- United States

- /

- Biotech

- /

- NasdaqGS:BEAM

Beam Therapeutics (BEAM) Revenue Growth Forecasts Test Market Caution on Persistent Losses and High Valuation

Reviewed by Simply Wall St

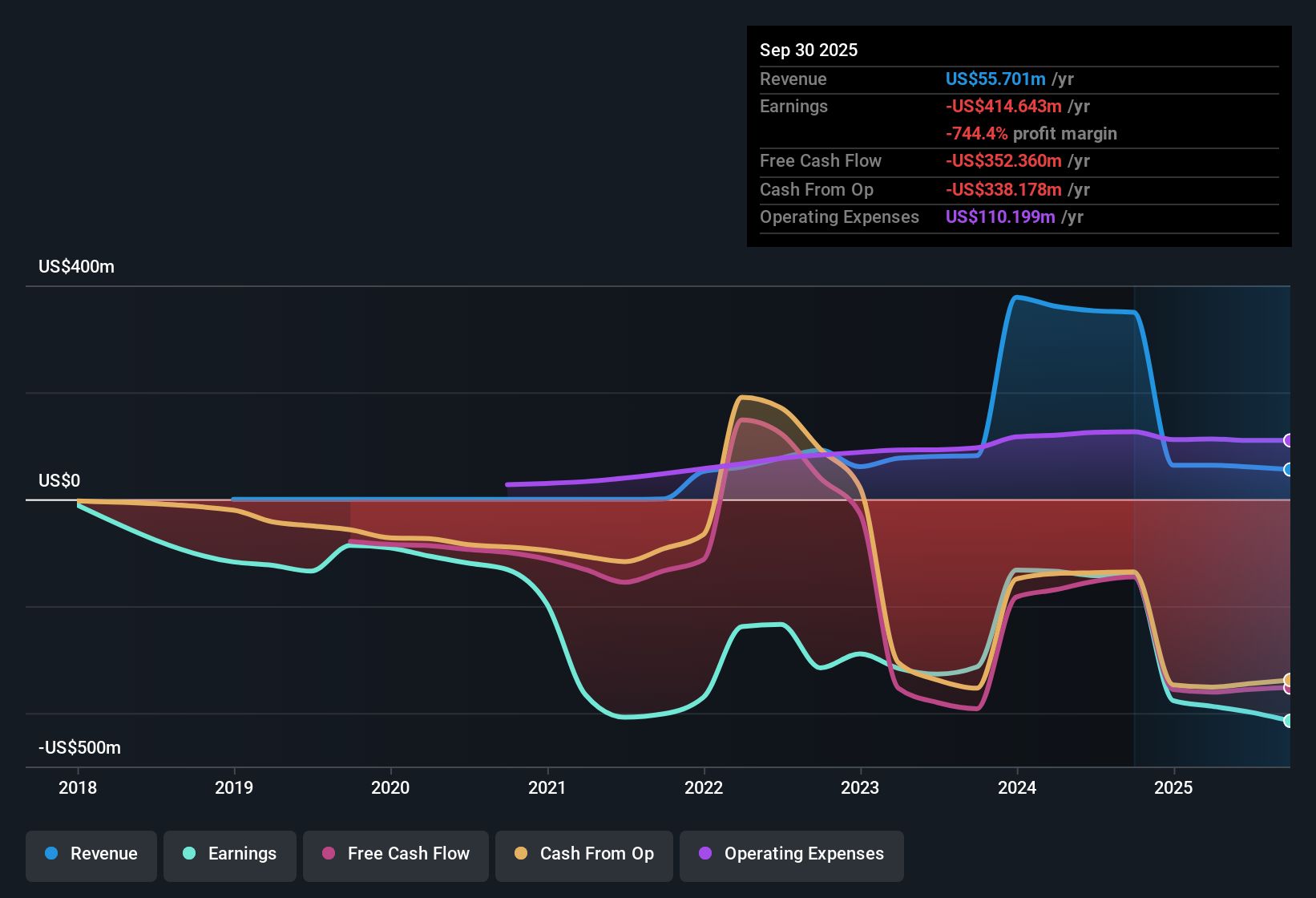

Beam Therapeutics (BEAM) remains unprofitable, and the company’s losses have widened at a rate of 2.2% per year over the past five years. Meanwhile, revenue is forecast to climb at an annual rate of 53%, outpacing the broader US market's projected 10.5% revenue growth. With these growth expectations, investors are balancing the promise of rapid expansion against persistent operating losses, a share price that has been volatile over the past three months, and a notably high Price-to-Sales Ratio of 40.1x. This figure stands well above industry and peer averages.

See our full analysis for Beam Therapeutics.Now that the numbers are out, the next step is to see how they measure up against the latest market narratives shaping sentiment around Beam. Some themes may hold up, while others could be in for a rethink.

See what the community is saying about Beam Therapeutics

PE Ratio Demands Lofty Growth

- Beam Therapeutics is trading at a Price-to-Earnings (PE) ratio of -4.6x today. Analysts project it would need to climb to 469.1x by 2028 for the valuation to match growth expectations.

- The consensus narrative notes that such an extreme future PE ratio can only be justified if the company’s forecasted profit margin swings from -661.3% to the biotech industry average of 16.1% within three years.

- This leap relies on revenue growing from $-398.6 million in earnings today to a projected $14.3 million by 2028.

- Even with these optimistic margin assumptions, the required PE ratio for Beam would vastly overshoot the current industry average of 15.5x, making the growth hurdle especially high.

- The current share price is $22.74, while the analyst price target is $46.77. This represents a 105% premium, which is an aggressive bet that actual business performance will outpace tough industry benchmarks.

Share Dilution Outpaces Peers

- Analysts expect Beam’s outstanding shares to rise by 7.0% per year for the next three years, a dilution rate that puts meaningful pressure on future per-share value relative to sector peers.

- Consensus narrative highlights that share count growth is not just a technical factor.

- It points to the company’s need for continuous fundraising to support clinical trials and research, increasing the risk to existing shareholders.

- Rapidly rising dilution could outweigh revenue gains if the business does not hit its ambitious milestones or faces regulatory or cohort trial delays.

Valuation Premium Remains Stretched

- Beam’s Price-to-Sales Ratio of 40.1x sharply exceeds both the US biotech industry average of 10.8x and the peer average of 12.4x, despite losses widening by 2.2% per year over the last five years.

- According to analysts’ consensus view, this steep premium is not sustained by near-term profitability.

- It reflects investor enthusiasm around programs like BEAM-101 and technology advances, but ongoing clinical risks and competitive threats could unravel such a valuation if growth stalls.

- The bullish catalyst is that the BEACON trial and ESCAPE technology may open up significant new markets. The counterpoint is that even a minor setback could shrink valuation multiples to industry norms.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Beam Therapeutics on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Want to put your own spin on the numbers? Share your perspective and shape the story in just a few minutes. Do it your way.

A great starting point for your Beam Therapeutics research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Beam Therapeutics faces mounting pressure from persistent losses, heavy dilution, and a valuation premium that depends on achieving extremely steep growth targets.

If you’re concerned about paying up for peak optimism, use these 844 undervalued stocks based on cash flows to spot companies trading at attractive prices with more grounded growth expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beam Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BEAM

Beam Therapeutics

A biotechnology company, engages in the development of precision genetic medicines for patients suffering from serious diseases in the United States.

Flawless balance sheet with low risk.

Market Insights

Community Narratives