- United States

- /

- Life Sciences

- /

- NasdaqCM:BLFS

New Innovation and Training Center Might Change the Case for Investing in BioLife Solutions (BLFS)

Reviewed by Sasha Jovanovic

- BioLife Solutions recently opened the Aby J. Mathew Center for Biopreservation Excellence at its expanded Bothell headquarters, adding 4,500 square feet of advanced conference and laboratory space to showcase its cell processing portfolio and provide training for customers in the cell and gene therapy sector.

- This facility highlights BioLife Solutions' commitment to accelerating research, fostering industry collaboration, and advancing innovation in biopreservation through in-house development and customer engagement.

- We'll now explore how BioLife Solutions' new innovation and training center shapes its investment narrative and growth potential.

These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

BioLife Solutions Investment Narrative Recap

To believe in BioLife Solutions as a shareholder, you need confidence in the expanding cell and gene therapy sector and the company’s role enabling long-term industry growth through product innovation and customer adoption. The launch of the new biopreservation excellence center signals ongoing investment in R&D and customer engagement, but it is not likely to change the near-term risk of high revenue concentration or impact the company’s most important short-term revenue drivers in a material way.

Among recent announcements, the introduction of next-generation cryopreservation products using the proprietary IRI technology aligns closely with the new center’s purpose. This development may help deepen customer relationships and reinforce recurring revenue streams, which has been a key catalyst supporting BioLife’s growth ambitions and efforts to broaden adoption within late-stage cell therapy programs.

However, given BioLife’s reliance on a concentrated customer base and the persistent risk if a significant client reduces orders or exits, investors should carefully consider the implications if...

Read the full narrative on BioLife Solutions (it's free!)

BioLife Solutions' outlook anticipates $161.3 million in revenue and $33.2 million in earnings by 2028. This is based on a 19.9% annual revenue growth rate and a $52.1 million increase in earnings from the current level of -$18.9 million.

Uncover how BioLife Solutions' forecasts yield a $31.30 fair value, a 29% upside to its current price.

Exploring Other Perspectives

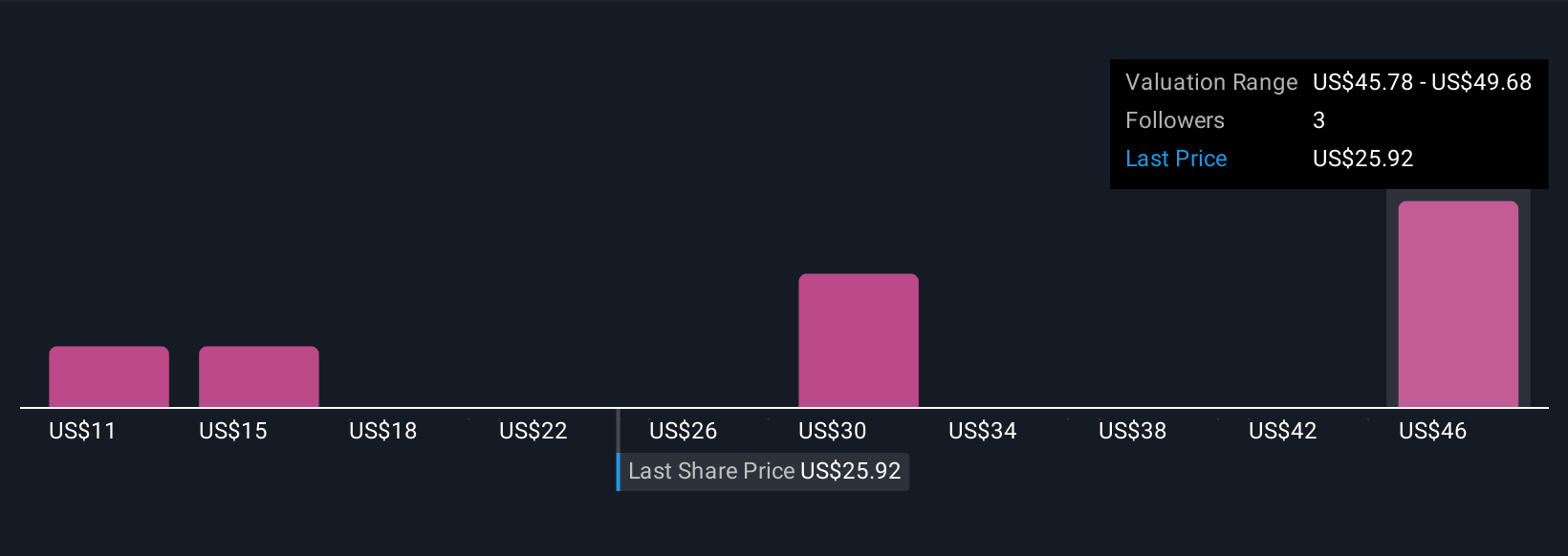

You’ll find fair value estimates from the Simply Wall St Community reaching from US$10.69 up to US$50.01 across four different viewpoints. With revenue growth and innovation highlighted as key catalysts, contrasting market opinions show that a range of factors could play a significant role in shaping returns over time.

Explore 4 other fair value estimates on BioLife Solutions - why the stock might be worth over 2x more than the current price!

Build Your Own BioLife Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BioLife Solutions research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free BioLife Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BioLife Solutions' overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BioLife Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BLFS

BioLife Solutions

Develops, manufactures, and markets bioproduction products and services for the cell and gene therapy (CGT) industry in the United States, Europe, the Middle East, Africa, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives