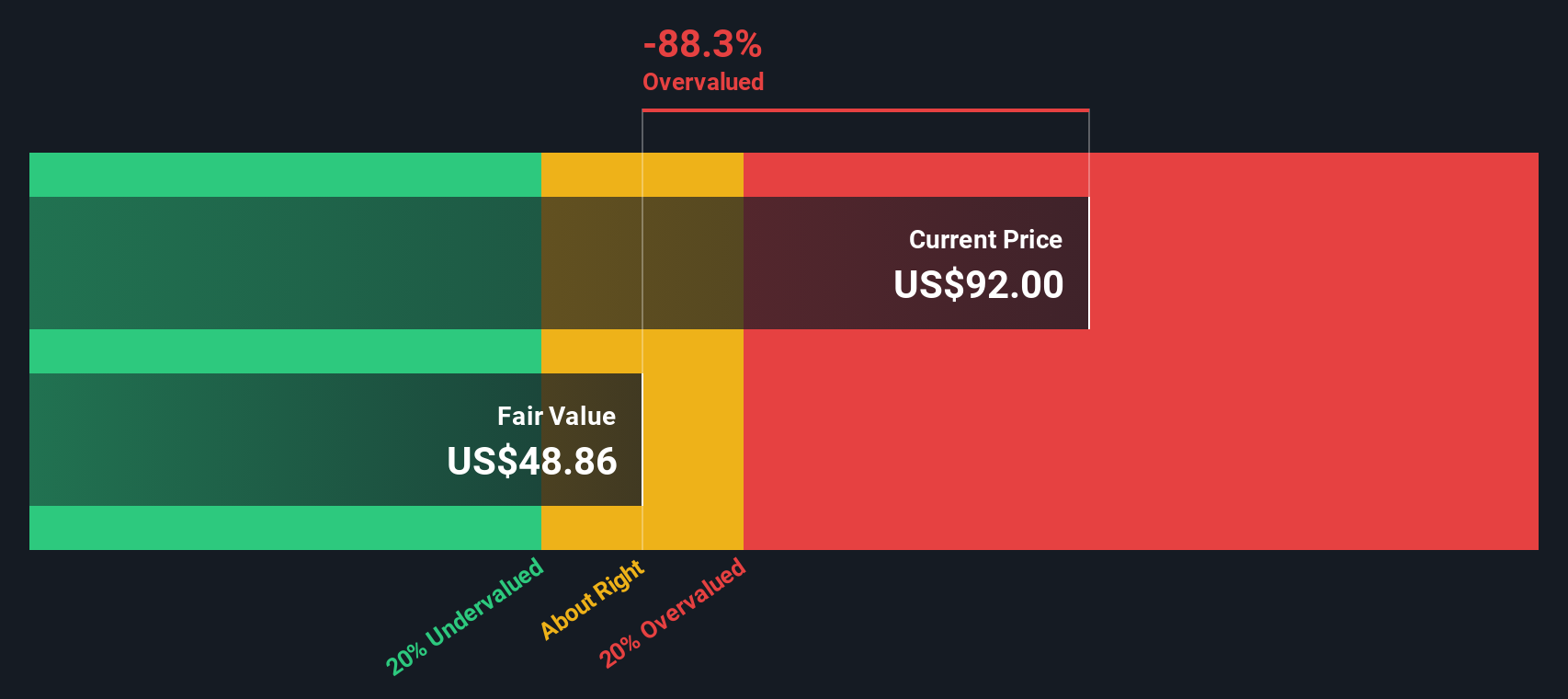

While the price-to-book suggests Belite Bio is trading at a hefty premium, our DCF model arrives at a much lower fair value of $48.86 per share. This suggests the market may be significantly overestimating future cash flows, which raises important questions about potential downside risk if expectations are not met.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Belite Bio for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Belite Bio Narrative

If our perspective does not quite align with your view or you would rather dive into the numbers firsthand, you can craft your own story in just a few minutes by using Do it your way

A great starting point for your Belite Bio research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

If you are serious about taking control of your portfolio, don't let great ideas pass you by. The right screeners could point you toward tomorrow's winners.

- Uncover rapid growth potential through these 27 AI penny stocks as they tackle real-world challenges in artificial intelligence and automation.

- Secure high-yield possibilities by checking out these 18 dividend stocks with yields > 3% to spot companies that consistently reward shareholders.

- Capitalize on undervalued gems with these 840 undervalued stocks based on cash flows, which may be trading for less than their true worth right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Belite Bio might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BLTE

Belite Bio

A clinical stage biopharmaceutical drug development company, engages in the research and development of novel therapeutics targeting retinal degenerative eye diseases with unmet medical needs in the United States.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives