- United States

- /

- Biotech

- /

- NasdaqGS:BEAM

Beam Therapeutics (BEAM): Valuation Insights Following Clinical Advances and Strengthened Financial Outlook

Reviewed by Simply Wall St

Beam Therapeutics (BEAM) is drawing attention following its latest updates on clinical progress in gene editing, a solid financial outlook, and visible milestones such as its recent scientific data presentation at a major healthcare conference.

See our latest analysis for Beam Therapeutics.

Despite ongoing progress in its clinical pipeline and a solid cash runway, Beam Therapeutics’ share price has seen some turbulence, declining by 31.5% over the last month. However, momentum has swung more positive in the last three months with a 31% price gain. Even as the one-year total shareholder return stands at -14.3%, the stock’s long-term performance remains subdued. Recent milestones and a flurry of investor interest suggest sentiment could be shifting for the better.

If these milestones have you curious about what else is developing in biotech, now is the perfect moment to discover fresh opportunities with our See the full list for free.

With the share price still well below analyst targets and the company advancing its high-profile clinical pipeline, should investors be eyeing Beam as an undervalued gene editing play, or is the market already factoring in future breakthroughs?

Most Popular Narrative: 77.9% Undervalued

According to davidlsander, the narrative points to a striking disconnect between Beam Therapeutics' fair value estimate and its recent close at $20.98. Investors are left with a story of major upside that is currently unrecognized by the broader market, at least for now.

This sum-of-the-parts rNPV analysis of only the two lead assets (BEAM-101 and BEAM-302) derives a base-case intrinsic value of $65 per share. Crucially, this $65 base-case valuation does not assign any value to the emerging BEAM-301 (GSDIa) or BEAM-201 (T-ALL) programs, nor does it include the transformative, multi-billion dollar option value of the ESCAPE platform. This suggests significant, unpriced upside remains.

Want to know the calculation behind this punchy price target? There is one huge assumption about future sales and a platform that could redefine the value story. Dive deeper and see for yourself what sets this narrative apart from the rest.

Result: Fair Value of $65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks in clinical trials or regulatory delays could challenge optimism and quickly shift sentiment regarding Beam's future prospects.

Find out about the key risks to this Beam Therapeutics narrative.

Another View: Multiples Signal Expensive Territory

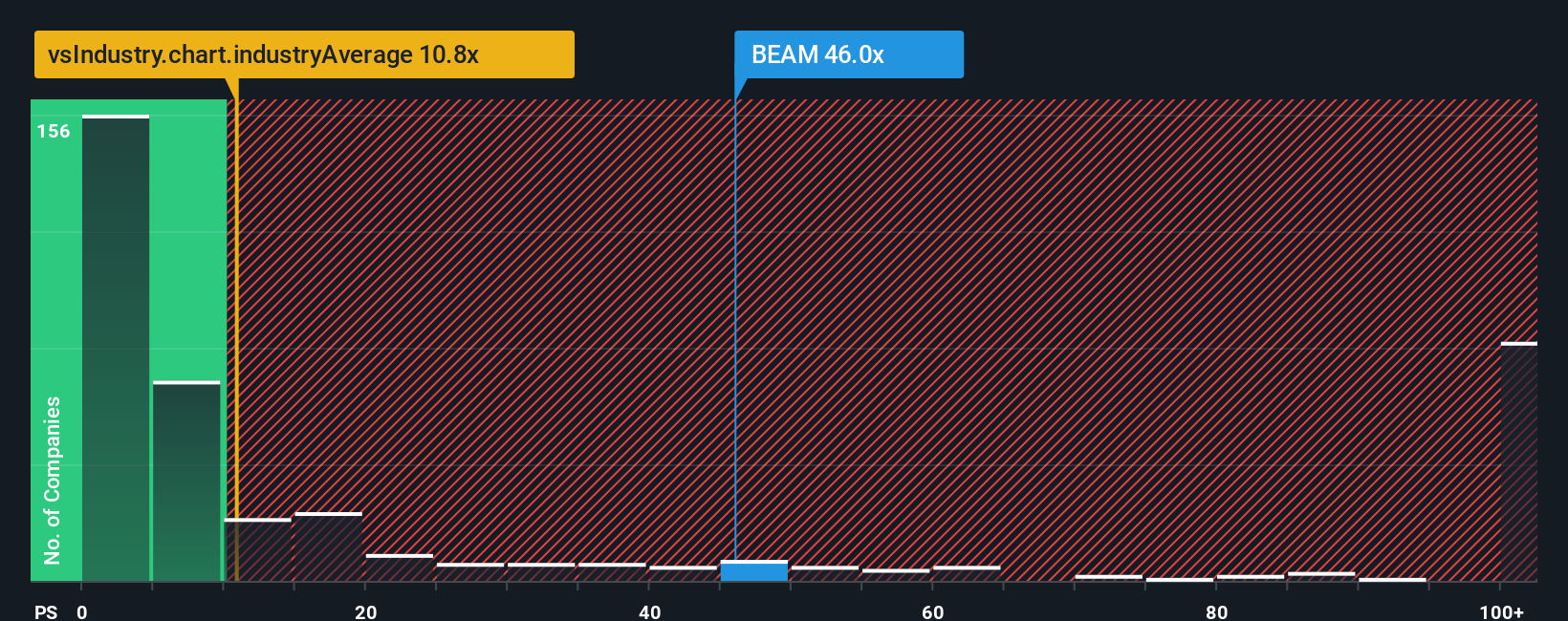

While the narrative approach suggests major upside, traditional valuation using the price-to-sales ratio paints a different picture. Beam's ratio is 37.2x, significantly higher than both the biotech industry average of 11.6x and its peer group at 18.1x. This level is far above the fair ratio. This raises questions about whether the market is already pricing in a lot of future success for Beam. Is it an opportunity being overlooked, or a valuation risk investors can't ignore?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Beam Therapeutics Narrative

If you see the story differently or want to put your own data to the test, crafting a custom narrative takes just a few minutes. Do it your way.

A great starting point for your Beam Therapeutics research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for More Smart Stock Ideas?

Seize fresh opportunities by using the Simply Wall Street Screener. Every search uncovers investment ideas that others might miss if they only focus on the headlines.

- Boost your portfolio’s income potential by tapping into these 15 dividend stocks with yields > 3% with yields over 3% and strong fundamentals.

- Spot game-changing companies pushing boundaries in artificial intelligence as you check out these 26 AI penny stocks influencing tomorrow's biggest trends.

- Uncover undervalued gems with strong cash flow with these 908 undervalued stocks based on cash flows before the crowd takes notice.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beam Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BEAM

Beam Therapeutics

A biotechnology company, engages in the development of precision genetic medicines for patients suffering from serious diseases in the United States.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives