- United States

- /

- Biotech

- /

- NasdaqGS:BEAM

Beam Therapeutics (BEAM): Assessing Valuation After Recent Double-Digit Stock Gains

Reviewed by Simply Wall St

Beam Therapeutics (BEAM) stock has caught investors’ attention after the company posted double-digit gains over the past three months. This comes as shareholders take stock of the company’s progress in gene editing and consider potential market opportunities.

See our latest analysis for Beam Therapeutics.

Momentum has clearly shifted for Beam Therapeutics, with a 32.8% gain in the past three months helping to push its 1-year total shareholder return into positive territory at 9.1%, despite some choppiness earlier in the year. While recent news has reignited optimism, the longer-term three-year total return remains deep in the red, which highlights both the promise and the volatility that come with innovative biotech stocks.

If you’re intrigued by breakthroughs in biotech, now may be a good time to see what else the sector offers. Check out See the full list for free.

With the stock climbing sharply and trading at a notable discount to analyst price targets, the question remains whether Beam Therapeutics is still flying under the radar or if the market is already factoring in its future growth potential.

Most Popular Narrative: 45.5% Undervalued

Beam Therapeutics is trading well below the narrative’s fair value estimate, with a last close of $25.01 versus a fair value of $45.92. This wide gap signals that the market has yet to fully price in the company’s future potential, according to the most widely tracked view on the stock.

Beam Therapeutics is focusing on advancing their two core franchises in hematology and liver genetic diseases, with promising lead programs BEAM-101 for sickle cell disease and BEAM-302 for alpha-1 antitrypsin deficiency. Both programs are showing strong preclinical validation, which could lead to increased revenue from new treatments. The BEACON trial for BEAM-101 demonstrated potential clinical differentiation, with rapid neutrophil engraftment and high HbF induction. This suggests that it could become a best-in-class treatment, potentially increasing market share and impacting revenue.

Curious what powers this big valuation leap? The calculation leans on ambitious projections for growth, margins, and future profit multiples. Want the full financial story, and the single assumption that sets this valuation apart? Unlock the details in the complete narrative.

Result: Fair Value of $45.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, safety concerns such as busulfan toxicity and a heavy reliance on early-stage clinical data could challenge Beam Therapeutics’ future growth narrative.

Find out about the key risks to this Beam Therapeutics narrative.

Another View: Market Multiples Tell a Different Story

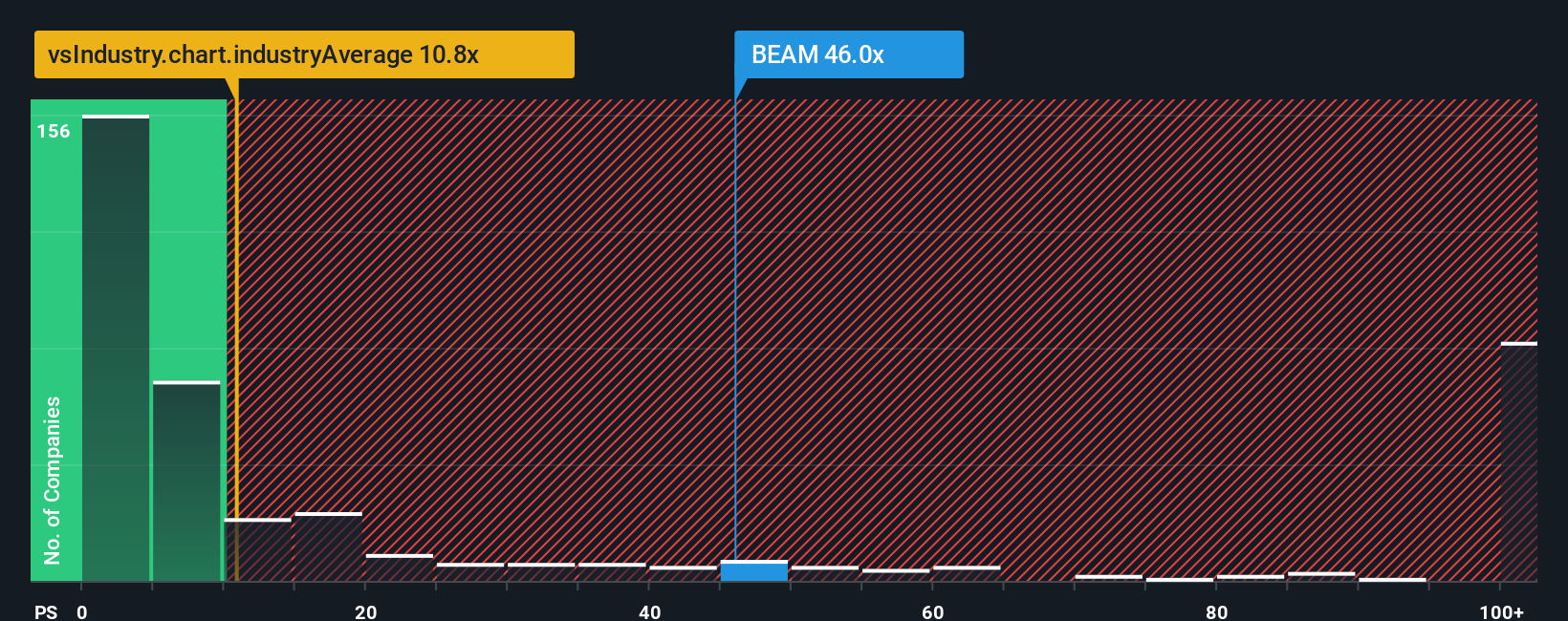

While the narrative-based valuation pegs Beam Therapeutics as undervalued, a look at market multiples gives a less generous picture. The company's price-to-sales ratio stands at 40.8x, which is considerably higher than both its peers at 13.4x and the industry average of 11.2x. When compared to the fair ratio for similar firms, this raises the question: are investors overlooking risks, or is the market simply pricing in future breakthroughs?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Beam Therapeutics Narrative

If you want to dive deeper or take a different perspective, you can examine the numbers and shape your own view in just a few minutes. Do it your way

A great starting point for your Beam Therapeutics research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Ready for More Winning Ideas?

Smart investing means keeping an eye out for new opportunities. Don’t settle after one promising find. Simply Wall Street’s screeners help you stay ahead of the curve.

- Unlock hidden value and see which stocks are priced below their true worth by checking out these 832 undervalued stocks based on cash flows before the rest of the crowd catches on.

- Maximize your income potential and grow your portfolio with stable companies offering yields above 3% by exploring these 22 dividend stocks with yields > 3% now.

- Get ahead of the next big innovation as breakthroughs reshape entire industries by reviewing these 26 AI penny stocks built on artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beam Therapeutics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BEAM

Beam Therapeutics

A biotechnology company, engages in the development of precision genetic medicines for patients suffering from serious diseases in the United States.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives