- United States

- /

- Biotech

- /

- NasdaqGS:BCRX

Is BioCryst a Hidden Gem After Clinical Updates Spur New Valuation Debate?

Reviewed by Bailey Pemberton

- Curious if BioCryst Pharmaceuticals could be a hidden gem or priced for perfection? Let’s dig into what the numbers and market are telling us now.

- Recently, BioCryst’s shares have been on a bumpy ride. The stock is down 6.6% over the last week and 13.7% year-to-date, but still up 65.7% over five years. This hints at both risks and long-term potential.

- The stock’s latest moves are happening alongside optimism sparked by recent clinical updates for its rare disease treatments, as well as industry attention on biotech innovation and M&A activity. Headlines highlighting advances in oral therapies and partnerships in the sector are influencing investor sentiment.

- When it comes to value, BioCryst scores a 5 out of 6 on our valuation checks, which is an above-average mark. We will walk through what that means in practical terms, compare different ways of assessing fair value, and by the end, show you an even smarter approach to judging if the opportunity is real.

Find out why BioCryst Pharmaceuticals's -4.2% return over the last year is lagging behind its peers.

Approach 1: BioCryst Pharmaceuticals Discounted Cash Flow (DCF) Analysis

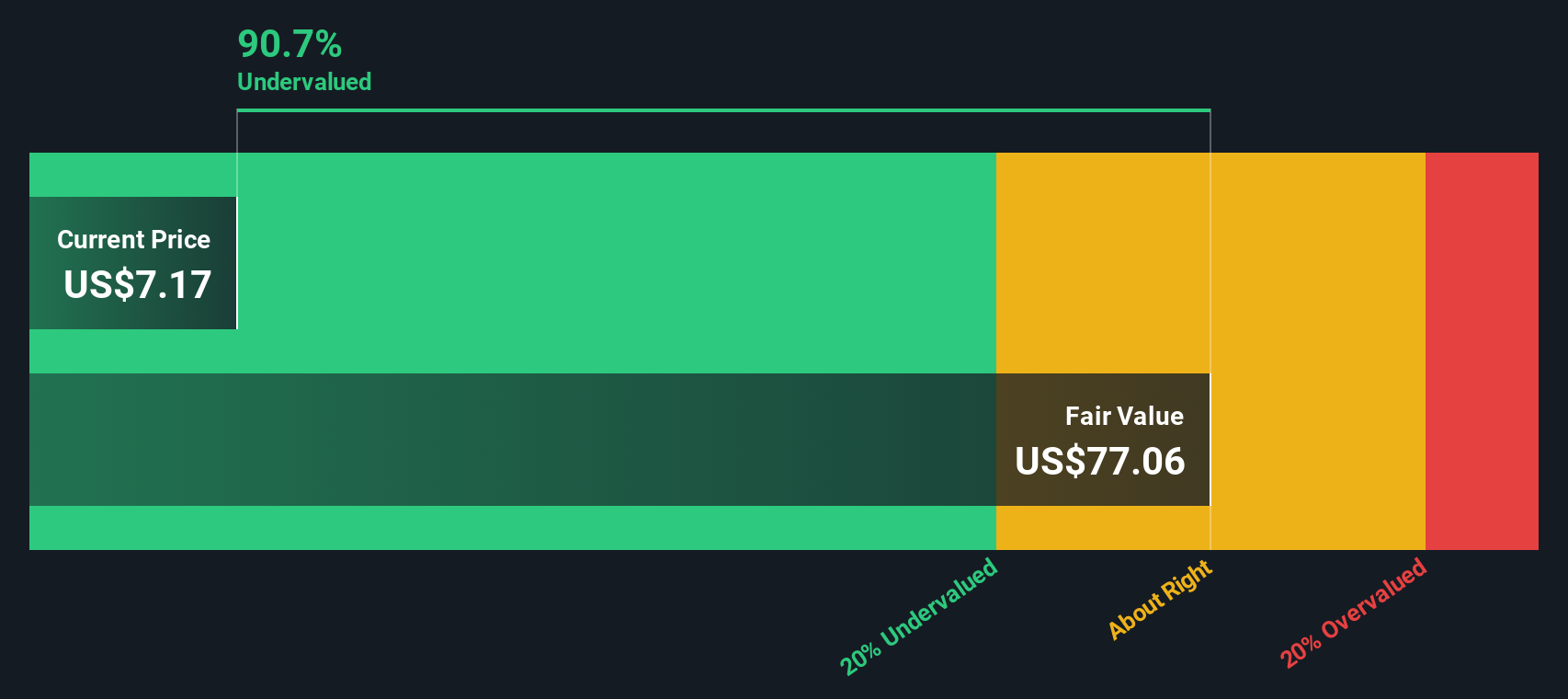

The Discounted Cash Flow (DCF) model offers a forward-looking way to assess value by projecting BioCryst Pharmaceuticals’ future free cash flows and discounting them to today’s value. This helps investors estimate what the business is really worth based on its ability to generate cash over time.

Starting with a current Free Cash Flow (FCF) of $15 million, BioCryst is expected to see substantial growth. Analyst projections estimate free cash flow could reach around $512 million by 2029. Ten-year forecasts, based on both analyst input and further extrapolation, show annual FCF growing to over $1.1 billion by 2035. All these projections are in US dollars.

Based on this analysis, the estimated intrinsic fair value for BioCryst’s shares is $76.93. This suggests the stock is trading at about a 91.2% discount to its fair value, indicating significant undervaluation compared to the current share price, according to this methodology.

In summary, DCF results indicate BioCryst could be a compelling value opportunity if these growth forecasts play out.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests BioCryst Pharmaceuticals is undervalued by 91.2%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: BioCryst Pharmaceuticals Price vs Sales

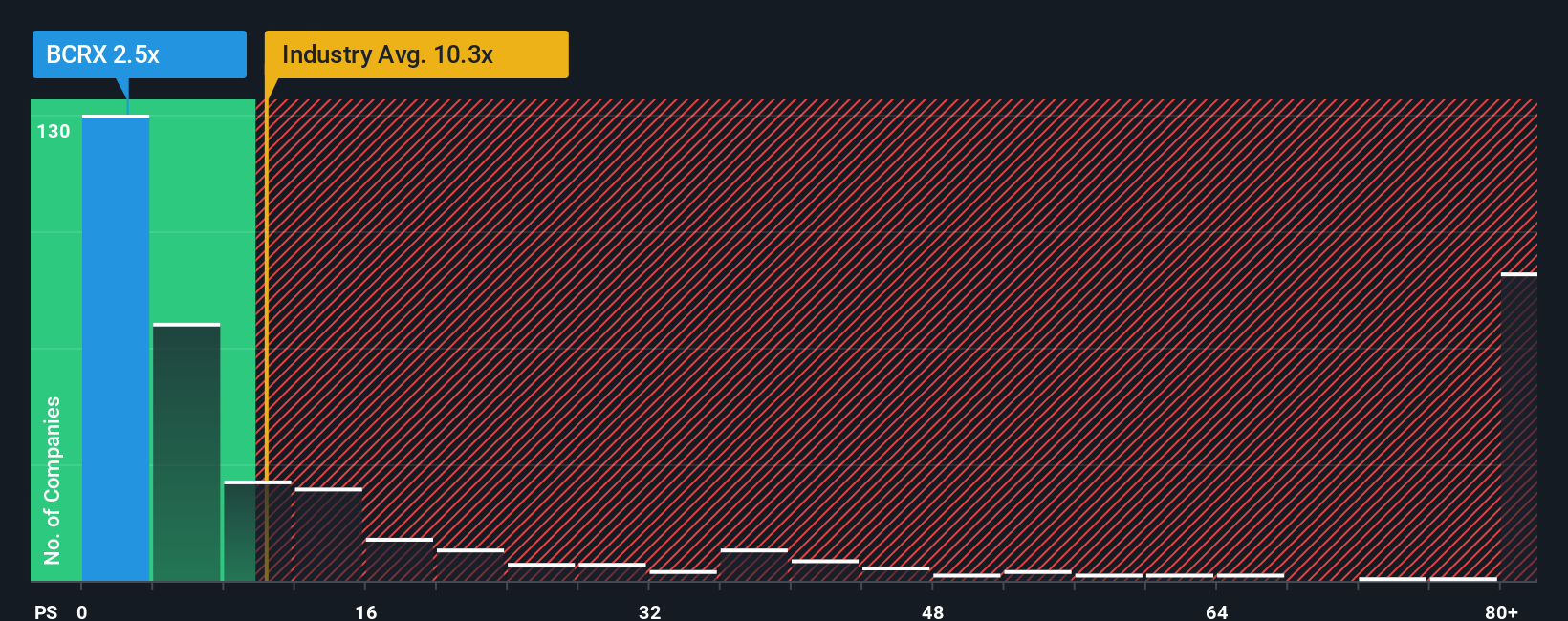

The Price-to-Sales (P/S) ratio is often a preferred metric for valuing biopharmaceutical companies like BioCryst, especially when a company is not yet profitable at the net income level or is experiencing rapid top-line growth. Unlike Price-to-Earnings, the P/S ratio offers a clearer picture by focusing on revenue generation regardless of current profitability, which is common for innovators investing in research and development for future growth.

Generally, companies with stronger growth prospects, more resilient revenue streams, or lower risk profiles can justify higher P/S ratios. Those facing limitations tend to trade closer to or below industry averages. Investors use this multiple to gauge how much they are paying for each dollar of sales, with comparisons to similar businesses providing initial context.

Currently, BioCryst’s P/S ratio stands at 2.4x. This is noticeably below the Biotechs industry average of 10.3x and also trails its peer group average of 6.0x. However, industry and peer benchmarks do not fully account for the nuances of BioCryst’s business model or growth outlook.

This is where Simply Wall St's proprietary Fair Ratio comes in. The Fair P/S Ratio for BioCryst is 4.6x, which factors in the company’s expected sales growth, profit margins, industry characteristics, market capitalization, and risk profile. Unlike industry or peer comparison alone, the Fair Ratio provides a tailored benchmark specific to BioCryst’s unique prospects and challenges.

Comparing BioCryst’s actual P/S of 2.4x to its Fair Ratio of 4.6x suggests the stock is undervalued at current levels according to this approach.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

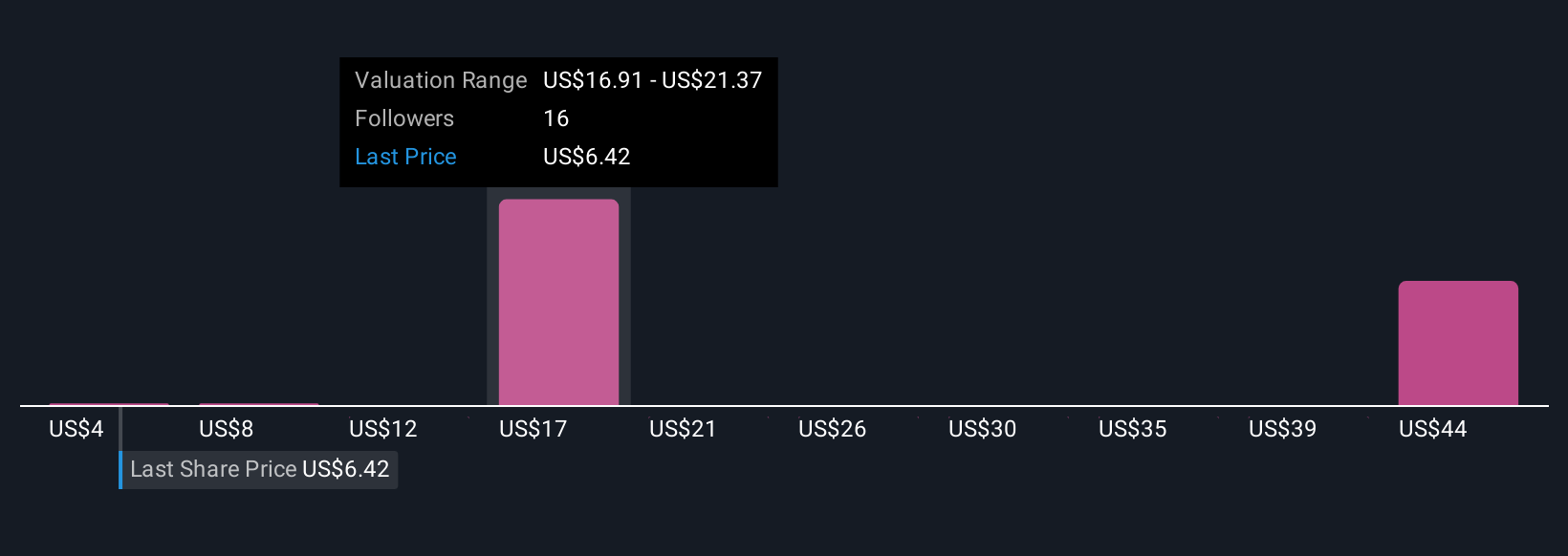

Upgrade Your Decision Making: Choose your BioCryst Pharmaceuticals Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let’s introduce you to Narratives. A Narrative is a simple but powerful tool that lets you connect your own story or perspective about a company directly to the numbers, such as your assumptions for fair value, future revenue, profit margins, and growth.

Instead of just relying on past data or analyst targets, Narratives help you frame BioCryst Pharmaceuticals’ investment case in terms of "why," tying together your view of its prospects with financial forecasts and a customized fair value. You can quickly build, update, and share Narratives using the Community page on Simply Wall St’s platform, where millions of investors exchange their views.

With Narratives, deciding when to buy or sell becomes clearer by comparing your Narrative’s Fair Value to the current share price. In addition, each Narrative updates automatically whenever new company news or earnings come out, keeping your analysis current and relevant.

For example, one investor might build a bullish Narrative for BioCryst based on strong ORLADEYO growth, expansion plans, and strategic acquisitions, resulting in a high fair value estimate around $30 per share. Another, focused on pipeline risks or increasing competition, could arrive at a much more cautious fair value nearer $11.

Do you think there's more to the story for BioCryst Pharmaceuticals? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BioCryst Pharmaceuticals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BCRX

BioCryst Pharmaceuticals

A biotechnology company, develops oral small-molecule and injectable protein therapeutics to treat rare diseases.

Undervalued with high growth potential.

Market Insights

Community Narratives